French oil giant Total plans to sell a stake in Norway’s Gina Krog field development as it scales back spending, according to analysts.

Total is seeking to offload less than half its 38 percent holding in the oil and gas deposit, said Preben Grevstad, a senior partner at bank RS Platou Markets. The project’s present value was estimated at 12.7 billion kroner ($2.1 billion) in a development plan approved by authorities last year.

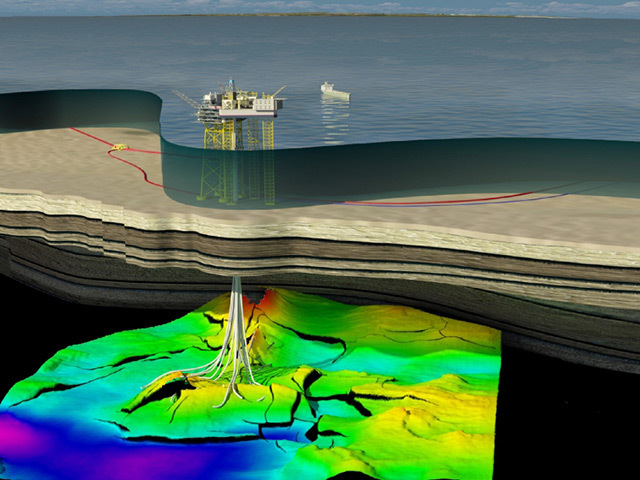

The field contains 107million barrels of oil and condensate, more than 3million metric tons of natural gas liquids and 12.5billion cubic meters of gas.

The partners forecast investments of £2.9billion and operating costs averaging £100million a year over its projected 16 year lifespan, with production set to start in early 2017.

“It’s known in the market that part of their share in Gina Krog has been for sale,” said Grevstad, who’s in charge of oil and gas at Oslo-based Platou’s corporate-finance unit.

Leif-Harald Halvorsen, a spokesman for Total in Stavanger, Norway, declined to comment.

Total, which followed larger Shell and BP in reporting lower fourth-quarter profit, is reducing investments as costs rise, refining margins shrink and oil prices stagnate.

The firm – Europe’s third-largest oil group – has targeted up to £12billion in asset sales by the end of this year as it focuses on bigger projects to raise production, and plans to cut spending after last year’s £16billion spend. It has targeted a production increase of more than 30 percent to three million barrels of oil equivalent a day in 2017.

Det Norske Oljeselskap ASA also plans to sell its 3.3% stake in the North Sea project, Grevstad said.

Det Norske, which has said it is considering new share offerings and debt as well as divestments, declined to comment on specific assets.

Oil companies are under pressure from investors to curb capital spending and concentrate on generating higher returns for shareholders as costs climb. Talisman and Marathon have said they will leave the Nordic country and RWE AG is looking to sell its Dea oil and gas unit.

“It’s a buyer’s market on several North Sea field developments as a lot of companies are struggling with cash flow and have capital-expenditure challenges,” said Grevstad.

Recommended for you