The operator of the UK’s Kraken development says the project is on track, that award of the development drilling contract will be made soon, that initial prepping of the ex tanker that will be used is done, with the fitting of process systems soon to start, and that a final appraisal well (Tyrone) is about to be spudded.

Enquest’s North Sea boss, Neil McCulloch told Energy that the company’s flagship was the biggest investment approved for UK waters last year.

The contract style is lump-sum, turnkey with a heavy emphasis on hired services, especially regarding the production vessel, which will be day-rated from Bumi Armada.

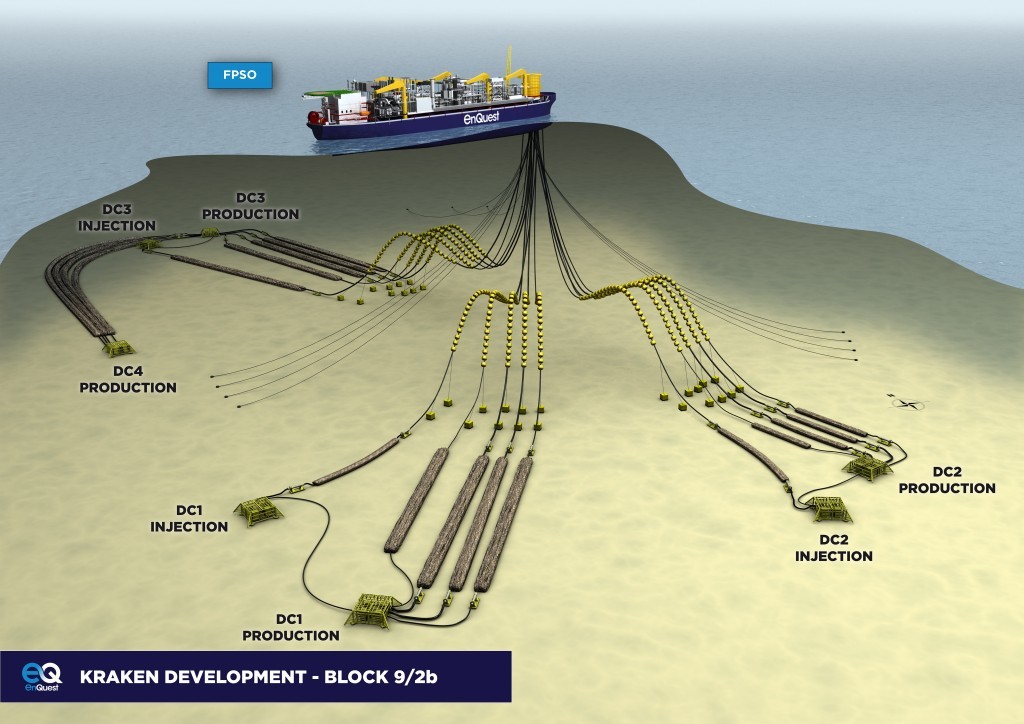

Found in 1985, Kraken is on block 9/2b, 125km east of Shetland.

Following various deals, EnQuest operates the field with a 60% interest. Cairn has 25% and First Oil holds 15%.

In November 2007, appraisal 9/2b-2 was drilled to 1,334m, 3km north of the 9/2-1-discovery well of 1985, encountering oil-bearing Paleocene Heimdal sands. Second appraisal 9/2b-3 was started in September 2008 on Kraken’s northern east flank, 3km from 9/2b-2, and 5km from 9/2-1A.

Five wells plus two side-tracks have been drilled into the Kraken reservoir. The drilling of Tyrone by the Ocean Princess will complete the appraisal programme, at least for now.

Development drilling will start next summer, for which templates were installed in-field last month. The current estimate is that whichever semi-submersible is selected will be kept fully employed for four years.

The aim is to get seven or eight wells drilled and completed prior to first oil, with the remainder following. The plan is for 25 wells. Aker has the (lump-sum) contract for subsea infrastructure.

Enquest’s journey to control and development of Kraken started in 2011, but in 2012 in terms of visible action. January that year saw Nautical Petroleum divest a 25% stake in the discovery to Enquest, which would thereafter become operator of blocks 9/2b & 9/2c.

The deal meant that Nautical would be granted a carry on in its future expenditure on Kraken of up to $240million . . . $150million firm and up to $90million contingent.

April 2012 saw EnQuest raise its interest to 60% by buying 15% of the project from venture partner First Oil, paying between $90million and $144million. The company then rolled up its sleeves and got on with concept selection, became operator and eventually submitting its field development plan to the Department of Energy and Climate Change in the middle of last year.

November 2013 saw the FDP accepted. This was based around recoverable reserves of around 137million boe of mobile 13.8 API crude, though the oil in place estimate is a lot higher. Success with the Tyrone appraisal could usefully add to the recoverables number and, once production has been running for some time, Enquest will be able to get a better feel for long-term recovery rates potential.

Under the FDP, peak production is expected to reach 50,000 barrels oil equivalent, once the field is brought on stream, most likely in 2017, but 2016 at a stretch.

Core elements are the leased FPSO, the drilling programme and the subsea array.

Gross capital costs for Kraken will be around $3.2billion, but is hard to define because of the decision to lease the vessel now being purpose-converted for owner Bumi Armada, which will also become designated duty-holder when production starts. Just three months ago, in July, it was disclosed that Bumi had awarded the conversion contract for the five-years-old twin-skinned tanker selected to Keppel in Singapore. The vessel will be rated for use in harsh environments and will have a storage capacity of 600,000 barrels.

Keppel’s work scope includes refurbishment and life extension works, upgrading the living quarters to accommodate 90 personnel, installation of an internal turret mooring system and the installation and integration of topside process modules.

Recommended for you