It’s that time of the year again when the likes of BP and Shell report their annual results. With BP and Shell alone representing roughly 20% of all the dividends paid in the FTSE100, the results of both companies are normally eagerly awaited.

With Brent oil prices averaging around at $44/barrel in 2016 and with significant market volatility, it was never going to be an easy year for the supermajors.

However, despite the oil price challenges, both companies reported significant progress in 2016.

A combination of cost reduction, portfolio management, asset sales, improved downstream performance and business simplification has resulted in BP returning to profit in 2016.

However, there is obviously more to be done. BP indicated that it will need an oil price in the range of $55-60/barrel to balance the book and with oil currently trading at this level, BP will need a fair wind to underpin their future plans.

The good news is that the sector is returning to profitability.

Although it will take a bit of time for this to translate into new investment and therefore new activity for the supply chain, at least there are some signs of recovery in what has been a rather challenging and difficult time.

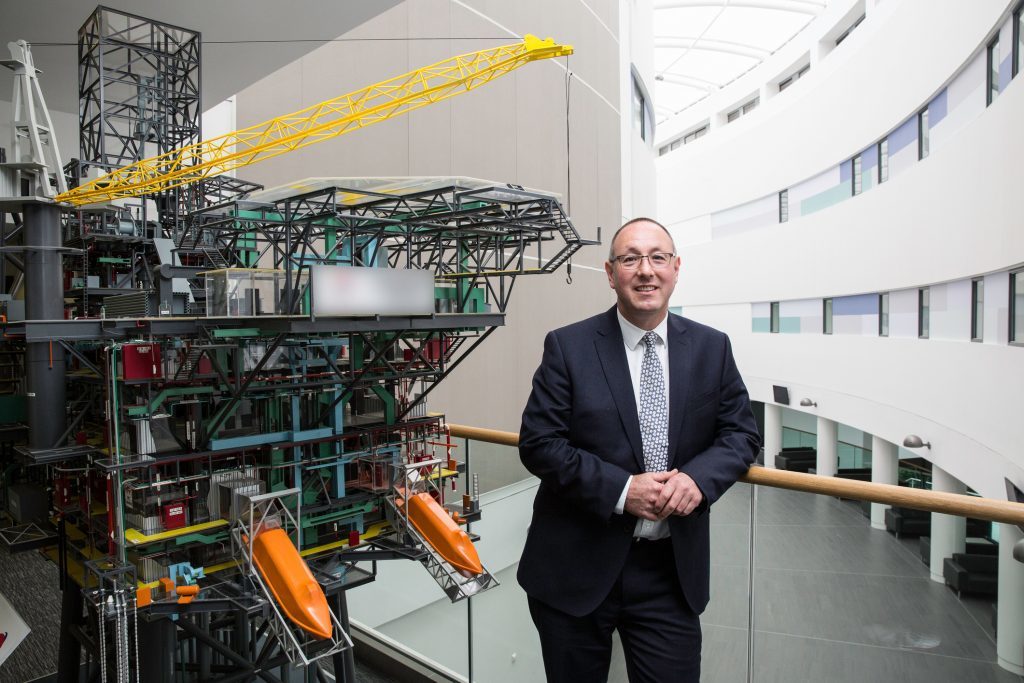

Professor Paul de Leeuw is director of the Robert Gordon University’s Oil and Gas Institute

Recommended for you