The purpose of the new research paper by Linda Stephen and myself is to throw light on the implications of “lower for longer oil prices” on long term activity in the UKCS to 2050. The oil price scenarios employed are $50 and $60 in real terms. For the year 2050 these translate into $96.1 and $115.3 in money-of-the day terms. The price scenarios are not forecasts.

The economic modelling incorporates projections of the new exploration effort reflecting the subdued levels of recent years but also the fairly high success rates achieved. The modelling was undertaken separately for the five main geographic regions of the UKCS, reflecting the variations in prospectivity, costs, types, and sizes of discoveries. The modelling also acknowledges the current situation of capital rationing in the determination of investment hurdles. That defined as “significant” is now more likely than “very serious” as a result of the price increases in recent months.

The modelling was undertaken on a large field database incorporating all of sanctioned fields, probable and possible fields, technical reserves, and new discoveries. The cost reductions painfully achieved over the last two years have been incorporated.

Key findings are that over the period 2017-2050 with the $60 real oil price cumulative production could be nearly 11 billion barrels of oil equivalent (bn boe). But there is also a large unexploited potential amounting to 5.6 bn boe. These resources are contained in 183 fields. Most are in relatively small pools, each containing less than 20 million boe.

With the $50 real oil price scenario over the period 2017-2050 cumulative production could be 8.8 bn boe. In this case the unexploited potential is 6.9 bn boe. These are in 271 fields mostly in small pools of less than 20 million boe.

Most of the exploited fields are in the category of technical reserves. Many of these have been discovered some years ago but have not progressed to the probable and possible stages. They are not currently being examined for development because they are expected to be uneconomic. Even if only a significant proportion of these fields were developed there would be a noteworthy increase in total recovery and large extra business for the supply chain. This is the challenge for the industry, OGUK, OGA, OGTC, OGIC and the ITF.

If “lower for longer” prices persist field investment will fall to levels well below these attained in the period 2009-2014. Further, the timing of the attainment of the economic limit of fields is accelerated. Thus, over the next several years expenditure on decommissioning will increase substantially. Over the period to 2050 cumulative expenditure on decommissioning could reach £50 billion.

A follow-up research paper will examine the extent to which higher prices can stimulate extra activity (production and expenditure) by the industry. It is expected that the sensitivity of activity to higher oil prices will be quite substantial. The present study found a large difference in production and other activity between the $50 and $60 price scenarios. But full reliance cannot be placed on major price increases. Technical progress has a key role to play in facilitating the development of small pools in particular.

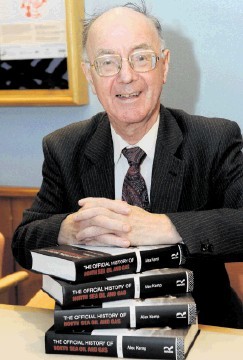

Alex Kemp is a professor of petroleum economics at the University of Aberdeen as well as director of Aberdeen Centre for Research in Energy Economics and Finance.

Recommended for you