US oil companies’ proven reserves fell in 2016, the second consecutive year of decline, the Energy Information Administration (EIA) said.

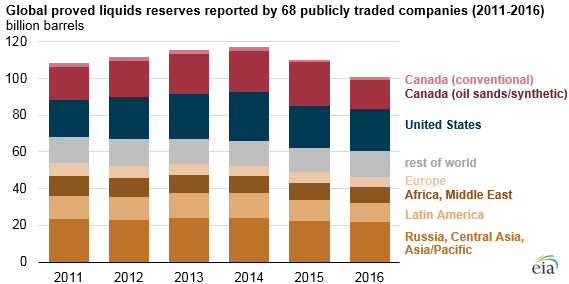

EIA said it tracked the performance of 68 firms listed of the US stock exchanges and found a net reduction of 8.2billion barrels in reserves.

EIA said the decline was caused by downward revision of existing resources, a lack of extensions and discoveries, and relatively high production.

The companies collectively extracted 8.9billion barrels of liquids in 2016.

So far in 2017, capital expenditures remain lower than for the same period in 2016 as larger companies with more production are reduce spending.

The 22 that produced more than 250,000 barrels per day reduced capital expenditures by $10.8 billion.

Those who produced less than 250,000 b/d in the first quarter of 2017 increased their capex by $2.6billion.