The UK general election showed attitudes to decommissioning are “changing for the better”, an analyst has said.

The Conservative Party and the SNP both called for the creation of an ultra-deep water port to support the sector in their manifestos.

The Scottish Government previously created a £5million fund to pay for upgrades to yards.

Ben Wilby of Westwood Global Energy said it was telling that political parties had touched on decommissioning, having completely ignored it in 2015.

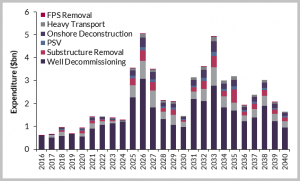

The UK Government will have to cover half of decommissioning costs through to 2040 – which represents a $28billion hit to Treasury coffers.

As such, it is in the government’s interests to keep costs low and make sure UK ports secure as much work as possible.

Mr Wilby said: “The key to governing a late life oil province like the North Sea is getting the balance right between initiatives to maximise recovery in late life assets with the practicalities of planning for decommissioning.

“Fail on the first and oil is left in the ground that could have generated tax revenues. Fail on the second and decommissioning costs far more than necessary with the UK Government covering roughly half of the cost.

“This is the challenge that the UK’s oil and gas regulatory authority is wrestling with.”

Getting the capacity right in UK yards is an example of the challenges faced.

More than 260 platforms are expected to be removed from the UKCS between 2017 and 2040.

If yards can’t cope, companies will look overseas to avoid serious cost overruns, Mr Wilby said.

He said the arrival of the Brent Delta platform at Able UK’s yard in Hartlepool in May and the award of a demolition contract for Repsol-Sinopec’s Buchan Alpha vessel to Veolia’s site at Lerwick indicated UK decommissioning is very-visibly under way.

But time pressure for upgrading facilities has been alleviated by the North Sea’s recent shows of resilience.

Many fields that were forecast to be abandoned in the current price environment have continued to produce as operating costs have fallen dramatically.

Read more: Exclusive – Centrica’s £35m North Sea field revival saves 70 jobs

As a result, Westwood forecasts that most decommissioning expenditure will come after 2025 – providing enough time for the continued development of decommissioning yards across the UK.

Recommended for you