Directors at London-listed Bahamas Petroleum said today they would take part in a share placing.

Bahamas investors will meet on the Isle of Man next month to vote on a share placing aimed at raising £2.6million.

The oil and gas explorer will issue 260million new ordinary shares at 1p each.

Today, the company said directors and “certain other members of the management team” had agreed to subscribe £200,000 in aggregate for 20,000,000 shares in aggregate.

It means the conditional placing has been increased to 170million shares in aggregate, with the directors and management representing about 12% of the total.

Participation in the raising by Directors and Management is as follows:

Dealings on the AIM will start around July 17, subject to the passing of the resolutions at next month’s meeting.

Directors have also agreed to defer 50% of their fees, to be repaid in shares conditional on conclusion of a farm-in for the drilling of an initial exploration well in the Bahamas.

The chief executive has agreed to defer 90% of all salary on the same basis.

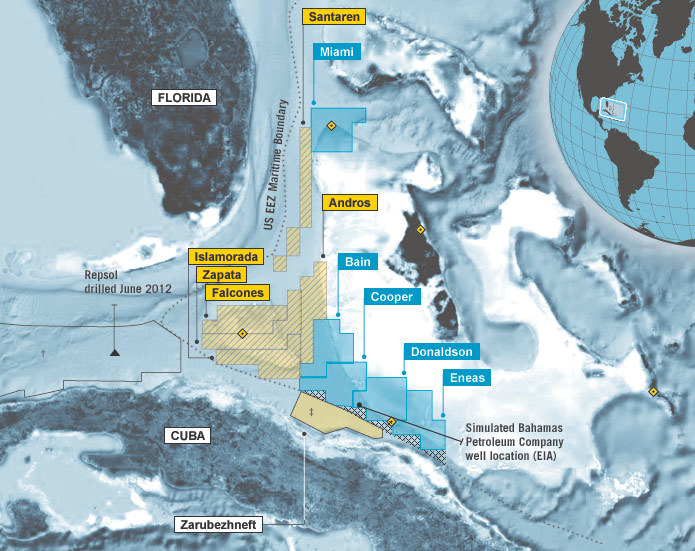

Chairman Bill Schrader said: “On 14 June 2017, BPC announced a placement to raise additional funding as we continue the process of seeking a farm-in from an industry partner, so as to enable drilling to commence on our highly prospective licences in the Bahamas.

“The directors, management and I are committed to the project and are confident that BPC will be able to achieve a successful farm-in. We are thus participating in the placement, further aligning our interest with that of other shareholders.”