Brent crude’s brief flirtation with a $60 price level already seems to be fading. OPEC and its friends are facing their last chance to swing sentiment in the oil market this year. They shouldn’t get too precious about it. What ministers say at their Nov. 30 meeting may have little bearing on what they actually do, but it could have a big impact on prices.

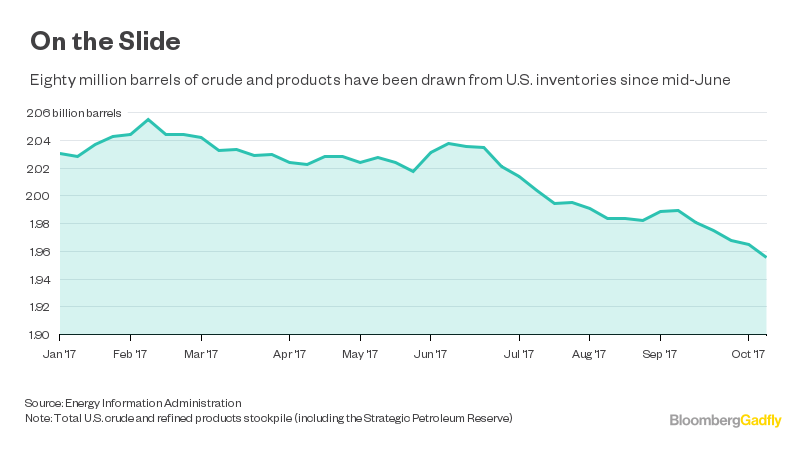

Compliance with the output cuts they agreed late last year has been better for longer than for any other deal in the group’s history. But now they must decide whether or not to extend their agreement after it expires at the end of March. That may seem like a long way away, and it is. A lot can change in the oil market in four months — just look at how inventories in key OECD countries have come down since the start of July.

For some it is too early to decide. Kuwait’s oil minister does not want to rush into extending the deal and President Vladimir Putin said in Moscow earlier this month that November was too early to make a decision. However, at the same time he also said he doesn’t rule out an extension to the end of 2018, helping to create a weight of expectation that the producers now have to manage.

Forecasts by their own analysts, as well as those of the International Energy Agency and others, all suggest that output restraint will still be needed beyond the March cutoff, but for exactly how long is an open question. So oil ministers could legitimately say that it is too early to decide what to do next.

There are problems with this course of action — or inaction — though.

Gadfly has already warned on the perils to OPEC’s resolve from the recent pickup in prices. Deciding to wait until later, to see how supply, demand and inventories evolve during the cold northern hemisphere months, sends the wrong message to all those people who trade in the oil markets. It would be taken as a sign of weakness, an indication that producers are not united on a course of action. Previous signs of dithering among OPEC and its allies have been punished with sharp downward moves in the oil price — to see this, look no further than what happened in March when the group started to waver over whether or not to extend the deal beyond its original six-month term.

OPEC and friends may well be divided but, if so, such disagreements should remain deeply buried.

Much better, from the perspective of the group, would be to agree Nov. 30 to extend the deal right the way through 2018. They could add a rider that it will be reviewed when they meet mid year — the post-meeting briefing from almost every gathering in recent history has included words to the effect that the group will continue to monitor market developments.

This decision would have absolutely no effect on the physical oil market over the winter, but it could have a dramatic impact on sentiment. It would reaffirm the group’s commitment to “do whatever is necessary” to rebalance the market.

Sure, there will be those who argue that even this shows weakness, because the action taken by the group so far has failed to achieve its goal even after increasing the original 6 months of cuts to 15 months. So they got the numbers wrong. They are not alone in that. In the last three months the International Energy Agency has revised global oil demand figures for 2015 and Chinese production numbers all the way back to 1994!

Oil producers’ commitment to cuts has been backed up since the middle of this year with real reductions in exports, at least from key OPEC countries, in addition to the cuts to reported production levels. Lower exports helped drag crude out of floating storage and commercial stockpiles, reducing the volume in transit by sea to the lowest level in at least two and a half years, according to data from Oil Movements.

A succession of hurricanes in the Caribbean and record levels of U.S. crude exports, combined with a dramatic reduction in American oil imports from Persian Gulf OPEC countries — principally Saudi Arabia, Iraq and Kuwait — have helped to bring down U.S. inventories, which are the most closely watched in the world.

But the overhang looks like it will persist past the deal’s current end date of March 31. The psychological support to oil prices from a firm, if premature, commitment to extending the deal is likely to deliver producers a more comfortable winter than further prevarication.

Recommended for you