With oil prices seemingly stable over $70 per barrel, is anyone in the UKCS planning to increase spending? – by Jonathan Clarke, Calash Ltd.

As we move into the second half of 2018, the UK has been enjoying the longest summer for decades. We have had more barbeques and outdoor drinks this year than any I can remember here in Aberdeen, creating an unusually joyous atmosphere and helping us move on from the oil downturn and the gloom of an uncertain Brexit.

Aiding this is the fact that Brent spot prices have now been above $70 per barrel for over three months, creating a sense of stability and certainty in the market. However, is this enough to justify increased UKCS investment, and if so, by who?

To help answer these questions, Calash has provided analysis for the Energy Voice’s 2018 industry survey results. So far, the survey has had 82 respondents from the UK (mostly director to middle management level). The respondents varied from Operators, service companies and others (including government, financial institutions (banks, equity provers), insurance, and legal and corporate finance advisors), with the findings presented here based on their views.

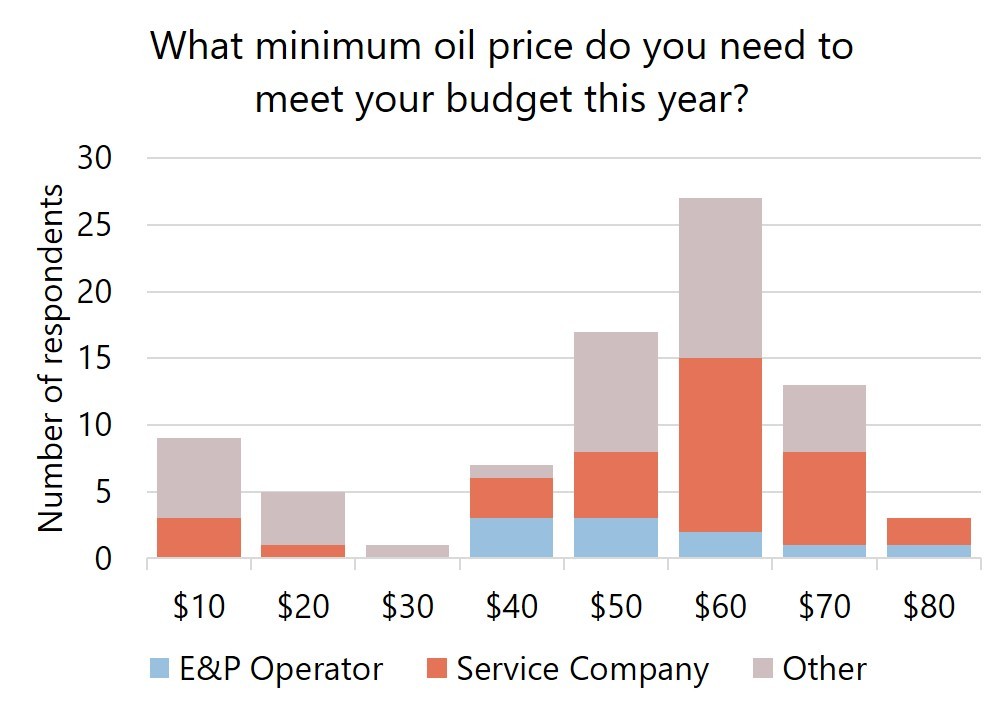

What oil price do we need to meet budgets?

Although a minority of respondents still require over $70 per barrel oil prices to meet their budgets, the good news is that the majority don’t.

In fact, the average response to this question was $50 – $60 per barrel, with E&P Operators suggesting that they can continue to operate profitably at a lower oil price. But does this mean they are ready to start increasing investment?

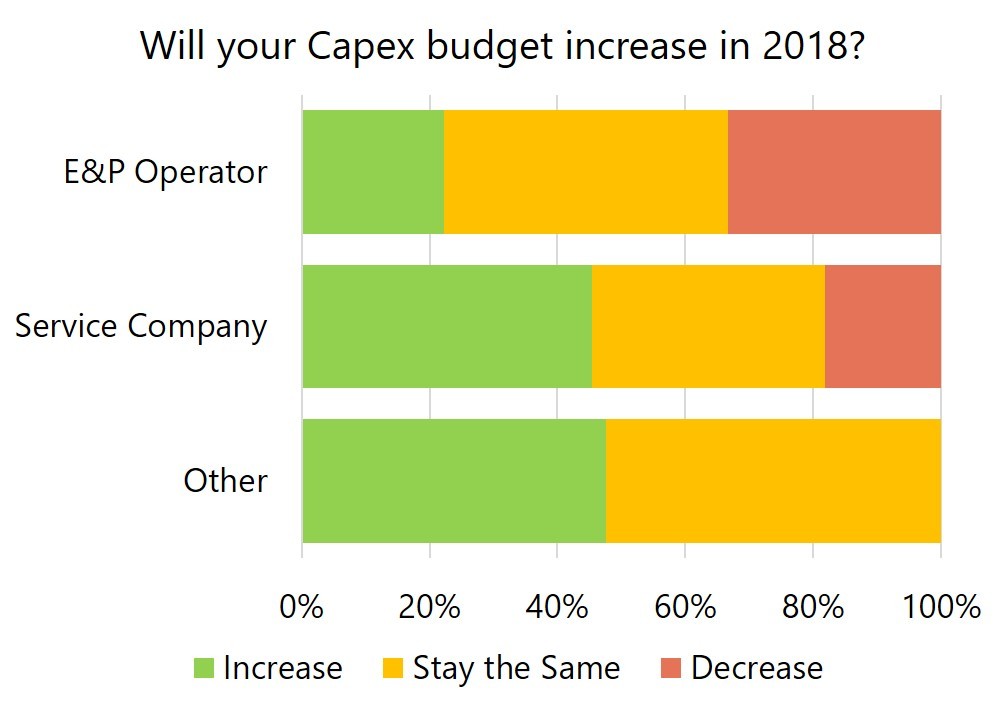

Will Capex / Opex / labour budgets increase in 2018?

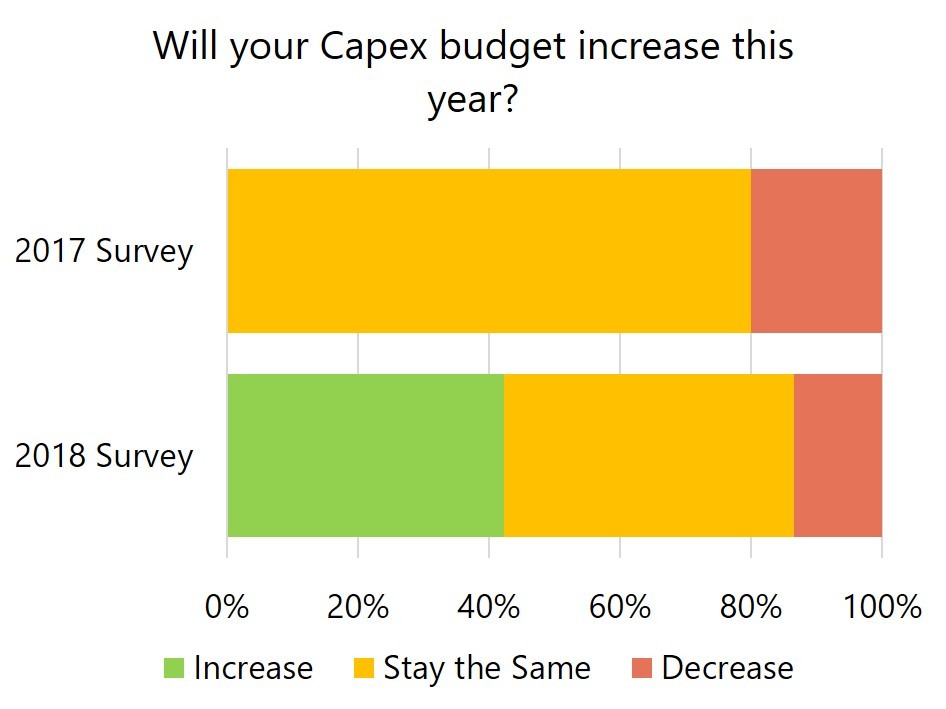

When asked about Capex, the supply chain was generally more optimistic about increasing their expenditure, with over 80% of service companies either planning to increase spend or keep it the same.

Other respondents thought that Capex would increase or remain at a similar level to last year – possibly based on a lot of their information coming from media and macro data providers.

However, E&P Operators prove to be the exception, with more respondents indicating they plan to decrease Capex rather than increase it, confirming their intentions to keep control of costs and do more for less.

Given that E&P Operators also indicated they had the lowest oil price requirements, there is an argument that Operators are still more focused on rebuilding their balance sheets and strengthening their own financial positions, to the detriment of the supply chain.

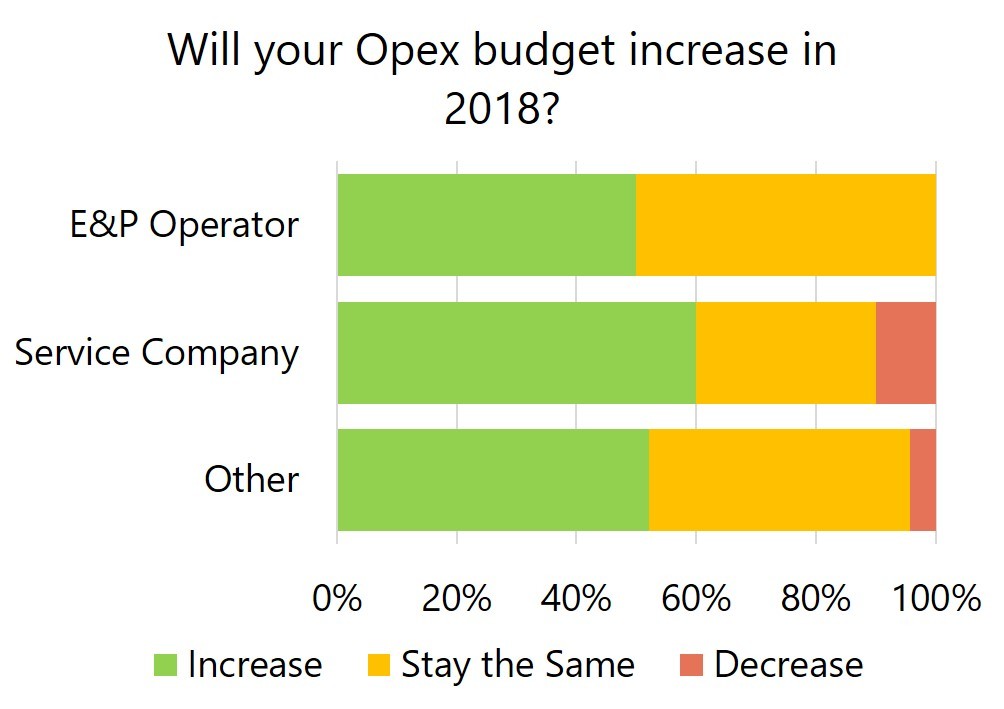

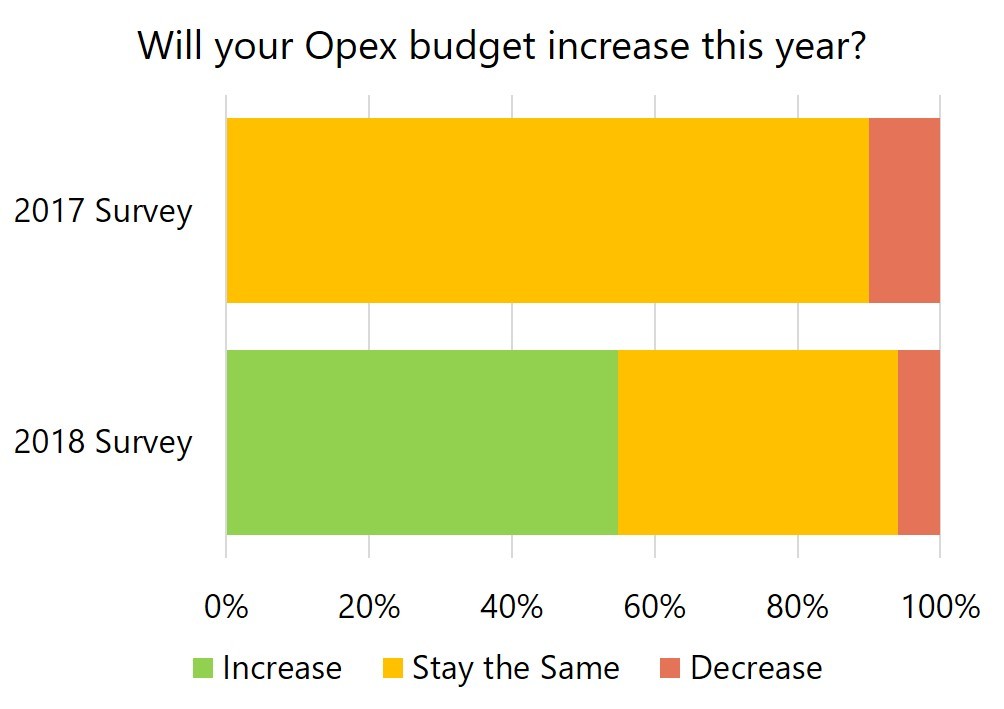

Fortunately, the view on Opex budgets is more optimistic, with more than half the survey respondents saying they will increase spend.

Again, the service companies appear to be leading the way, with 60% of them saying they will increase Opex related spending.

The E&P Operators also indicated they would increase Opex spend, with none of the respondents surveyed saying they would look to reduce their budgets. If this reflects the reality in the market, it should provide an increasingly stable environment for operations, inspection, maintenance, and repair providers. Good news for some in the supply chain.

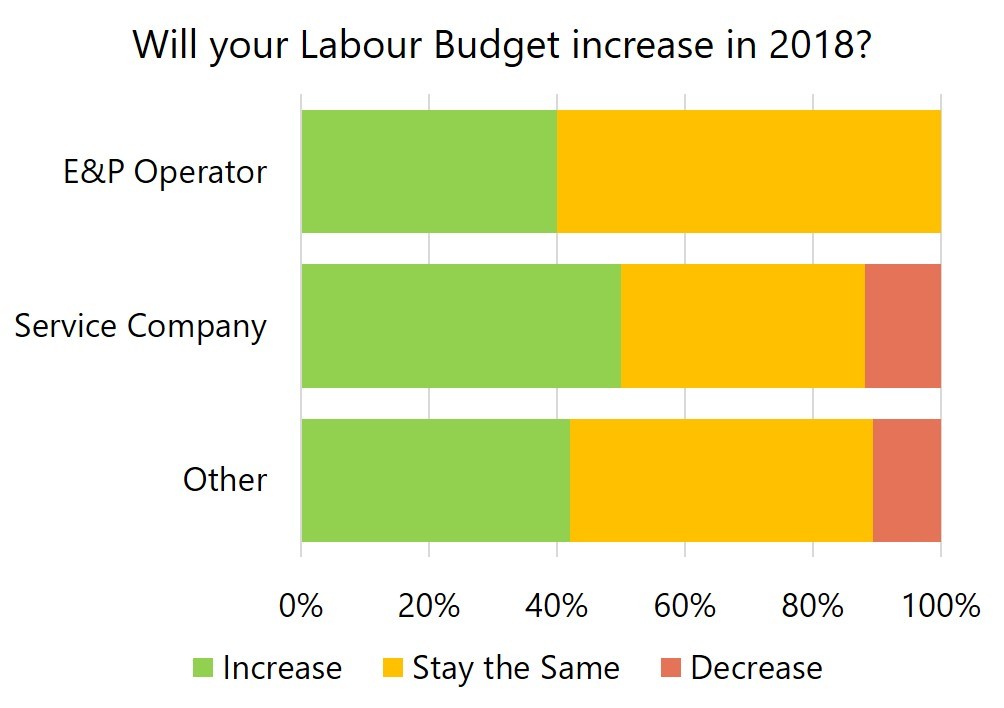

Unsurprisingly, the trend for labour budgets follows Opex, with just under half of respondents planning to increase spend.

E&P Operators are looking to increase or maintain staff, though it appears that there are still some companies in the supply chain looking to find further efficiencies. Overall however, sentiment has moved away from the industry anticipating significant job losses, and total employment should be on the rise in 2018.

Are we still cutting costs, and have the cuts now gone too far?

While it is encouraging that most E&P Operators and service companies appear to be planning to increase spend in 2018 (or at least Opex), we must remember that this follows several years of hardship.

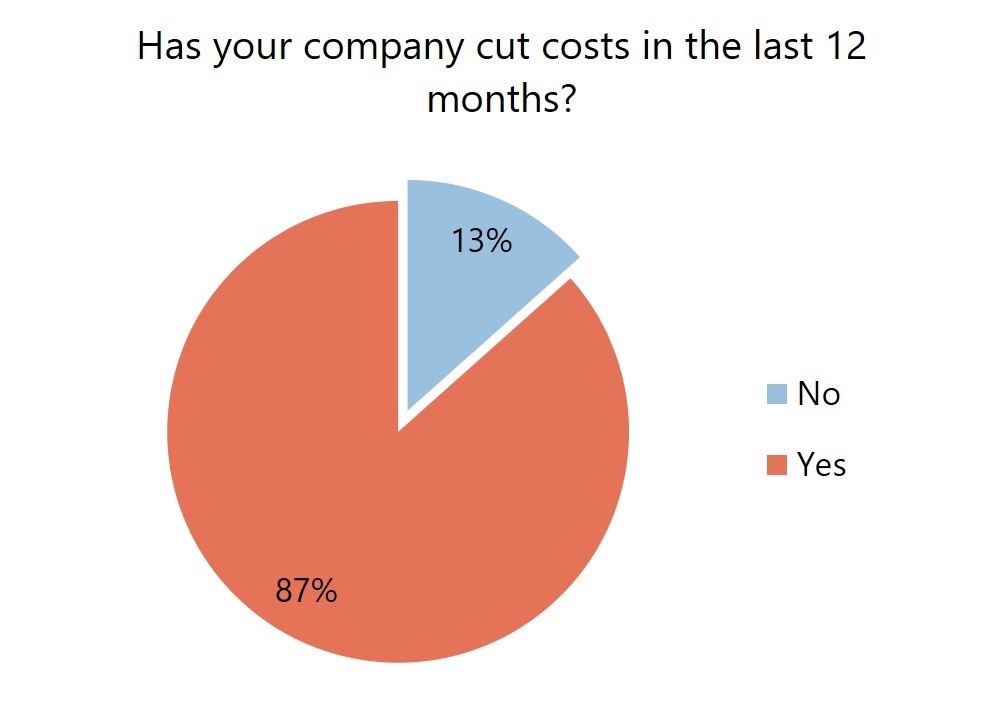

Cost cutting has continued through 2017 and into 2018, with 87% of survey respondents indicating they have cut costs within the last 12 months.

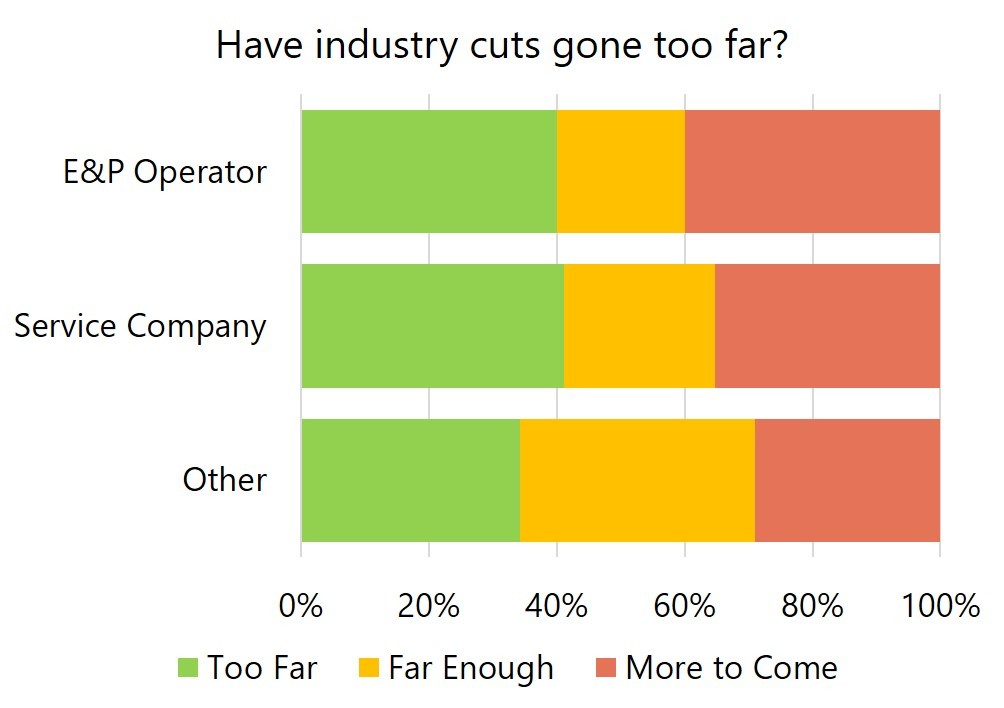

Worryingly, a third of respondents feel that there are more cuts to come, only slightly less than the 38% that believe cuts have already gone too far.

This reveals a level of realism exists in the market, one that seemingly contradicts the suggestion that Capex and Opex budgets should rise this year. However, the industry and its stakeholders want to increase efficiency and lock in the gains already made. Everyone is now expecting to do more for less going forward.

Are we more optimistic than we were last year?

Operators and service companies in the UKCS are a lot more confident about the UKCS market than they were last year, as demonstrated by the proportion who indicated they would increase Capex and Opex expenditure in 2018.

Increased oil prices and reduced costs have no doubt played a large part in promoting rising UKCS confidence.

In Calash’s view, the cost cuts that the UKCS has achieved (however painful) should largely be here to stay. That mainly leaves oil price as the big question mark hanging over our heads.

Production losses in Libya and Venezuela (and soon Iran) are largely being compensated by increased output from Saudi Arabia and other OPEC members. Meanwhile, US shale growth appears to be stalling due to a lack of midstream infrastructure.

Overall, this paints a rather complicated picture for future oil prices, especially with Trump asking Saudi Arabia to increase production to bring prices down in the US. However, the market appears to have struck a balance, meaning E&P Operators and service companies should be able to continue “doing more for less”, and increase the attractiveness of the UKCS for investment.

While times may still be challenging for many UKCS companies, we at Calash believe there is good reason to be optimistic in 2018. If investment does indeed start rising, perhaps we can continue to relax around a few more barbeques and enjoy the rest of this warm summer.

Calash is an Energy and Natural Resources Commercial and Strategic specialist consultancy, with offices in Houston, Aberdeen, New York, London, and Sydney.

Calash is an Energy and Natural Resources Commercial and Strategic specialist consultancy, with offices in Houston, Aberdeen, New York, London, and Sydney.

Recommended for you