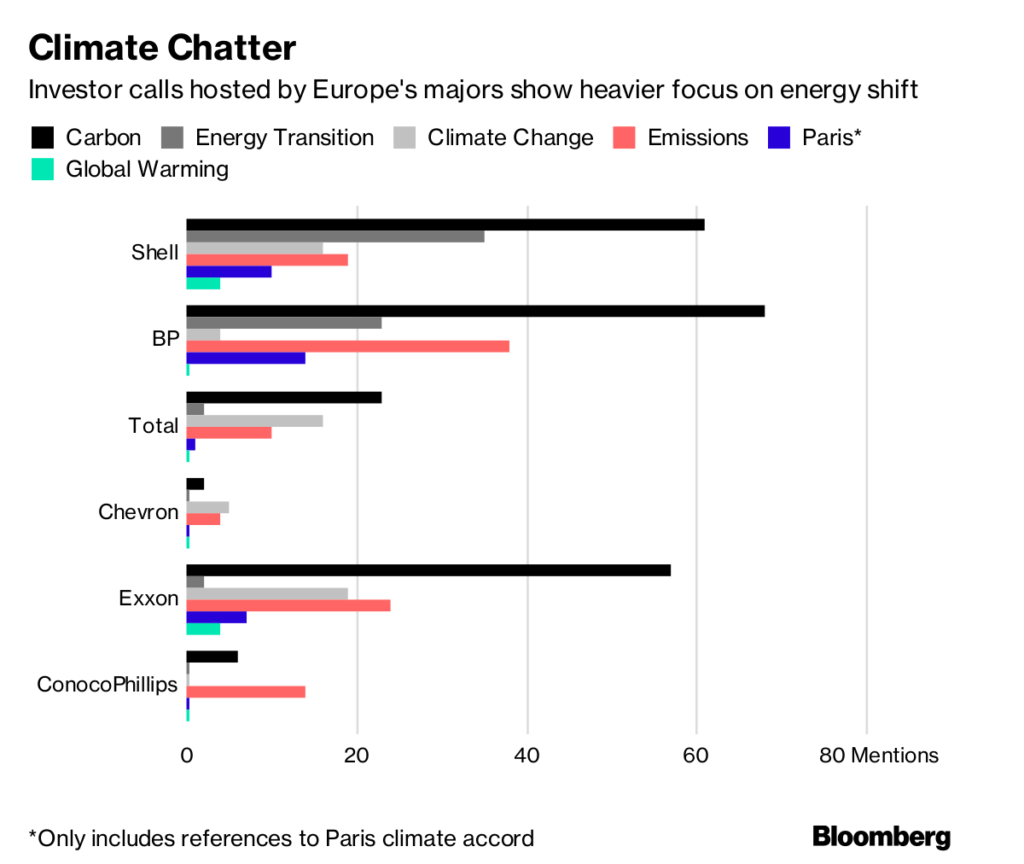

If you want to know what the world’s biggest oil companies are saying to their shareholders about climate change, look to Europe.

BP Plc, the U.K. energy giant that suffered a catastrophic oil spill eight years ago, refers to “carbon,” “emissions” and the Paris climate agreement more than any other major, according to an analysis of investor presentations over five years. California-based Chevron Corp. barely addresses those topics at all.

Perhaps that’s unsurprising, since Europe has some of the most strict emission laws, while the U.S. is the only country on the planet exiting the Paris accord. Yet the picture isn’t clear-cut. Texan behemoth Exxon Mobil Corp. has used the term “climate change” in public conference calls more than any other major, though one single discussion last March largely accounted for that result.

Exxon and Chevron are also investing in clean energy and have pledged support for the Paris agreement, regardless of the participation of their government.

Yet oil companies may face more pressure to tackle the topic of global warming in Europe, where three-quarters of people say it’s a “very serious problem,” according to a European Commission survey. In the U.S., less than half the population are sure global warming is happening, a Yale University study shows.

Heightened pressure in Europe may also explain why both BP and Royal Dutch Shell Plc publish separate budgets for low-carbon fuels, spending $500 million to as much as $2 billion respectively, while American companies don’t do the same.

“Often easy to generalize, but for some reason it seems that North American investors are not attempting to put as much pressure on oil companies as their European counterparts,” said Jake Leslie-Melville, a consultant at Boston Consulting Group Inc. “European oil companies are now being asked a lot of questions about their plans for the energy transition, while the North American side seems much quieter.”

Exxon said in a statement that it has invested $9 billion in “energy efficiency and low-emission technologies,” without giving a timeframe. The risk of climate change “is real and we want to be part of the solution,” it said.

Chevron said it’s working with policy makers on emission-reduction policies, while ConocoPhillips said it’s “focused on action to reduce our climate-related risk” and has cut greenhouse-gas emissions by 6.9 million tons since 2009, keeping “absolute emissions nearly flat.”

Houston-based Conoco also said that “European companies operate under different financial and regulatory regimes so their public communications may vary from ours.”

Bloomberg’s analysis looked at earnings calls and conference-call presentations, enumerating comments made by company executives and other participants, such as analysts.

Recommended for you