Houston’s Occidental Petroleum received a $10 billion commitment from one of the world’s richest men to help boost its bid to acquire The Woodlands-based Anadarko Petroleum.

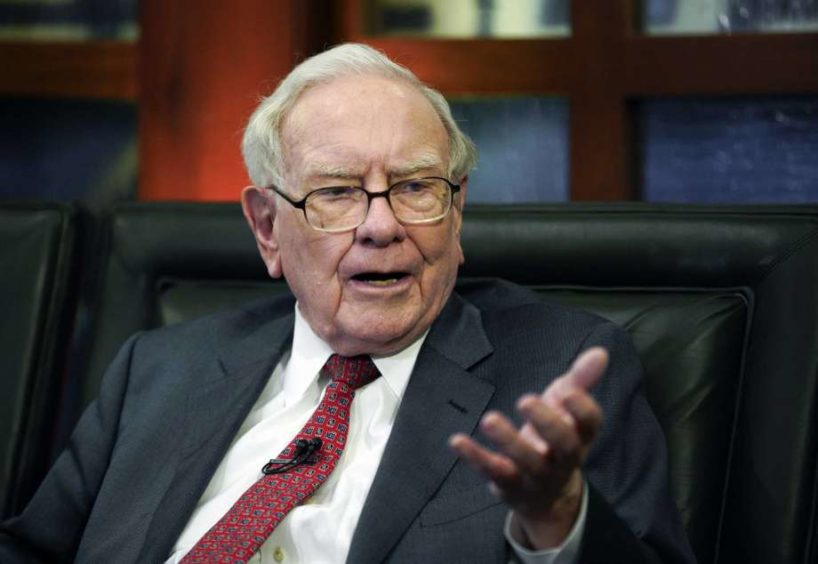

Warren Buffett’s Berkshire Hathaway firm is offering the $10 billion influx to help improve Oxy’s offer for Anadarko as it pushes forward in its bidding war with Chevron.

Anadarko’s board of directors is currently reviewing Oxy’s offer that it has deemed potentially superior.

Chevron agreed to acquire Anadarko for $33 billion at $65 per share more than two weeks ago as Anadarko had preferred Chevron’s fit and long-term value over a larger Oxy bid. But Oxy came back last week with a bigger $38 billion offer at $76 per share that included more up-front cash than its previous offers.

Anadarko also is waiting to see if Chevron will increase its offer. Anadarko would have to pay Chevron a $1 billion breakup fee if it pulls out of its current deal.

Over the weekend, Oxy executives reportedly flew to Omaha, Neb. to meet with Berkshire Hathaway leaders in Buffett’s hometown.

“We are thrilled to have Berkshire Hathaway’s financial support of this exciting opportunity,” said Oxy Chief Executive Vicki Hollub. “We look forward to engaging with Anadarko’s Board of Directors to deliver this superior transaction to our respective shareholders.”

Berkshire Hathaway is committing the $10 billion only if Oxy can seal the deal with Anadarko. Berkshire Hathaway would receive 100,000 shares of the expanded Oxy, including the option to purchase up to 80 million more shares.

The deal would keep Oxy from having to increase its debt load as much and also could help assuage the concerns of some major Oxy shareholders that it was potentially biting off more than it could chew with an Anadarko acquisition.

This article first appeared on the Houston Chronicle – an Energy Voice content partner. For more from the Houston Chronicle click here.