PROVIDENCE Resources and partner Star Energy have applied to the Irish authorities to convert their Dalkey Island licence in the Kish Bank Basin offshore eastern Ireland into a standard exploration concession with a view to drilling an exploration well.

Providence, operator of the LO 08/2 block, said that as part of the proposed activities, the partners have begun the application process for a foreshore licence over the area in order to carry out well-site survey and drilling operations.

The company also recently commissioned a third-party geochemical study on residual oil samples from a nearby well which has confirmed the presence of a highly mature Paleozoic marine oil prone source rock in the Kish Bank Basin.

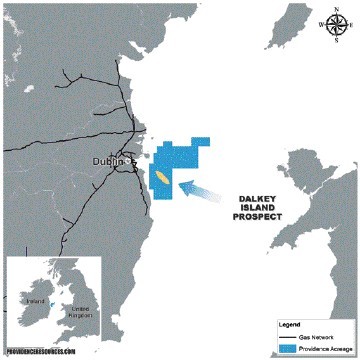

The Dalkey Island prospect is located about 10km (six miles) offshore in just 25m of water.

John O’Sullivan, Providence’s technical director, said of the next stage: “Having completed our technical assessment of the basin, the partners have elected to progress the Dalkey Island prospect into the drilling phase.

“While considerable exploration risk still exists, the recent additional studies, which have revealed evidence of a highly mature oil prone source rock in the basin, have provided significant encouragement as a similar interval is considered to be the source for the prolific producing oil fields in the Liverpool Bay Area, offshore UK.”

Previous exploration drilling in the Kish Bank Basin has confirmed the potential for petroleum generation with oil shows seen in a number of wells together with natural hydrocarbon seeps recorded from airborne surveys.

New analysis of vintage 2D seismic data has revealed the presence of a large undrilled structural closure at Lower Triassic rock strata level situated some 10km offshore Dublin.

Providence believes that this feature, known as the Dalkey Island exploration prospect, may be prospective for oil, as there are prolific oil productive Lower Triassic reservoirs nearby in the eastern Irish Sea offshore Liverpool.

While the Dalkey Island exploration prospect could contain as much as 870million barrels of oil in place, the undrilled prospect still has significant risk.

On the plus side, drilling would be relatively cheap, given the prospect’s location in shallow water and close proximity to shore.

Providence is the operator of Block LO 08/2 and the Dalkey Island Prospect with 50% interest, with Star holding the remaining 50%.

Meanwhile, there has been progress offshore west of Ireland with another key Providence target . . . Dunquin, which is believed to be a giant gas-bearing structure.

The Irish subsidiary of Repsol is now farming into the Dunquin permit by obtaining 25% equity interest from operator ExxonMobil and one of its partners Eni.

Providence said that Repsol is acquiring half the 25% from ExxonMobil and the other half from Eni.

Upon completion of the transaction, which is subject to regulatory and partner approvals, ExxonMobil will continue as the operator of the concession with 27.5% interest, Eni will also hold 27.5%, with Repsol having 25%, Providence 16%, and Sosina the remaining 4%.

The Dunquin licence is spread across five blocks in the deepwater South Porcupine Basin, where waters reach a depth of more than 1,500m.

The northern portion of the prospect has been surveyed and a decision on the drilling of the first Dunquin exploration well would appear to be the next step.

However, there is still flux in terms of ownership and the expectation is that this will have to stabilise first.

Eni advised earlier this year that it intends to sell its entire portfolio offshore Ireland, including Dunquin and other holdings in the Porcupine, Rockall, and Slyne Basins.