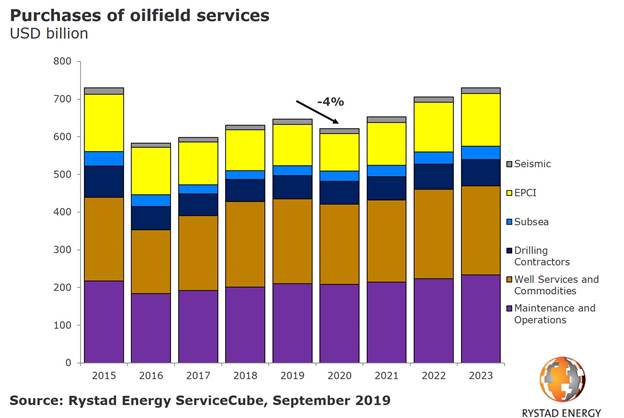

Lower oil prices will push the global service market into a recession in 2020 after three successive years of growth, according to Rystad Energy.

Audun Martinsen, head of oilfield services research at Rystad Energy, forecasts a 4% decline in global oilfield service revenue if oil prices stay flat next year.

Martinsen said: “Lower oil prices call for negative growth in the service market in 2020.

“For suppliers, this means that a three-year growth story will come to an end regardless of which market segment you look at.”

The service market will likely achieve 2% growth in 2019, to $647 billion. In 2020 this number will fall to $621 billion with an oil price of $60 per barrel (Brent).

Looking at the various market segments, the shale industry will likely drag down oilfield service purchases as it contracts by 6% next year.

Offshore will fall 1% as oil companies cut brownfield and exploration activity in an attempt to reduce spending.

Other onshore activity will see revenues slashed by around 5% as OPEC scales back investments to curtail output.

However, due to the existing backlog, some service segments can still realize positive revenue growth.

Subsea equipment, SURF (subsea umbilicals, risers, and flowlines) and offshore drilling can still accelerate in 2020, but growth will fall from the double-digits to the single-digits.

Mr Martinsen said: “This new market view stands in stark contrasts to what we previously forecasted when oil price estimates stood around $70 for 2020.

“At that oil price, the service market was expected to grow by 2%, held up by offshore and shale.

“However, downside risks have been mounting in the oil market, and we could face additional headwinds in 2020.”

Rystad forecasts a positive outlook for the global oilfield services market.

Mr Martinsen added: “In 2021 we will see the long cycle effects manifesting into a greenfield, exploration and brownfield wave, which will come into play and initiate a 5% growth as the oil market sees relief and investments follow.”

Looking towards 2023, offshore market segments, shale and other onshore segments are likely to realize an average compounded annual growth rate of 2% to 3%.

Subsea purchases, construction and installation, and equipment seem even more robust at 7% due to the massive influx of large offshore and LNG projects and the fact that subsea developments see a new renaissance, according to Rystad Energy.

Recommended for you