Scotland. Proud home of the noble haggis, magnificent Highlands and, of course, Scotch whisky.

Scotch whisky was first distilled more than 500 years ago and to this day remains a cornerstone of Scottish society and the economy. Every year, Scotland produces roughly 390 million litres of whisky – the equivalent of 156 Olympic swimming pools – and exports roughly 1.2 billion bottles globally. Indeed, Scotch whisky now accounts for more than 20% of all UK food and drink exports. The country also has some of the best offshore energy resource in Europe. So why not bring the two together?

Distilling whisky is energy intensive.

Before we could determine exactly how and where offshore renewable energy can be used, we needed to estimate just how much energy is required. Using annual energy consumption (broken down into electricity and thermal demand) and whisky production data for numerous distilleries, we were able to calculate the number of kWh required to produce each litre of whisky.

Taking the average kWh/litre measurement, we then applied this to the annual production of every distillery in Scotland to determine overall energy need. We calculated that the 122 distilleries in Scotland consume almost the same amount of energy each year as 250,000 British households – roughly 3.7TWh, of which 140GWh is electric demand.

Most of this energy is currently met through the burning of fossil fuels but this is starting to change. Scotland is world-leading in its emissions reductions targets and Scottish industries are following suit. The Scotch Whisky Association has a goal of sourcing 20% of primary energy requirements from non-fossil fuels by 2020, increasing to 80% by 2050. Diageo has already installed anaerobic digestors that make good use of organic waste and reduce dependence on fossil fuels, and companies like Green Stills have developed processes that greatly increase the efficiency of energy use. Such initiatives are crucial if targets are to be met, but more is still needed.

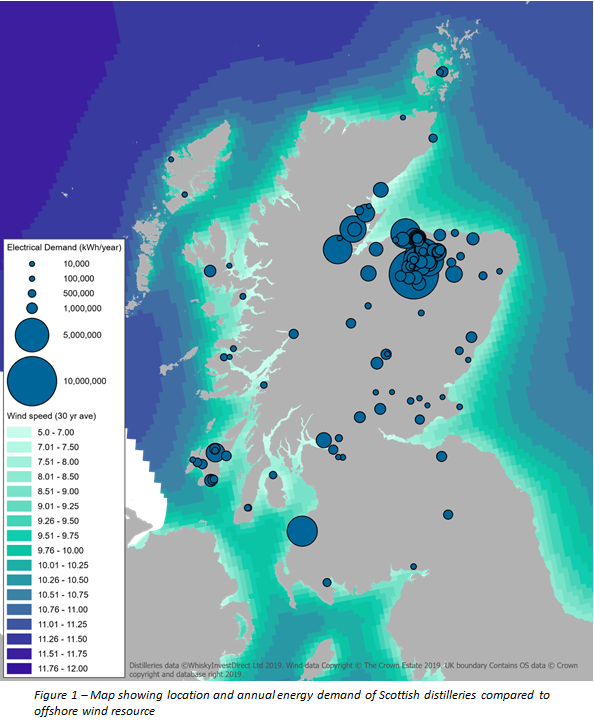

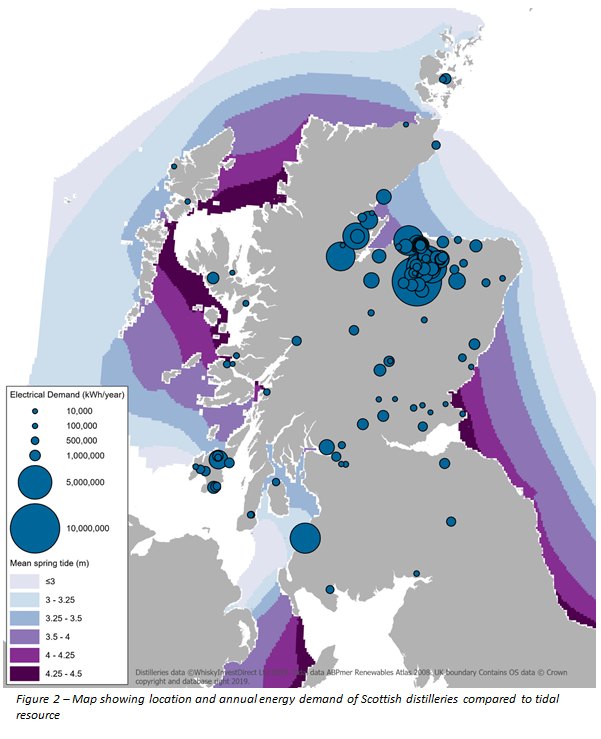

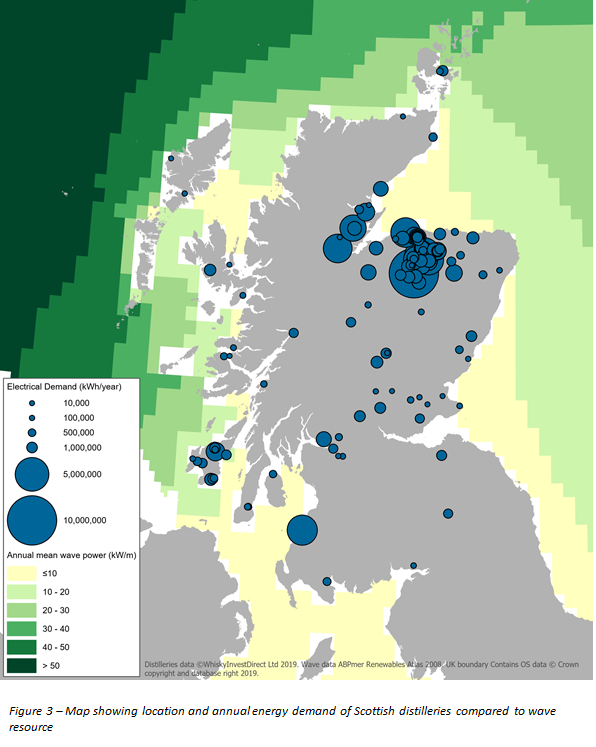

Distilleries with their high energy demand and often remote, coastal locations – many of which have constrained grids – are ideal contenders for marine energy. Using wave and tidal data from the UK Renewables Atlas and wind data from the Met Office, we created GIS maps showing the locations of all Scottish distilleries, individual energy demand, and nearby offshore wind, tidal, and wave resource. These can be seen in Figures 1, 2, and 3 respectively.

As can be seen from the maps, Scottish distilleries are often located in clusters. Speyside has by far the highest concentration, with other clusters apparent in island regions such as Orkney and, of note for tidal developers, Islay.

The presence of distilleries on islands such as Islay means there is much higher local demand than might be expected from relatively small local populations. Islands are also where you can find the best offshore energy resource, especially for wave and tidal generation. A mutually beneficial possibility presents itself.

Making use of locally generated, renewable energy could help one of Scotland’s largest, and most iconic industries decarbonise. Should Scotch whisky switch to renewable sources of electricity, almost 60,000 tCO2e greenhouse gas emissions could be prevented – 0.15% of Scotland’s total. If thermal demand can also be met renewably, this goes up to a saving of almost one million tCO2e or 2.6% of Scotland’s total.

Given Scotland’s world leading climate change emissions reduction targets, acting now will help the Scotch industry stay ahead of policy requirements and will likely be smiled upon by Holyrood and Westminster alike. As well as being cleaner, socially responsible, and politically prudent, switching to local, renewable generation could prove beneficial for island distilleries’ bottom lines by reducing dependence on expensive fuels that must be imported from the mainland.

Indeed, this is already starting to happen.

In August 2019, the HySpirits project was awarded £148,600 by the Department of Business, Energy, and Industrial Strategy (BEIS) to investigate the use of hydrogen as the combustion fuel within the distilling process. This project is a partnership between Orkney Distilling Ltd, the European Marine Energy Centre (EMEC), and Edinburgh Napier University and aims to remove the need for fossil fuels such as kerosene and LPG.

This project will build upon the progress Orkney has already made in becoming a global centre of hydrogen development. Like many islands, Orkney has excellent renewable energy resource. So much so in fact that the local grid is unable to accommodate it.

Rather than letting the potential go to waste, the local government along with partners, such as EMEC and local community generators, decided to use the surplus electricity to generate hydrogen. The Surf ‘n’ Turf project, for example, uses community-owned wind power and tidal power from EMEC to produce hydrogen that is then used by the Kirkwall Harbour and ferries. If and when the HySpirits project is successful, it will provide a roadmap for similarly situated distilleries to decarbonise.

Distilleries are also ideal clients for renewable developers. Recent research by Xodus has found that one of the major hurdles facing offshore energy developers is a lack of economic certainty, often stemming from a failure to qualify for support in the UK government’s Contracts for Difference (CfD) subsidy mechanism.

The latest CfD auction has resulted in record low strike prices for offshore wind, with an average of £40.63/MWh. Such prices are comparable with traditional forms of generation and mean that the offshore wind sector is now able to compete without subsidy. However, it is no surprise that the successful bids came from the largest, most experienced developers.

Smaller offshore wind developers have struggled and a failure to qualify for CfD subsidy support means the future of many projects is now uncertain. Likewise, with tidal and wave energy which, despite both experiencing relevant cost reductions in recent years, are said to be 10 and 20 years respectively behind offshore wind and cannot hope to compete with this sector for subsidy in the short to medium term.

Uncertainty over future revenue results in higher investor risk and therefore increases the cost of finance. This can undermine the economic case for otherwise viable projects. An alternative means of achieving this certainty is via Power Purchase Agreements (PPAs) whereby generators sell electricity directly to demand centres. To be attractive, offshore generators will need to be able to offer some guarantee of supply and stabilise their output requiring some form of energy storage.

Fortunately for tidal, current storage technologies are well-suited to tidal resource variability helping the economic case stack up. With their high demand and proximity to good offshore resource, distilleries are ideal candidates for such agreements. By providing a guaranteed market and price for renewably generated marine energy, distilleries can help such projects achieve the economic support they need to develop while meeting their own decarbonisation and social responsibility targets.

Offshore renewable generators – particularly wave and tidal – further stand to benefit from such an arrangement by being able to develop their technologies outside competitive markets. Rather than having to directly compete against more established technologies and more experienced developers in a very public domain, PPAs will allow tidal and wave developers to hone their technologies and learn through doing on a smaller, more private scale. IPPAs will allow less established technologies to continue to develop and improve, encourage supply chains to develop, and will allow developers to gain experience.

Ultimately this will enable these technologies to survive and thrive until such time that a more supportive subsidy framework is introduced, or the technologies become able to compete within the existing market.

Xodus’ Renewables team specialises in offshore wind, tidal, wave, and energy systems consultancy and is well-placed to support any distillery or developer interested in pursuing a mutually beneficial arrangement. We have experience supporting in such fields as site selection, generation technology specification, and energy storage as well as feasibility studies and EIA.

Recommended for you