New research identifies why women fail to advance—and suggests what the industry can do about it.

Companies that have a significant share of female leaders outperform their peers, according to McKinsey research. Companies in the oil and gas (O&G) industry should carefully consider this insight, given that the industry has struggled to attract, retain, and promote women. Addressing this problem is important: the sector faces an aging workforce as well as demand for new kinds of skills in areas such as advanced analytics, machine learning, and robotics.

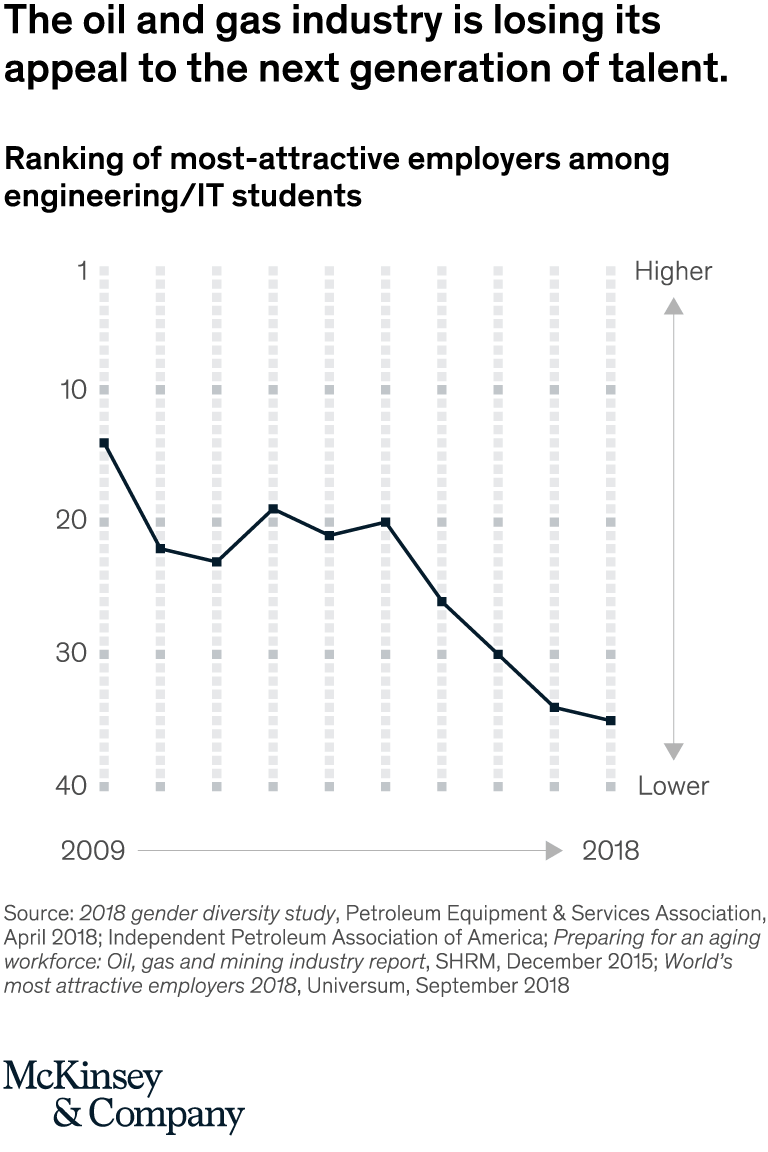

At the same time, the industry’s appeal is declining among younger people (Exhibit 1). A decade ago, O&G was the 14th most attractive employer among engineering and and IT students; now it is 35th. Given the need for talent, it is critical for the O&G industry to deepen and diversify its pool. One way to do that is to bring in and retain more talented women. There is a long way to go. Right now, women comprise only 15 percent of the O&G workforce.1

Exhibit 1

To understand the status of women in the O&G industry, McKinsey analyzed data from 250 companies. We also evaluated individual O&G company data compiled through McKinsey’s Women in the Workplace 2018, which evaluates the attraction, retention, and attrition rates of women in corporate America.2 Finally, we interviewed more than 20 current and former CEOs and senior executives.

What we found was that at a time when the need for new types of talent is great and the competition for it intense, O&G companies are failing to retain many of the comparatively few women they attract in the first place. Half of the 250 O&G companies we surveyed don’t have a single woman in top management; another third have only one.

This low female participation has real consequences. McKinsey’s previous research, Diversity Matters, found that companies in the top quartile for women leaders are 15 percent more likely to have above–industry average financial returns. While the research is careful to note that no causal connection can be proved, it observes that the correlation suggests “that when companies commit themselves to diverse leadership, they are more successful.” One O&G executive applied that thought to the ground level: “This is a business decision. By 2025, we are going to be a millennial and Generation Z workforce [that is] inclusive and diverse. If your business is not, you are going to get bottom-of-the-barrel workers.”

Problems in the pipeline

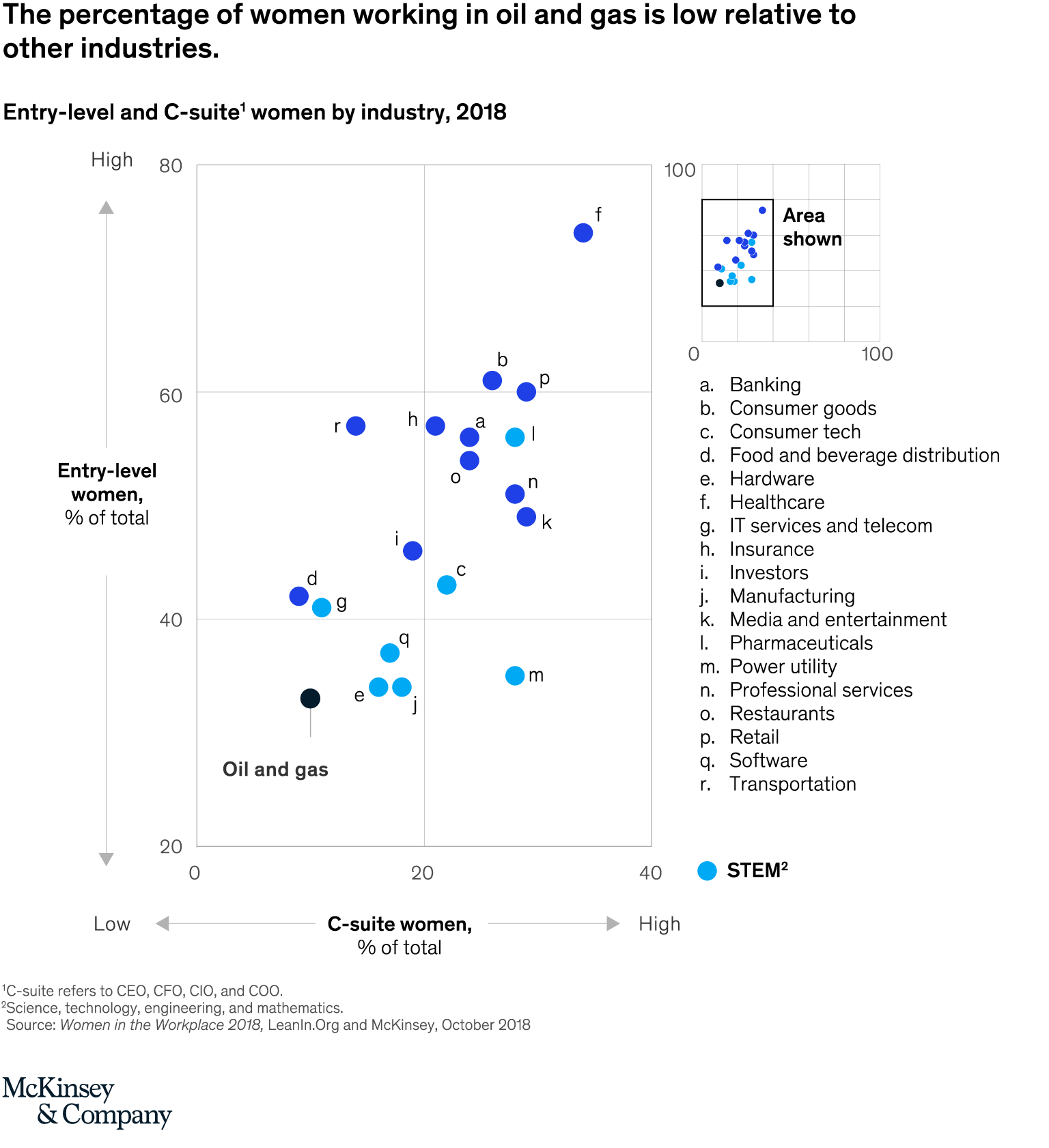

The problem of untapped female talent is not unique to O&G, but it is more acute. When compared with 18 other industries, O&G was last in female participation at entry level and second to last in the C-suite (Exhibit 2). When compared with other science, technology, engineering, and mathematics (STEM) industries, it ranked last.

Exhibit 2

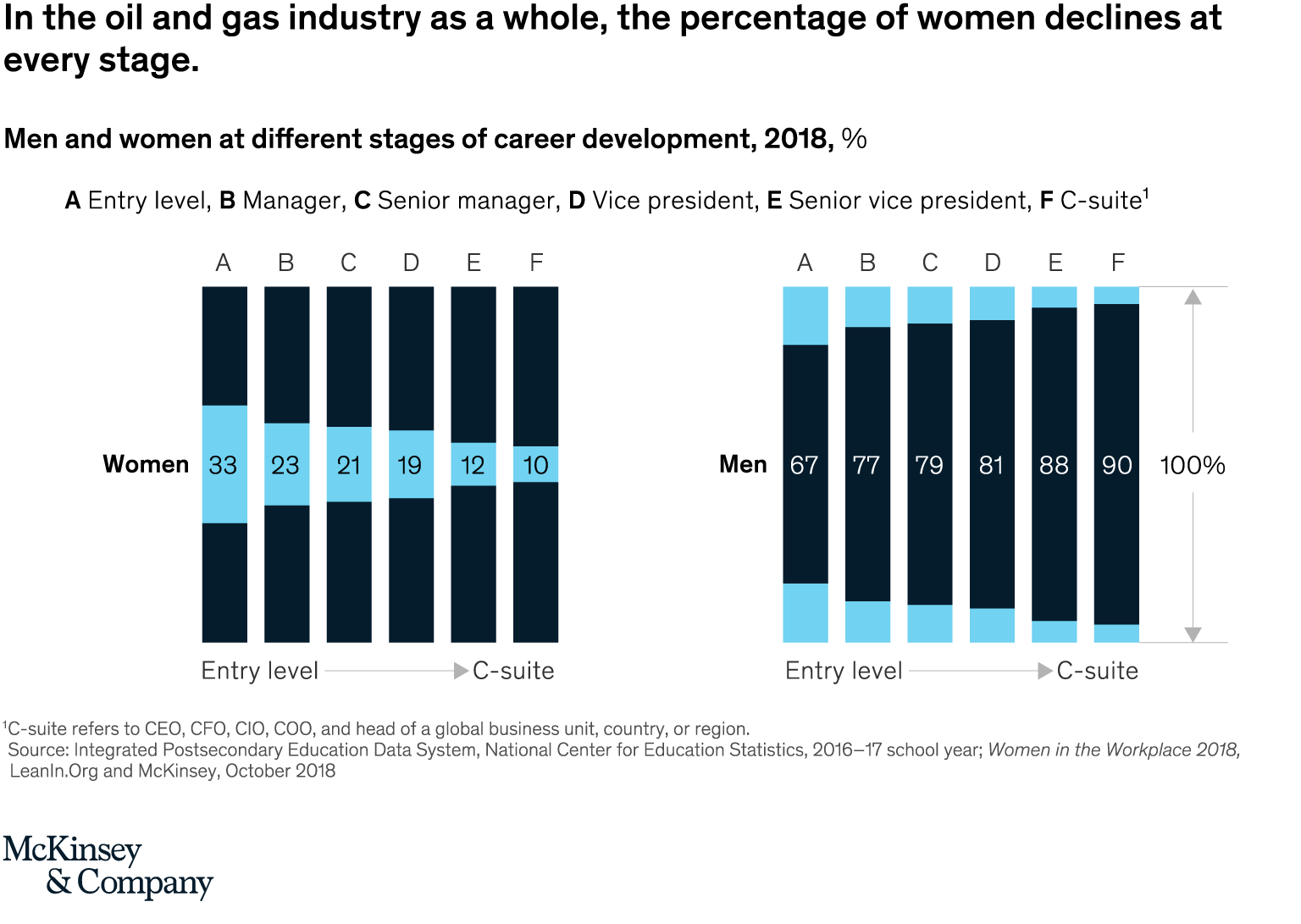

Only a third of entry-level employees in the O&G industry are female, compared with 41 percent across other STEM industries and 48 percent for the corporate sector as a whole. Certainly, one reason is structural. Women account for only a small share of graduates in relevant majors, such as mechanical engineering (13.9 percent) and petroleum engineering (17.1 percent).3 That likely affects the number who take up entry-level positions. In other STEM fields, women account for 35 percent of graduates (and 57 percent of all college graduates).4

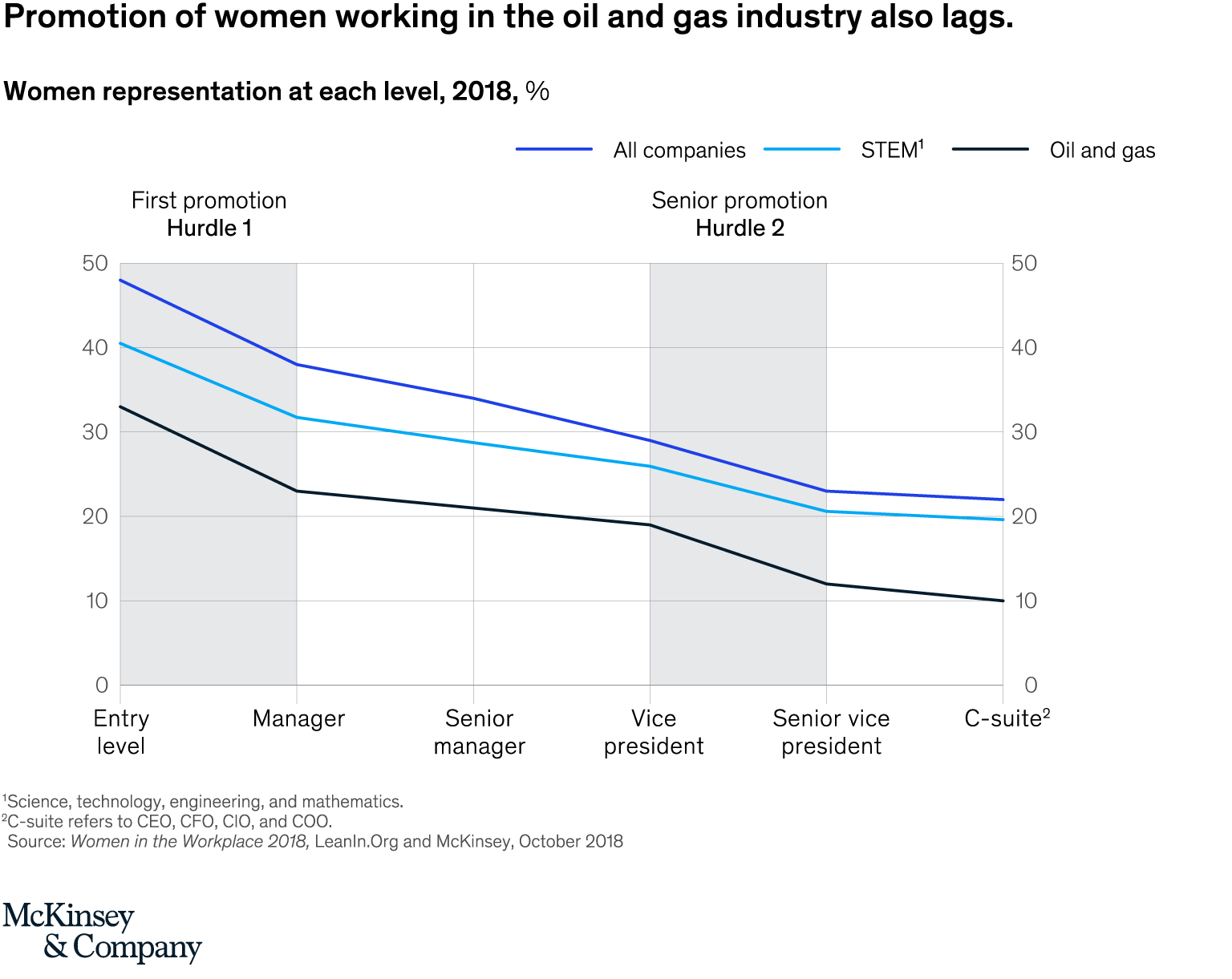

But that difference at the beginning doesn’t explain why, at every subsequent stage of the O&G pipeline, the percentage of women declines, and at faster rates than in other industries. Our research indicates that there are two main hurdles for women in O&G—getting the first promotion into management and then getting promoted at the senior vice-president (SVP) level (Exhibit 3).

Exhibit 3

Hurdle 1: Getting the first promotion

Hurdle 1: Getting the first promotion

While our Women in the Workplace research shows that getting the first promotion is a challenge for women in many industries, it is worse in O&G. Female participation in O&G declines 31 percent from entry-level roles to manager roles, compared with 22 percent in other STEM industries and 20 percent in the overall corporate workforce.

Why do so many women fall at the first hurdle? The reasons will vary depending on the company and across O&G subsectors (see sidebar, “Where the women executives are, by subsector”), but we believe that one factor relates to the common expectation that it is necessary to accept international or remote assignments to get promoted. That can be challenging for those starting or raising young families at this point in their careers. One CEO we interviewed noted that the centers of O&G operations are often in remote or otherwise unappealing places. But passing up such opportunities early in their careers worsens women’s chances of promotion later. Men, of course, can face the same issue, but based on our experience and after discussions with O&G leaders, we believe that it affects women more, hurting their relative representation.

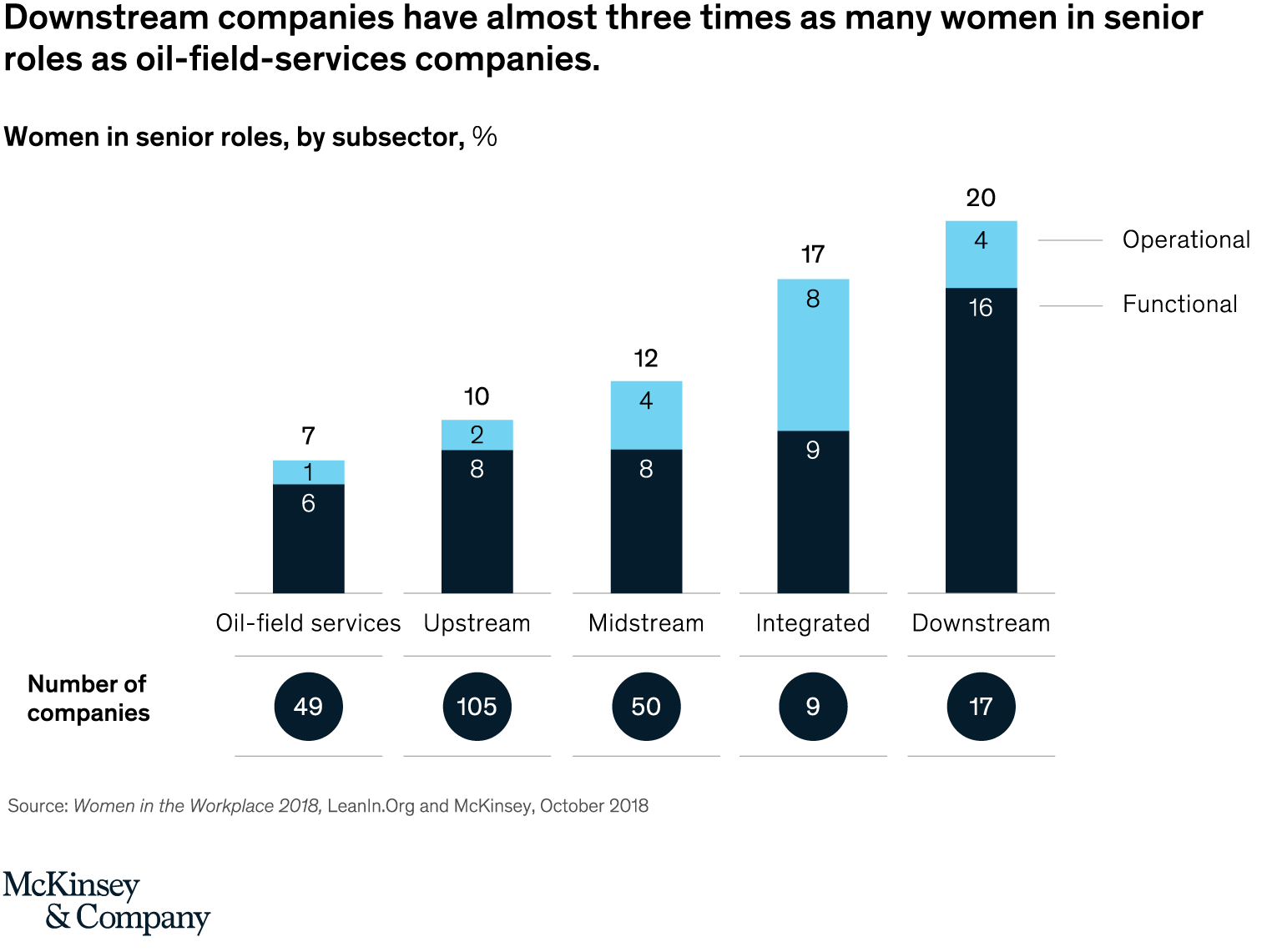

Where the women executives are, by subsector

Our analysis of the executive teams of 250 North American O&G companies found that the percentage of women in top roles—meaning at the vice president, senior vice president, and C-suite levels—varied significantly, depending on the subsector. Executive-level female representation in integrated exploration and production (E&P) companies (including majors and other companies integrated downstream) and downstream-only companies is two to three times higher than in oil-field services and upstream companies (Exhibit 4).

Exhibit 4

Downstream companies have almost three times as many women in senior roles as oil-field-services companies. Why? We cannot be sure, but here are some hypotheses.

Integrated E&P companies, relative to other subsectors, are known for having extensive programs to attract, develop, and retain female talent, including generous and flexible leave and part-time work polices. These programs may help to retain women throughout the pipeline. Integrated E&P companies “have been very focused on bringing [women] in,” says one female executive who has spent her career in one. “They gave me incredible training and moved me along very quickly.” Oil-field services, by contrast, have more volatile margins and may not feel able to invest as much in similar programs.

Downstream companies lead all subsectors in the percentage of executive-level women in functional roles. Senior executives in this sector are typically expected to have led and performed well in commercial roles, such as marketing and sales. Senior executives in upstream companies, on the other hand, are typically expected to have succeeded in frontline operations experience—an area with relatively few women. So it is likely to be the case that senior functional roles at downstream companies can draw from a deeper female talent pool compared with senior operations roles at upstream companies.

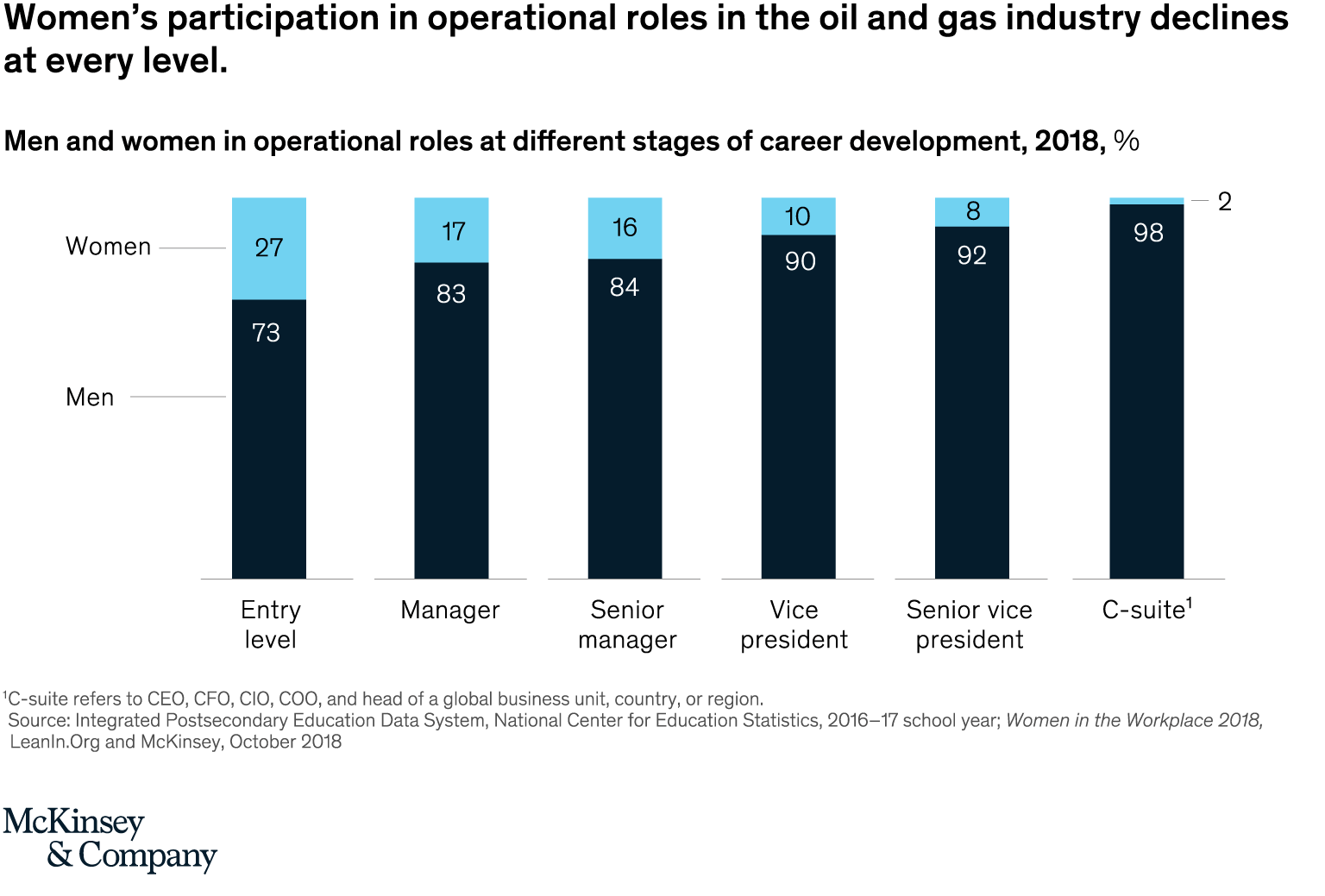

Our analysis supports this premise. It found that advancement to the O&G C-suite is particularly difficult for women in operations—those with frontline roles and profit-and-loss responsibilities. Once women in operations reach the senior-manager level, they suffer in comparison to men in every way—hiring, attrition, and promotion. The result: women hold only 2 percent of C-suite operational positions1 (Exhibit 5).

Exhibit 5

Another possible factor, widely mentioned in interviews but difficult to assess, is unconscious bias. One executive noticed that a list of high potentials in their company had notably few women on it. Curious as to why, their team looked at the relevant performance reviews and found that women in equivalent positions to those in the high-potential group also had similar performance records. Why, then, were these women not considered “high potential”? The answer was that they had mistakenly been overlooked.

Required moves to remote locations and unintentional biases mean that O&G loses many women relatively early in their careers. This contributes to the creation of a “hollow middle,” which has profound long-term effects, reducing the number of women available for promotion. As a result, women can never catch up and remain even more underrepresented throughout the pipeline.

Hurdle 2: Challenges on the journey to the top

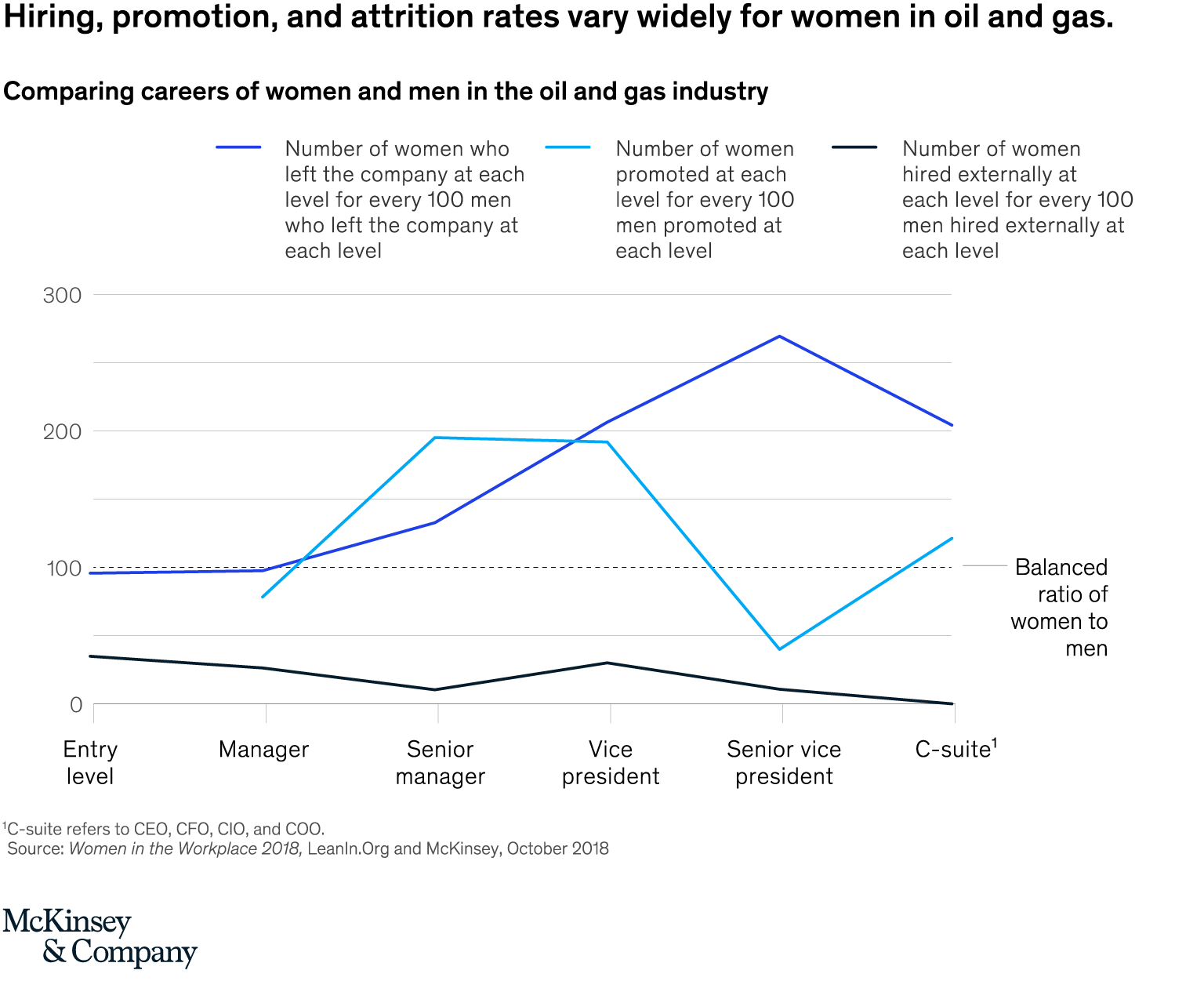

The second and even higher hurdle for women is the leap from vice president (VP) to senior vice president. Overall, the proportion of women represented in the industry declines by 38 percent from VP to SVP, almost twice the fall seen in other STEM industries and corporate America as a whole. There are industry-wide difficulties at every point—hiring, promotion, and attrition (Exhibit 6).

Exhibit 6

Hiring: At the SVP level, for every 100 men hired externally, on average only 11 women are. We identified two possible reasons for this. First, there is the hollow middle—there just are not many women around to promote. Second, some executives we interviewed noted that today’s SVP candidate pool—people in their 40s and early 50s—is relatively shallow because of the “lost generation.” What we mean by that is that the oil-price crash in the 1990s drove people to leave the O&G industry and others not to enter. Executives we interviewed also speculated that women are more likely to hold functional roles, such as finance, legal, and accounting. These skills are readily transferable to other industries, unlike some male-dominated roles, such as petroleum engineering. It is possible that women who would now be in senior roles left disproportionately for other fields and did not return when oil prices recovered.5 Again, the result is a smaller pool of women available to advance, relative to men.

Promotion: According to our data, women actually perform well relative to men with respect to getting promoted to senior manager and vice president. However, because there are relatively few women to start with, in absolute terms the number of women at these levels remains low, even though their promotion rates are higher. The same is true at the C-suite level.

That record makes it all the more striking that for every 100 men promoted to the SVP level in O&G companies, only 40 women are. One factor could be the consequences of prior career decisions, such as opting out of line positions or remote assignments. These roles are often what executives and boards seek in senior leaders. A former executive and director of several O&G boards told us, “[In global oil and gas companies], if you don’t actually live overseas, you cannot go beyond a certain level.” In addition, executives we interviewed noted that women who make it as far as VP may have more limited internal networks because of the lack of other women around and above them. There may also be biases in the form of cultural misperceptions of women’s abilities. “Women are often seen as better facilitators and collaborators, and therefore more encouraged to step into staff roles,” one senior woman told us. “I was adamant about staying in line [roles]. Women who were good got moved into staffed jobs . . . if you did two staff jobs you would never go back to line.”

Attrition: Women in O&G who make it to SVP are almost three times more likely to leave than men; 269 women leave at this level for every 100 men. This is unique to the O&G industry: attrition rates at SVP are equal for men and women in other STEM industries and are actually less for women in the rest of the workforce. This is particularly notable given that women in O&G leave at similar rates compared with men up until VP, where their attrition rate doubles.

One possible reason is that women at this level may begin to believe that they can go no further and decide to move laterally or leave the sector entirely. As a former chairman and board director of several O&G companies put it, “Women who get promoted [to SVP] and think they won’t get promoted beyond that leave earlier rather than later.” Some top executives we spoke with agreed. These assertions are admittedly subjective, but they are plausible.

For companies, the priority should therefore be to gather evidence, and then figure out how to address the issue.

To put it all together, in the O&G industry as a whole, women account for only one in eight SVP positions, and one in ten in the C-suite (Exhibit 7).

Exhibit 7

What companies can do

What companies can do

As the industry undergoes rapid change, including the need to incorporate new skills in advanced analytics, machine learning, and robotics, there is great potential to both increase female participation and to realize its benefits.

Each company needs to understand the specific reasons for fall-offs in female participation, and then create specific solutions to address them. That said, we have found that three inflection points are widely relevant: at the entry level (and before) and at the first and second promotion hurdles discussed above. We have also identified initiatives that could pay off at each point.

Entry- and pre-entry level: Recruiting the talent of the future

Build a persuasive narrative. Given widespread public interest in renewable energies and concern about the role of fossil fuels in climate change, O&G companies have an uphill battle in making the case for their industry. How can they attract talented people to what is increasingly perceived as a “dirty” industry? Companies need to articulate a positive narrative to graduates and entry-level hires on how the sector can promote economic development and help manage the transition to the energy system of the future.

Identify what degrees and skills are needed and aggressively recruit new and recent female graduates in these fields. As the data and technical needs of the industry evolve, many companies need to retool the profiles of their target entry-level candidates. In short, not everyone needs to be a petroleum engineer or geologist. Expanding the range of new-hire profiles will create a deeper pool of candidates. As a result, companies may have more success attracting women from other STEM fields where they often have a higher representation relative to fields specifically allied to O&G. For example, women comprise only 14 percent of mechanical engineering graduates but make up 21 percent of computer science majors and 47 percent of chemistry majors.

Would you like to learn more about our Oil & Gas Practice?

The first promotion hurdle: Rising into management

Evaluate whether remote assignments are critical for early promotions. To retain more young women, and indeed to provide more flexibility to everyone, companies may want to consider developing alternative career paths that do not require moving to remote environments. This may not be possible for some subsectors, such as oil-field services, but it fits in well with broader changes to industry operating models that are already occurring. For example, several companies are rethinking what activities can and should be centralized; there are also more ways to monitor operations remotely. Being physically present in the field may no longer need to be a rite of passage for everyone.

Ensure that the slate of male/female candidates considered for early promotion is representative of the employment pool. This is one way to protect against unintended bias. Research has found that in companies that have adopted these practices, more women get promoted.

Create and communicate to young workers the possibility of flexible career paths. Developing such pathways will benefit both men and women, but women probably a bit more, setting them up for future success. Consider creating clear career paths that allow people to step out of operational or frontline roles depending on their personal circumstances. If young workers can see a way to balance career and family, they may be more likely to want to stay. At the same time, however, women must be sure not to take extended “detours” off track that will hurt their chances for more senior promotions later.

Provide early-tenure women access to female role models. Seeing women succeed is encouraging in itself. These relationships could result in women sponsoring other women, helping them navigate opportunities and advancement in their companies.

The second promotion hurdle: Rising into senior management

Communicate clearly to women at every level what it takes to advance. For instance, if long stints in operational roles are a requisite for top jobs, companies should encourage women, helping them to take these positions. Only then will there be a pool of experienced women candidates with the credentials to rise to senior executive positions.

Analyze the history of senior promotions and link female sponsorship programs to succession-planning processes. Companies that have struggled with attracting, retaining, and advancing senior women should assess what happened in specific cases, and what can be done to better groom talented women. Based on what they have learned, companies can build tailored sponsorship programs for high-potential women. This may be particularly useful for women in operational roles, where the challenges of advancement are the highest.

Consider rethinking the approach to building top-level executive teams. Research indicates that having a significant number of women on senior executive teams can improve decision making. Having women on board brings in different cognitive styles, which helps to improve creativity and problem solving. In addition to such prerequisites as breadth of experience and on-the-job performance, companies can consider the value of incorporating diverse leadership qualities as a consideration in senior promotions.

What the industry can do

Industry-wide change will require industry-wide action. Companies need to come together to collectively develop, implement, and communicate progress. Here are some areas to consider.

Lead the leaders. Educate top executives, board members, and shareholders on the value of hiring and promoting more women.

Create leading performance indicators that companies can adopt. These should be focused on inputs that can help improve the advancement of women rather than outcomes. Examples could include percentage of managers who have undergone unconscious bias training; or whether internal-hiring recruiters consider proportional slates of men and women candidates; or the prevalence and scale of women-oriented sponsorship programs.

Encourage companies to voluntarily adopt and publish scorecards. Managers are trained to manage numbers. Knowing where and how women are advancing creates useful transparency. It may also encourage healthy competition among companies to do better.

Compile a playbook of industry-standard best practices to showcase examples of progress.

Kassia Yanosek is a partner in McKinsey’s Houston office, where Sana Ahmad is an associate partner; Dionne Abramson is global director of external affairs in McKinsey’s Luxembourg office.