Anderson Anderson and Brown Corporate Finance is delighted to share with you our quarterly Deals+ update for Q4 2019 in conjunction with Energy Voice, highlighting selected oil and gas mergers and acquisitions and fundraising transactions across the UK.

From an oil and gas perspective, deal-flow slowed slightly towards the end of 2019 with fewer Private Equity (PE) backed transactions in comparison to previous quarters but with the majors continuing to take a disciplined approach to capital and operating expenditure with a resultant focus on the disposal of non-strategic assets.

This has led to the exit from the North Sea of oil majors where the efforts are on restoring confidence in the equity markets by withdrawing from high-cost regions of production.

Despite this, a sign of renewed confidence in the North Sea was Aberdeen-based SCF Partners’ deal for Peterhead-based Score Group plc for £120 million, and newly-formed Waldorf Partners’ purchase of producing North Sea fields through the acquisition of Endeavour Energy UK.

The deal provides Waldorf with a 25.68% and 30% stake in the Alba and Bacchus fields.

The recent climate protests and proposed environmental policies have led to a lack of appetite for small-cap producers operating in the North Sea and 2019 can therefore be seen as a year of opportunism with valuations still far behind pre-crash levels and the debt-markets remaining relatively “strong” with cheap debt and reserve-based lending often fuelling such opportunities.

Elsewhere, E&P operator Cairn Energy plc continued to divest non-core assets with the sale of subsidiary company Capricon Norge AS to Solveig Gas Norway AS for a sum of £77m.

Aberdeen-based and PE-backed Motive Offshore continued their impressive growth plans with the acquisition of Pumptech AS, a provider of pumping and hydraulic equipment rental and repair services.

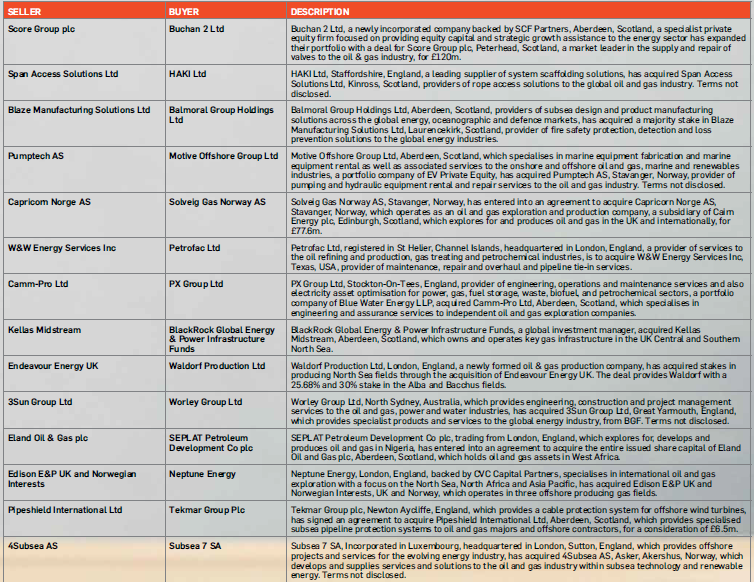

Mergers and Acquisitions (click on image to enlarge)

Fundraisers