I have been working in Syria on a gas project but had to leave because of the political situation there, plus the imposition of sanctions by the European Union (EU) on that country’s oil and gas industry.

It was hugely disappointing because the gas project is a very interesting one and I have enjoyed working and living in Damascus.

The EU has also imposed new sanctions on the oil industry in Iran, which are likely to have much greater impacts than those on Syria because Iran is a very important producer and exporter of oil.

But are these sanctions likely to have the desired effects?

I read an article a few days ago which claimed that the sanctions on Iran, and in particular the threatened closure of the Strait of Hormuz to oil tankers, would not work.

The author wrote that “history is littered with failed oil embargoes ranging from Cuba, Rhodesia, South Africa and Iraq after 1990”.

I should be old enough to remember these other embargoes but confess that I don’t.

However, the big difference between those and the new embargoes is that the former were not targeted at oil producers, with the exception of Iraq. The other countries were very dependent on imported energy, so had to find ways around the sanctions.

In contrast Iran is a major exporter of oil. The sanctions, including ones on banks and other financial services, are intended to cause economic difficulties for the Iranian government and force it to give up its ongoing nuclear programme. The EU sanctions involve an immediate ban on all new oil contracts with Iran, whilst existing contracts will be honoured until July 1.

A basic problem for the EU is that it only has powers over its own member states and will have to persuade other countries to support its actions. The US will definitely do that because of longstanding opposition to Iran’s nuclear ambitions but other countries may not.

In 2010, about 20% of Iran’s oil exports went to EU countries, some on long-term contracts, with Italy accounting for about half the total. China accounted for another 20%, Japan 17%, India 16% and South Korea 9%.

Japan and South Korea are expected to support the sanctions but there are doubts over China – as usual – and India.

Even a reduction of 50% in Iran’s oil exports would cause massive problems for the country’s finances. An obvious strategy would be to find alternative markets to the EU, probably by heavy discounting, but I believe that would be very difficult. Russia, for example, is a strong supporter of Iran but has no need to import oil.

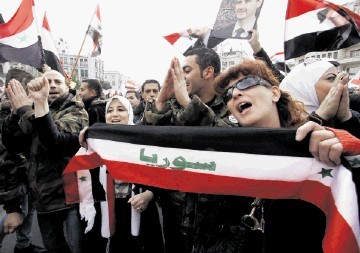

I have first-hand experience of the sanctions in Syria, which seem to be hitting the average man and woman in the street, rather than the ruling elite.

Despite the country’s oil and gas reserves there is insufficient domestic refining capacity, so many products such as diesel and petrol/gasoline have to be imported. That is now very difficult because of the sanctions so there are increasing shortages.

The Syrian oil minister said recently that the oil sanctions had cost his country $2billion in lost revenues since September. However, there have been no significant political changes in Syria to date.

The financial impacts on Iran would be much greater because the government is very dependent on oil revenues.

Yes, there might be some compensation from higher oil prices, particularly if there are conflicts in the Strait of Hormuz, but I expect Saudi Arabia and possibly other Gulf countries to increase their production if that happens. In any case, there appears to be tacit support in these countries for the sanctions.

I believe therefore that the sanctions will soon force a more conciliatory response from Tehran. Quite simply, the Iranians will not be able to cope with a long-term reduction of their oil revenues.

There are not many Scottish oil service companies working in Iran and Syria, so there will be few direct impacts on the oilfield supply chain industry here.

However, there is the peculiar case of the Rhum gas field on the UKCS, which is a 50/50 joint venture between BP and the Iranian Oil Company. BP was forced to suspend production from Rhum in November 2010 in order to comply with earlier EU sanctions.

Quite when production might be restored from this gas and condensate field is anybody’s guess and its reactivation could prove challenging because it is classed as high pressure/high temperature and no one has ever had to reactivate such a reservoir.

Tony Mackay is the MD of energy economists Mackay Consultants

Recommended for you