It has become a well-trodden path for Aberdeen-based oilfield service companies to seek new markets and push into unknown territories by setting up business or making acquisitions of local companies or businesses.

Iraq could be the next jurisdiction to see a significant influx of entrants, but what are the legal challenges facing Aberdeen oilfield service businesses in doing so?

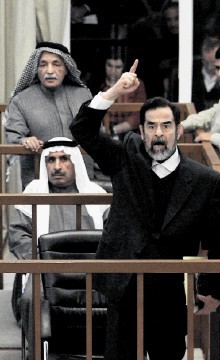

Iraq has only recently become the focus of international business after the Saddam era, and the Iraqi legal framework is very much a work-in-progress.

A close look at the business trends shows that the common practice has been for foreign businesses to enter the country through establishing branches or subsidiaries, rather than partnering with or acquiring existing local businesses.

Unlike other countries in the Middle East, where a statutory cap is usually set for foreign ownership of local companies, the Iraqi Companies Law offers the flexibility of 100% foreign ownership. Such flexibility may be considered as an incentive, in part, for avoiding legal structures that embody arrangements with local partners in Iraq through the acquisition of minority interests in existing structures.

However, a more practical reason justifying these common market trends of setting up branches and subsidiaries remain the difficulty in undertaking comprehensive and reliable due diligence in relation to existing Iraqi businesses or assets.

By way of example, it is practically impossible to confirm whether a particular company is subject to any pending legal proceedings in Iraqi courts.

Court records are not electronically kept and are not centralised.

Any search of courts’ records would need to be undertaken manually by visiting each and every single court.

The costs involved in such a due diligence exercise could be cumbersome for an acquisition process and, more importantly, it is difficult to rely on the results of such a due diligence.

Based on the above, foreign businesses are left with the alternative of establishing a new presence in the country, whether through setting up a branch office or an Iraqi subsidiary in the form of a limited liability company (LLC).

And, between those two options, the LLC remains the more favourable structure given that foreign businesses are not permitted to register a branch in Iraq (except in the Kurdistan region) unless they have won a government contract first.

Another difficulty is the fact that the branch would continue to be in existence only as long as the government contract is in place, which would cause the relevant oilfield service company significant uncertainty when considering investing in Iraq.

One of the main challenge that all new businesses have to face in Iraq is the unfriendly timeframes for establishing a branch or an LLC.

For instance, the timeframe for establishing an LLC could range, in practice, from four months up to seven months and no fixed milestones can be set or expected from the process.

This is largely due to lack of clarity in the registration requirements and the margin of discretion and time that local authorities take in requesting further documents/information during the registration process; and constant developments in the Iraqi legal framework.

On a more positive note, the Iraqi market remains generally an attractive place to do business given the large potential and opportunities that the country holds.

Oilfield service businesses looking to enter the market would be advised to seek a full suite of professional advice that encompasses international, regional and local input in order to minimise the various relevant legal risks that are present.

Frank Fowlie is a partner in Aberdeen with CMS Cameron McKenna.