Chinese oil firm Cnooc’s Buzzard platform in the UK North Sea may have a role to play in a flagship carbon capture and storage (CCS) project, developers have said.

Ian Phillips, director of the Acorn CCS and hydrogen scheme, said discussions were being held with Cnooc about the possibility of using Buzzard as an “intermediate station to provide subsea control” for the offshore leg of the project.

Partners are also “exploring the idea” of deploying an “isolated power buoy” which could provide control, Mr Phillips said on Thursday during a webinar.

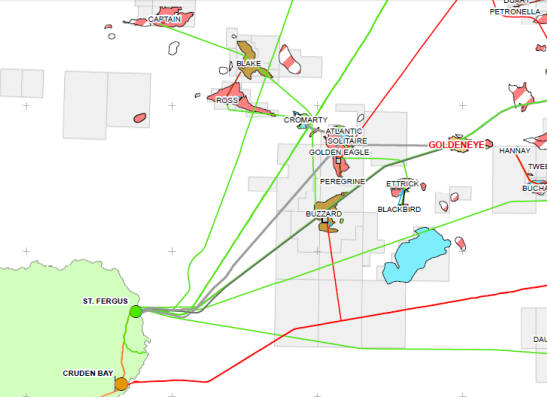

The Buzzard platform sits about 1.2 miles from a section of the Goldeneye pipeline, which could be used to transport carbon dioxide from the St Fergus gas terminal, near Peterhead, to the depleted Goldeneye reservoir for storage as part of the Acorn project.

Aberdeenshire-based firm Pale Blue Dot (PBD) is leading the way on Acorn, which, to date, has received funding support from oil and gas firms Chrysaor, Shell and Total, the UK and Scottish Governments, and the EU.

Costain and Petrofac were recently chosen to support the design front-end engineering design (FEED) stage of the project.

Mr Phillips said FEED work would soon get under way and should finish around the second quarter of 2021.

A final investment decision (FID) will be taken no earlier than late-2021, he said, adding that Acorn would not yield many procurement opportunities before 2022.

Mr Phillips said Acorn partners hoped to start carbon dioxide injection in 2024, but acknowledged the timeline was unavoidably “woolly” at this stage.

He said there is currently “no market” for carbon disposal and that work with government was on-going to “land” the commercial model that would get major CCS projects up and running in the UK.

Mr Phillips compared the situation to the advent of the offshore wind industry.

The contracts for difference subsidy scheme was created to help develop the offshore wind market and Mr Phillips expects a “similar process” to play out with CCS.

He said CCS projects, particularly in their early days, would place a burden on taxpayers and that, as such, Acorn had an obligation to deliver value for money.

Acorn will also be competing with a number of other UK CCS projects for funding support and, therefore, needs to demonstrate its competitiveness.

Mr Phillips said Acorn partners did not expect to buy much newly-developed technology for the CCS and hydrogen plants at St Fergus.

“Our aim is to use technologies we can be confident of,” he said. “Given that we’ll be spending north of £500m on this, you wouldn’t expect me to say anything different.

“Certainty of operation and certainty of revenue is critical. We will be procuring equipment and going for what is the best and most competitive option.”

He also said there was no obligation to prioritise procurement from the UK supply chain.

And Mr Phillips spoke about the UK CCS industry’s “false dawns”.

A project involving Shell and SSE at Peterhead Power Station had been competing with a scheme in North Yorkshire for funding in 2015, only for the £1 billion grant to be withdrawn, scuppering the project.

Mr Phillips said things “felt different” this time as the issue of climate change had become more visible, generating more political will and hunger to deliver low-carbon solutions.