UK operators will “struggle” to find semi-submersible rigs for work in the North Sea next year, according to new analysis.

Bassoe Offshore claims the “tide is beginning to turn” for the UK rig market, which has been severely depressed in recent years due to an overabundance of vessels and little work.

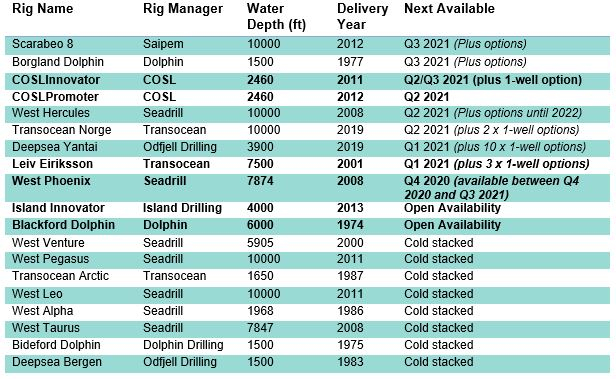

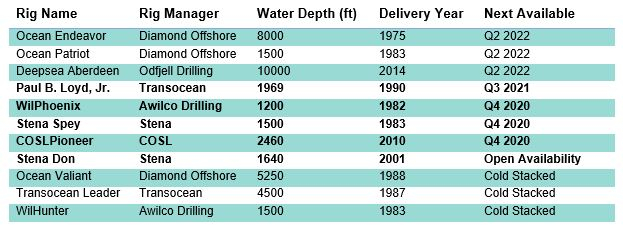

Bassoe states that a combination of rigs being scrapped, prepared for scrapping or cold stacked, and firms revaluating costs through Chapter 11, will mean just five vessels will be available next year, one of which is already very limited.

That’s out of the total UK fleet of 11, including three which are cold-stacked.

This “may be a problem” the firm said, considering there are currently between 10 – 12 new campaigns planned off the UK and Norway between Q1 and Q3, several of which are already out as tenders.

Few would be enough to justify reactivating one of the three cold-stacked rigs in UK waters, Bassoe said, which often runs to a cost of tens of millions of dollars.

There are some vessels which can travel between the Norwegian and UK sectors and, while there is potential for some in Norway to cross the North Sea, “most are unlikely to do so”.

There are six such rigs available between Q4 2020 and Q3 2021 but two of these do not become free until late Q2 or early Q3 next year.

If all rig requirements for 2021 come into fruition (which may not be the case) then UK operators may “have to rethink timing of their planned campaigns”, Bassoe said, and “consider drilling during the harsher months of the year to secure a slot”.

Operators typically avoid the winter months due to the risk of downtime.

The latest oil price crash has seen a host of drilling firms enter US-style Chapter 11 bankruptcy, with many reassessing their fleets as they restructure their business.

Therefore, scrapping of more rigs “is expected to be announced imminently”, Bassoe said.

The downturn has led to campaigns being widely deferred in the UK sector, with hopes of activity returning in 2021.

The Cromarty Firth has, in recent months, played host to a wider array of vessels being laid-up there than usual.

Recent times have also seen UK rig day rates of between $140,000-$160,000, Bassoe said, which is “only just covering operating costs and unsustainable for the drillers who own and manage them”.

A solution may lie in sharing of vessels for wider campaigns – a model that has been encouraged by the OGA, although failed to gain traction to date, which Bassoe put down to their “complexity in organising”.

The firm added: “This considerable change is not one that can be counteracted easily.

“There is not a stack of North Sea-capable newbuilds sitting dormant in shipyards awaiting delivery.

“This will be a permanent or at least a long-term shift in the segment which could be further exacerbated, with more units cold stacked or scrapped, if operators do not find a way to proceed with plans in the coming year.”

Recommended for you