Anderson Anderson & Brown Corporate Finance (“AABcf”) is delighted to share with you our quarterly Deals+ update for Q4 2020 in conjunction with Energy Voice, highlighting selected oil and gas M&A and fundraising transactions across the UK.

In the energy industry, it would be safe to say that we all agree 2020 has delivered us some of the most challenging times for the upstream oil and gas (E&P) and oilfield services sectors (OFS). From a global pandemic and deep economic slowdown to increasing climate change concern and changing investor sentiment, to low commodity prices and geopolitical price war. But despite severe difficulties at every level, from investors to corporate to individuals and society, it has been a fascinating, albeit highly frustrating year across both OFS and E&P.

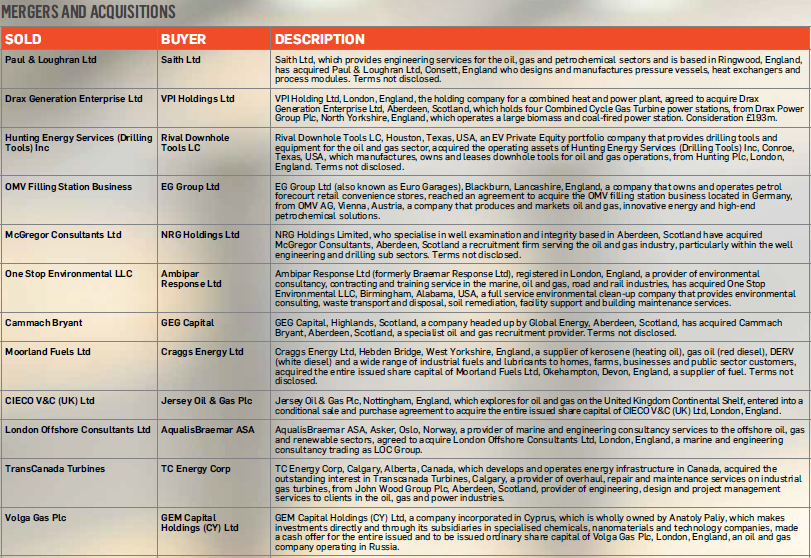

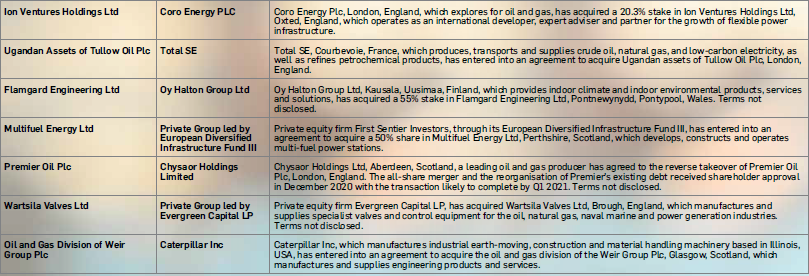

From an M&A perspective activity continued to focus on ‘transformational’ deals that either reduce capacity across the sector, restructure the capital structure or provide partial exits for private equity investors who entered during the last super-cycle. When rumours started to pass around in September that Chrysaor may be looking to do a deal with Premier Oil, not many would have predicted that the deal would have been a reverse merger into a ready-made Main Market London listing. The deal, when completed will deliver an enlarged group with more than 250,000 boed and will become the London Stock Exchange’s largest independent E&P operator.

Beyond traditional E&P company strategies, it has been fascinating to watch how some of the majors continued to re-invent themselves by showing much greater commitment to energy transition than anyone might have anticipated prior to 2020. Led by BP and Shell, we have also started to see other significant E&P operators such as Equinor and Total changing their strategies and corporate image by pursuing green objectives in hydrogen development, Carbon Capture, Use and Storage (CCUS) and offshore wind.

In the OFS sector over-capacity continues to be a headwind pointing towards the need for continued carve-outs, asset sales and divestments. The growing shift towards capital-light business models will likely drive activity across the sector, with M&A activity being focused on digital technologies and the move towards low carbon solutions. While consolidation appears likely across both OFS and E&P sectors, this will require more innovative and complex deal structures in order to gain shareholder approval with public market players having to demonstrate significant value accretion in the wake of other competing calls for cash.

Recommended for you