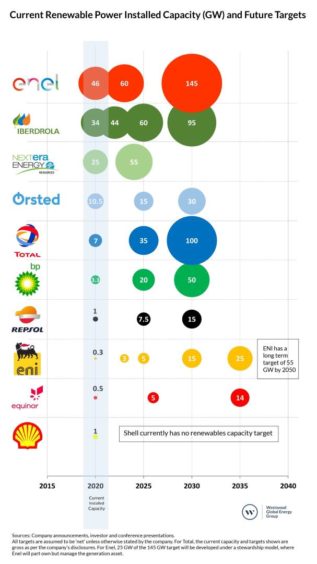

Total is expected to outpace clean energy giants Iberdrola and Ørsted on renewable power capacity by the end of the decade.

The French supermajor’s ambition to reach 100 gigawatts (GW) of green energy by 2030 is eclipsed only by Enel which is targeting 145 GW, according to analysis from Westwood Global Energy Group.

In comparison, Iberdrola and Ørsted have targets of 95 GW and 30 GW respectively.

Over the last four years Total has invested $8bn (£5.7bn) in renewables and power with a significant focus on solar PV.

The Paris-headquartered firm recently announced plans to rebrand as ‘Total Energies’ in order to reflect its changing asset portfolio.

It was one of a number of companies that was awarded acreage for wind farm development in the latest Crown Estate round, building on its existing involvement in the Seagreen project.

David Linden, head of energy transition at Westwood, said: “Total has set a course to diversify its portfolio, reflected by its proposed name change to Total Energies last week.

“And it’s leading the way – Total’s targets are double that of peers like BP at 50GW. However, in energy terms renewables will still be the minority in Total’s entire portfolio.

“In future, the combined scale of ambition of both clean energy and oil and gas supermajors, together with their focus on onshore wind and solar, could see them compete in high growth markets.

“Collaboration will be an increasingly important part of the modus operandi as technologies, markets and companies converge, especially in green hydrogen where the boundaries are more blurred.”

The research contrasts the portfolios of European oil and gas majors BP, Shell, Total, Repsol, ENI and Equinor with clean energy supermajors Iberdrola, Enel, NextEra Energy and Ørsted.

In addition to renewable power capacity comparisons, the insight highlights key technologies, portfolio investments and growth regions for each company.

Arindam Das, head of consulting at Westwood, said: “It’s not yet clear how the growing renewables portfolio of oil and gas companies will be valued by the investment community.

“In the next decade oil companies are still expected to be underpinned by sizable fossil fuel businesses.

“Can the renewables portion of their portfolio become of material scale to deliver stable, low risk returns that investors will accept?

“Or do investors still expect higher risk, higher returns? The answer to these questions will have a great bearing on the energy transition and the oil and gas majors’ role in it.”