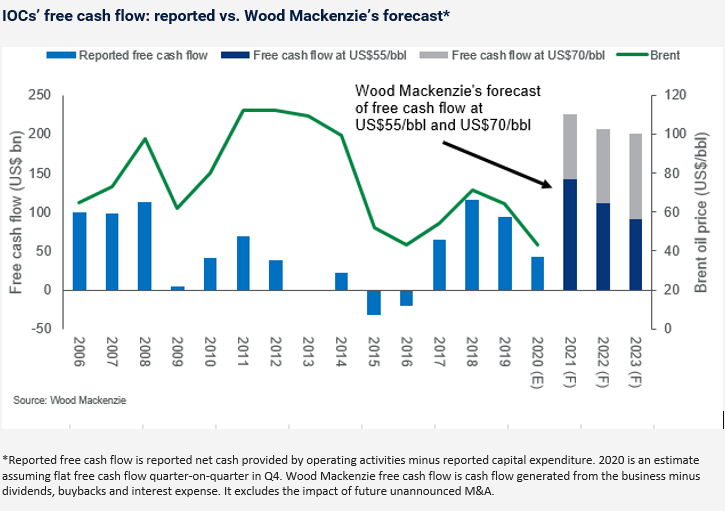

International oil companies (IOCs) could be on track for record free cash flow this year should Brent continue its rise, according to Wood Mackenzie.

The analyst firm said IOCs could generate their highest levels of free cash flow since 2006 – $140bn – should the international benchmark average $55 a barrel.

However, that would “rocket” to double the previous peak should Brent average $70.

It comes as Socar Trading SA of Azerbaijan and Bank of America this week revealed expectations of $100 oil in coming years.

The rise in free cash flow comes as “savage cost cuts” led to IOCs reaching breakeven costs of $38/barrel, compared to $54 pre-crisis, Wood Mackenzie said.

Tom Ellacott, senior vice president, corporate analysis, expects a V-shaped recovery.

“The record annual losses being announced in the Q4 earnings season serve as a stark reminder that 2020 was one of the toughest years in the industry’s history”, he said.

“But IOCs emerged from the crisis far more resilient to lower prices. The scale of their financial reset has primed the sector for a V-shaped recovery in free cash flow.

“Our IOC peer group of 40 companies generates over US$115 billion of surplus cash flow over the next three years after shareholder distributions, investment and interest at US$55/bbl prices. At US$70/bbl, cumulative surplus cash flow generation over the next three years would rocket to US$400 billion.”

How the money is spent will be “very different” from previous up-cycles, with mending broken balance sheets top of the list.

Firms will aim to lower gearing – relating to the percentage of borrowed capital as a funding source – to the low end of historical ranges of “about 20%”, Mr Ellacott said, helping firms weather any future price volatility.

“We expect companies to continue to plan for the worst, prioritising net debt reduction in redeploying surplus cash flow.

“Some players will also look to speed up debt reduction by selling non-core assets

“Both M&A and organic-led growth in renewables will be on the strategic agenda. But disciplined screening criteria will have to apply to new energy investment too if oil and gas companies are to profitably diversify their product mix into low-carbon energy.”