BP is fielding final bids from a handful of junior energy companies for its North Sea assets, according to people familiar with the matter.

Oil and gas producers Tailwind Energy, Serica Energy, Ithaca Energy, EnQuest and newcomer Waldorf Production UK. have been considering binding offers for some or all of the assets, the people said, asking not to be identified discussing confidential information.

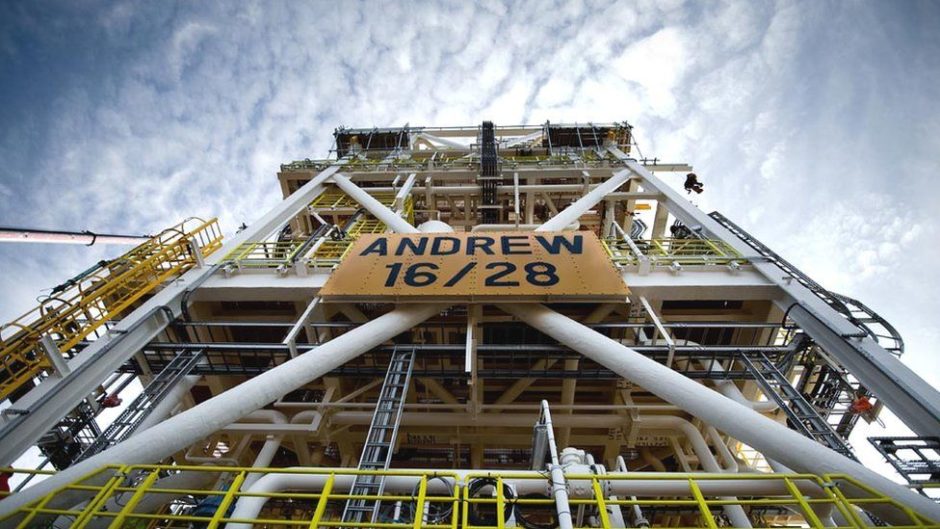

BP is looking to offload its stake in the Shell-operated Shearwater hub and its operated Andrew asset and could end up selling its interests to different bidders depending on the interest it receives, the people said.

Representatives for BP, EnQuest, Ithaca, Serica and Waldorf declined to comment, while a spokesperson for Tailwind didn’t immediately respond to requests for comment on the North Sea bids.

The interest comes amid an uptick in mergers and acquisitions in the North Sea region, where consultant Wood Mackenzie Ltd. says activity this year has already surpassed 2020 levels.

The BP fields were due to be purchased by Premier Oil last year under revised terms after oil prices crashed and its largest creditor initially blocked the deal. The transaction, which was valued at $625 million, was later dropped following a reverse-takeover of Premier by Chrysaor Holdings Ltd.

BP is undergoing a global restructuring after it promised to slash its greenhouse gas emissions and increase investments in low-carbon energy. The firm aims to sell $25 billion of assets by 2025 to help ease its debt burden and fund the energy transition.

Recommended for you