As governments and corporates set ambitious targets to decarbonise, investment in low-carbon technology is becoming increasingly attractive as a core investment strategy. “Low carbon” comprises technologies that enable the energy transition.

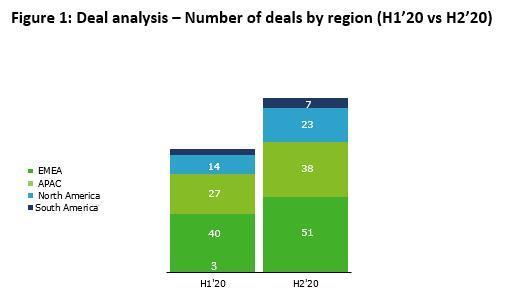

Last year was an active 12 months for low-carbon M&A, as transaction volume ultimately remained steady, regardless of the impact of Covid-19. Transaction volume grew in the second half, and outperformed first half transaction numbers, underpinning the fact that investors have taken a long-term view of low-carbon investments and the importance of the energy transition.

Source: Deloitte Analysis: Mergermarket (www.mergermarket.com), Inframation & SparkSpread (www.inframationnews.com), and Clean Energy Pipeline (www.cleanenergypipeline.com)

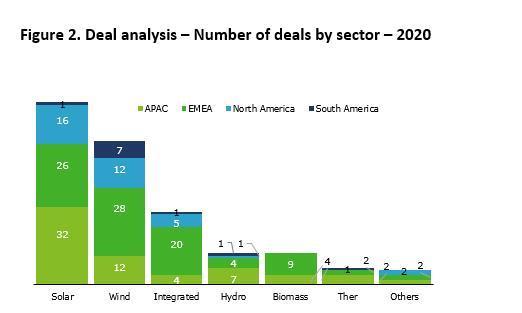

Source: Deloitte Analysis: Mergermarket (www.mergermarket.com), Inframation & SparkSpread (www.inframationnews.com), and Clean Energy Pipeline (www.cleanenergypipeline.com)

The United States led countries in low carbon energy, delivering 33 deals in 2020 ahead of Spain and China, who delivered 27 and 24 respectively. These were followed by the United Kingdom (17), India (15) and France (11), with the top six countries accounting for c63% of all low carbon energy transactions. In contrast, South America was the least active region with only two countries, Brazil and Chile, delivering a combined 10 deals – c5% of global low carbon energy transactions.

By region, EMEA was the most active zone with 17 countries completing and announcing a total of 91 deals, c45% of all global low carbon energy transactions. By sector, solar and wind were the most predominant, accounting for c66% of all transactions.

Source: Deloitte Analysis. Mergermarket (www.mergermarket.com), Inframation & SparkSpread (www.inframationnews.com), and Clean Energy Pipeline (www.cleanenergypipeline.com). The above analysis is comprised of deals announced or completed in 2020 and are above $50m, apart from the ‘Others’ section which includes deals below $50m in the nuclear and green hydrogen space.

Source: Deloitte Analysis. Mergermarket (www.mergermarket.com), Inframation & SparkSpread (www.inframationnews.com), and Clean Energy Pipeline (www.cleanenergypipeline.com). The above analysis is comprised of deals announced or completed in 2020 and are above $50m, apart from the ‘Others’ section which includes deals below $50m in the nuclear and green hydrogen space.

The low-carbon energy market appears to be in a good position for another strong year of M&A activity, with a total of 415 present opportunities. Solar and wind continue to lead the way for low-carbon energy, representing 247 of the present opportunities globally. China seems well placed to overtake the US as the most active country for low-carbon energy deals. With 58% opportunities, this is double the number of deals completed by the country in 2020. There are 55 opportunities present in US (33 deals in 2020), 38 in UK (17 deals in 2020), 31 in India (15 deals in 2020), and 11 in Sweden (three deals in 2020).

There are also significant opportunities arising from other sources of low-carbon energy. Integrated energy and biomass opportunities are more than double the volume completed in these sectors for 2020, whilst opportunities in hydrogen are almost triple the number of deals completed last year. Thermal energy transactions accounted for seven deals in 2020, with current opportunities in this sector sitting at 28, quadruple the number of deals completed in 2020.

We predict low carbon M&A transaction volume to be a strong performer again in 2021, with increasing investment in enabling technologies, such as EV charging, battery storage and energy technology (including optimisation and aggregation platforms).

Recommended for you