Aberdeen’s oil field service sector could capitalise on an emerging global shale oil market which is predicted to generate up to 14million barrels of oil per day by 2035.

But energy experts at professional services firm PwC says the north-east industry must grasp the nettle and both exploit and adapt its wealth of offshore engineering knowledge, skill sets and experience and technological expertise now. According to a PwC report, Shale Oil – the Next Energy Revolution, exploiting global shale oil reserves could revolutionise the world’s energy markets over the next couple of decades.

The findings also outline the potential for the production of shale oil to spread gradually from its current US base, increasing to almost 12% of the world’s total oil supply over the next 20 years.

With significant shale gas resources already identified in the UK, it is thought this could also be a good leading indicator of the potential for shale oil to be found closer to home.

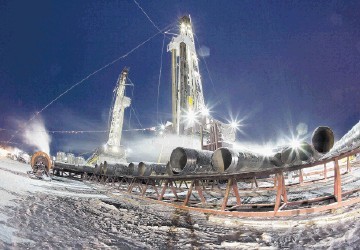

Specialist companies are already extracting and investigating shale gas in locations across Scotland – including “fracking” near Falkirk – and it is thought numbers could rise as the shale oil market develops.

Recognised as a global energy hub servicing the North Sea as well as global markets, Aberdeen is said to be ideally placed to capitalise on the opportunities this represents.

Alastair Geddes, a director in the PwC’s oil and gas team in Aberdeen, said: “In our Northern Lights reports we outlined the need for Aberdeen to not only extend mature North Sea fields through incremental developments and technical innovations but capitalise on new opportunities in areas such as west of Shetland to secure a long-term future for the oil and gas industry in the north-east of Scotland.

“Shale oil represents yet another exciting opportunity for the industry, particularly oil field services companies.

“However, if we are to become a key international player in this market, a move that could positively impact investment, employment and economic growth across the region and the UK, then we need to grasp the opportunity with both hands.”

The PwC report examines scenarios that consider the potential impact of future growth in shale oil production on global oil prices and assesses how these changes could impact the wider economy and the oil and gas industry over the period to 2035.

The findings show that successful exploitation of this resource could push global oil prices down by around 25%-40% over this period, resulting in significantly lower oil prices than would otherwise be the case and a consequent increase of around £500-800 in GDP per person in the UK (at today’s GDP values).

Mr Geddes added: “While recent announcements by the UK Government on issues such as decommissioning and brown field allowances will go some way to encouraging investment in the industry and increasing the longevity of the UK continental shelf, the reality is this is a finite resource.

“It is also clear that, if global oil prices drop, the UK Government could lose some North Sea tax revenues.

“For the UK Government, shale oil and gas presents an opportunity to create a new growth engine for UK plc as well as a new source of tax revenue.

“It has the potential to reshape the global economy, increasing energy security, independence and affordability in the long-term.”

Hydraulic fracturing or “fracking” is a technique that uses water, pumped at high pressure, into the rock to create narrow fractures to allow the hydrocarbons to flow out.

Recommended for you