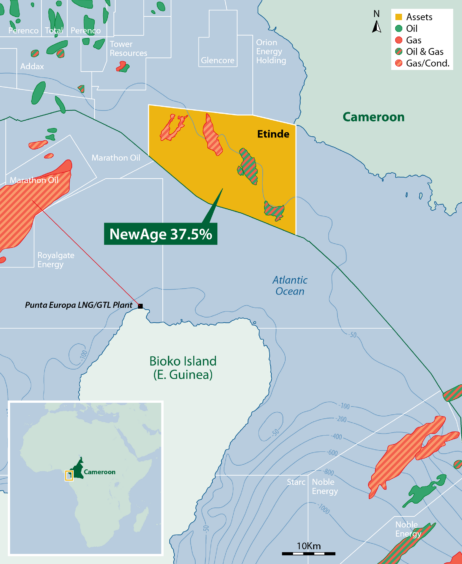

New Age (African Global Energy) expects to bring on its Etinde gas project, in Cameroon, and Marine III, off Congo Brazzaville, in 2024.

It may follow this with a gas and liquids development in Ethiopia.

New Age’s EVP of exploration and new business David Peel set out the company’s thinking at an IN-VR event. Speaking during the 2cnd Global E&P Summit, Peel said New Age aimed to take final investment decision (FID) on its Etinde project in the first quarter of 2022.

The development would consist of 10 wells in shallow water and two wellhead platforms, in the first phase. This carries an expected price tag of $1.1 billion.

The aim would be to maximise condensate production. Production from Etinde would be processed via two trains onshore, with gas sold into the local market. In the first phase, the company would focus on reinjecting gas to sustain condensate recovery.

Production would begin from the first phase in the second quarter of 2024.

The second phase would see gas exported from Etinde. The company has not taken a decision on where this would go but one option raised by Peel was exports via LNG facilities in Equatorial Guinea.

FID would come in the first quarter of 2025, Peel said, with first production in the first quarter of 2026. The second phase would cost around $300 million.

Etinde is only 35 km from the shore. “The Cameroon domestic market could open further in time, that’s something we hope for. We would inject for a few years and then export to Equatorial Guinea or a floating LNG (FLNG) project, while maintaining a certain amount for domestic demand.”

Marine moves

New Age has had success in Congolese waters already. It sold a 25% stake in the Marine XII licence in 2019 to Russia’s Lukoil for $800mn.

It retained a stake in the next-door Marine III licence. Peel said the permit had an extension of the Nene field in Marine XII.

Describing the area as a “heartland” for New Age, Peel said the company had a 75% stake in the shallow-water block. New Age had planned to drill a well, for $30mn, in the first quarter of 2022. However, this has been delayed as a result of COVID-19.

Development of a find would likely involve a floating production, storage and offloading (FPSO) unit and shuttle tankers.

The mid case for the development would suggest “the potential to flow at 20,000 bpd”, Peel said. This assumes a recoverable volume of 200 million barrels. Additions may come later, from the M’Bafou and Banga extensions.

Earlier stage

New Age also has interests in Ethiopia and South Africa. In the former, it drilled the El Kuran well in 2014 finding liquids and gas. “The trick is to find options for the gas,” Peel said, suggesting power generation or even gas-to-liquids (GTL).

The company has limited commitments on the licence, of a full-tensor gradiometry (FTG) study or seismic survey.

The key to production will be acid fracking of the reservoir at Block 8, Peel continued. There are options for near term production, for instance through an extended well test.

In South Africa, the privately owned company has the Algoa-Gamtoos licence. It is in the same area as TotalEnergies’ Luiperd and Brulpadda discoveries, Peel said.

“We’ve only got 2D seismic on our acreage, our main work commitment is for 3D seismic.” The company needs to shoot 500 square km of 3D to mature its leads into prospects.

In the shallow water parts of the block, there are similarities to PetroSA discoveries to the west. Further out, the potential scale of discovery increases with transform margin type opportunities.

Financing

Peel noted that there were increased opportunities for gas projects in Africa, where 10-15 years ago discoveries of this resource would have been written off.

Opportunities for financing have become more challenging, but this is not impossible for independents, he said.

There is a chance for independents to string together a number of 100-200 million barrel discoveries in Africa and make a “material business”, he said. These more modest discoveries would not meet the materiality threshold for majors, particularly given their new energy transition directions.

China’s Hopu has a 49% stake in New Age, while Kerogen Capital is the next biggest owner at 23%.

The Chinese investor’s presence has highlighted alternative opportunities for financing, Peel said.

“Hopu is in tune with Chinese vendor financing. A Chinese yard can borrow money very cheaply. If you get to FID and want to build a wellhead platform, they’re prepared to finance it,” he said. Repayments are made once production has started.