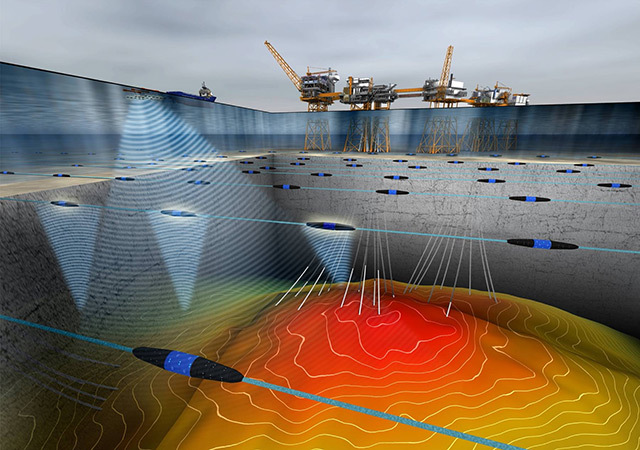

Seismic data is one of the most powerful weapons in the upstream oil and gas industry’s arsenal. The higher the quality the greater the likelihood is that exploration targets can be assessed effectively before the drillbit turns and producing fields can be accurately managed, leading to superior recovery rates.

BP clocked this years ago, with Energy’s editor becoming particularly aware of the company’s innovative use of seismic West of Shetland where, for many years, the giant Clair field frustrated until its geological code was finally cracked in the mid to late 1990s.

Over the past several years especially, this company has gradually come to value and make increasing use of the seismic weaponry at its disposal, especially 3D when hunting for new resources and 4D/4C for producing existing fields to maximise production.

And the way to do that is to start out by obtaining the sharpest, high resolution imaging possible and then using sharp geological minds and considerable computing power to build the models that today play such a crucial part in building up reservoir knowledge as a management tool.

According to Herlinde Mannaerts, seismic delivery manager in Aberdeen, BP has conducted a huge amount of seismic work in the North Sea over the past couple of years alone and there is no sign of that effort easing.

Indeed, over the roughly six/seven years period ending-2017, BP is committed to investing the thick end of $500million to North Sea seismic operations in the belief that this will deliver a substantial return on the investment.

But it hasn’t always been this way, even at BP.

“If you look back five to ten years, there wasn’t quite the appreciation then as now that, if you want to increase recovery factors from mature fields, then there are two key technologies,” Mannaerts told Energy.

“One is the use of seismic imaging to unlock remaining reserves and enhanced oil recovery schemes. Having realised that, what we’ve been doing since 2010 is work through our fields portfolio systematically asking what the seismic “health” of each of these fields is.

“Do we really have the crispest image to guide us to where the remaining reserves in mature fields especially are actually located as the pools are getting smaller? You see, if we have data of the quality needed to achieve first-class imaging, then this enables us to pinpoint where new wells need to be placed.”

The bottom line is boosting recovery factors for both oil and gas assets.

“In BP’s case we’re between 42% and 50%,” said Mannaerts. “It’s about how can we push the oil that remains in the ground so we can add 10-15% to that.

“And the two technologies that we see doing that are waterflood and seismic technology. That is why imaging, both from a static perspective and from a dynamic perspective is so important.

“We have a long-term plan which basically describes what the imaging needs are for each of the (UKCS asset) hubs.”

Through the strategic application of seismic technologies the objectives are:

- To identify additional targets in hub areas through improved imaging. This is achieved by using (wide azimuth) high density OBC (ocean bottom cable) acquisition including at Clair, Farragon, ETAP and Magnus.

- To improve recovery factors by use of reservoir monitoring (4D seismic) through repeat towed streamer acquisitions or permanent seabed systems such as at Foinaven/Loyal/ Schiehallion, plus ETAP and Ula (Norwegian sector).

- And to reduce costs through synergies and collaboration with other BP regions (for example Trinidad); also through life-of-field, long-term planning that enables long-term contracts with key suppliers.

According to Mannaerts, even elderly assets have benefited from the current approach. For example, new OBC seismic was acquired at Magus in 2010.

Indeed OBC is now a permanent feature across a number of BP North Sea assets including the important Norwegian sector Valhall field where cables are embedded in the seafloor. This investment means that the company can monitor 4D and waterflood movement over time, so assisting in the drive for increased recovery.

In 2011, BP shot eight proprietary surveys, some of which were collaborative.

Last year (2012), the company ran seven proprietary shoots, one of which was a technology test. Again there was collaboration.

“This year (2013) , we have about eight proprietary shoots planned, so continuing our sustained approach,” said Mannaerts.

“For 2014, my entire programme is about acquisition for exploration purposes. We’ll again be looking West of Shetland; maybe a little bit in the Southern North Sea and some in the Central North Sea. So 2014 has a very strong exploration focus.

“In 2015 and 2016, we have a significant amount of development seismic to do; with some appraisal too, including in and around the Clair field.

“The trend is clear. In expenditure terms we’re looking at $80-100million per year since at least 2011. Prior to that, BP’s annual UKCS seismic spend tended to come in around $20-40million. So, we’ve basically doubled and in some instances tripled the spend since.”

Back to Valhall; this is where the world’s first LoFS (life of field seismic) system was installed in 2003, the heart of which is a 120m array of ocean bottom cabling and transmission nodes.

Clair is another example of a field where BP has invested in equipping with a life-of-field OBC network.

Mannaerts: “On Clair, we have an array under the platform to help us see where the fluids are really going in this highly complex reservoir.”

While the advances in seismic survey and data-gathering technology have been hugely important, they would be pointless unless processing capability had moved ahead at least as rapidly.

According to Mannaerts, this has indeed been happening, both at oil company and at seismic survey contractor level.

“Acquisition carried out in the North Sea is handled completely by my team; we select the right contractor with the right technology based on the life-of-field seismic health assessments that we conduct,” she said.

“Turning to the data, we have the luxury of a processing centre (in Aberdeen) which is managed by one of our strategic contractors (CGG). Most of the (data) volumes are produced in-house with my team overseeing the processing work. They can also meet with the asset teams so that our seismic and reservoir specialists can work with our contractor’s people to really get an integrated approach.

“Sometimes we will go to other contractors if we are in need of special technologies but that would be on a needs basis only. But we work mostly with CGG, also Western Geco.

“Processing is one of the issues that we have. If you look at the time we think about acquisition; to acquisition delivery; to processing delivery; to starting interpretation to actually beginning to drill a well is three to five years.

“One of the issues I would like to see resolved in time is how can we effectively shorten the cycle time from acquisition to site selection to actual drilling? I believe that is a key question.

“Conventional towed streamer data is 3.27gigabytes per sq.km; if you look at HD OBC, we’re talking 235gigbytes per sq.km. It is a staggering difference. If you see over time where we started with acquisition and processing to where we are now and the type of image we can generate, that’s really all the effect of having that high computing power. But even with high computing power, processing HD OBC takes about 12-18 months and, in complex situations, even longer.”

It’s complex and mind-bogglingly so. Superior computer speed and power are vital, as are efficient algorithms and so forth. Ultimately it’s about picture building… creating the crispest, highest resolution imagery possible.

That enables much better well placement and, according to Mannaerts, explains why some wells drilled in the past weren’t as rich in reservoir as had been hoped for, so affecting production from whatever field.

In short, seismic is a relatively low-cost way of building accurate pictures of a field’s reservoir (or indeed an exploration prospect). Mannaerts sees plenty of scope for getting better, much of it through co-operation between oil companies, including the sharing of resources and the seeing of common gains through advances in technology.

“Among the things we’re looking at and being systematic about is areas of vessel co-operation; benefiting from multi-year contracts that give commercial advantage, but also operational efficiency. This also provides a platform for field trials and technology innovation.

“So, for example, with HD OBC, the question was can we increase its efficiency?” asked Mannaerts.

“That was one of the big questions. One of the things we did was to introduce a second source vessel so one is then looking at simultaneous seismic sources and that increases the operational efficiency by about 70%.

“We’re also looking at how we can make our processing algorithms faster and more efficient; so we’re looking into full wave-form technology and its offspring. Western Geco and CGG have done a lot of work on this front. These are the topics that everyone is focusing on.

“There is also a lot of effort going into how we can push 4D rock properties attributes and interpretation. What are the actual physics of the seismic data telling us in terms fluid, in terms of rock properties and in terms of how can we get the oil out . . . which means the reservoir.”

For Mannaerts and her team of 25 split between the UK and Norway, the quest… indeed pace… is relentless, given that this is ultimately about finding new resources to exploit and getting the best out of what BP already has.

So, no pressure!

Recommended for you