NEO Energy has completed its long-running acquisition of a portfolio of assets in the central and northern North Sea from ExxonMobil.

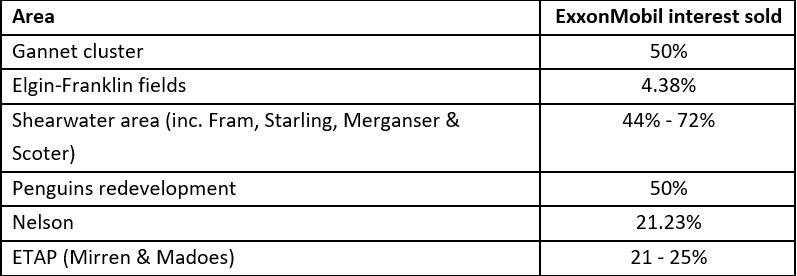

The deal, first announced in February 2021, covers stakes in 21 assets, including 14 producing fields and a number of infrastructure positions, mainly operated by Shell.

Completion of the transaction has been some time in the making, prompting regulator the Oil and Gas Authority (OGA) to open an inquiry into its progress in October.

The probe comes amid wider concerns that slow transaction completions may have a chilling effect on the market.

New European Offshore (NEO) Energy, backed by private equity group HitecVision, said the acquisition of the ExxonMobil portfolio would make it one of the top five North Sea oil and gas producers.

The transaction, worth more than $1bn (£760m), provides the company with interests in major producing hubs including the Shearwater area and the Penguins redevelopment.

The OGA investigation relates specifically to Elgin Franklin, which is operated by TotalEnergies alongside seven other joint venture parties.

In October, the regulator said it would examine engagement between these companies in the wake of the announcement.

Commenting on the completion of the sale, an OGA spokesperson told Energy Voice: “We are pleased that the transaction has concluded.

“However, when we opened the investigation we said it would examine the engagement between the parties since EEPUK and NEO Energy announced the proposed transaction in February 2021 and that included serving the parties with information notices asking them to account for their actions since then, and that investigation into the engagement between the parties is ongoing.”

NEO was created in October 2019 when Hitec merged its North Sea-focused investment vehicles Neo E&P and Aberdeen-based Verus Petroleum.

Last week NEO announced the acquisition of JX Nippon E&P UK, the British business of Japan’s ENEOS holdings, for £1.2billion, granting it non-operated interests in multiple producing fields and associated infrastructure across the North Sea including a 20% stake in the Mariner field and an 18% interest in the Culzean field.

It followed the takeover of Zennor Petroleum in summer, and the acquisition of a package of UK North Sea oil and gas fields from TotalEnergies worth £485m.

Following the Zennor deal, NEO said its daily production would average around 80,000 boepd in 2021, and that further developments would raise this to between 90,000 and 100,000 boepd over 2022-26.