A new report from risk assurance group DNV finds that offshore wind will be the primary driver in competition for ocean space, but overall marine investment will fall as reduced oil and gas expenditure is not offset by growth from other sectors.

DNV’s Ocean’s Future to 2050 report finds that “exponential growth” in offshore wind power will be the primary driver of a nine-fold increase in sea space by mid-century.

Indeed, by 2050, offshore wind alone will require an area the equivalent to the landmass of Italy, analysts said.

Growth will be particularly pronounced in regions with long coastlines and a current low penetration of offshore wind, DNV noted, with demand for space set to grow 50-fold in the Indian subcontinent and 30-fold in North America.

The report aims to offer a holistic forecast of the marine or “blue” economy, touching sectors including food, energy, shipping, tourism and desalination.

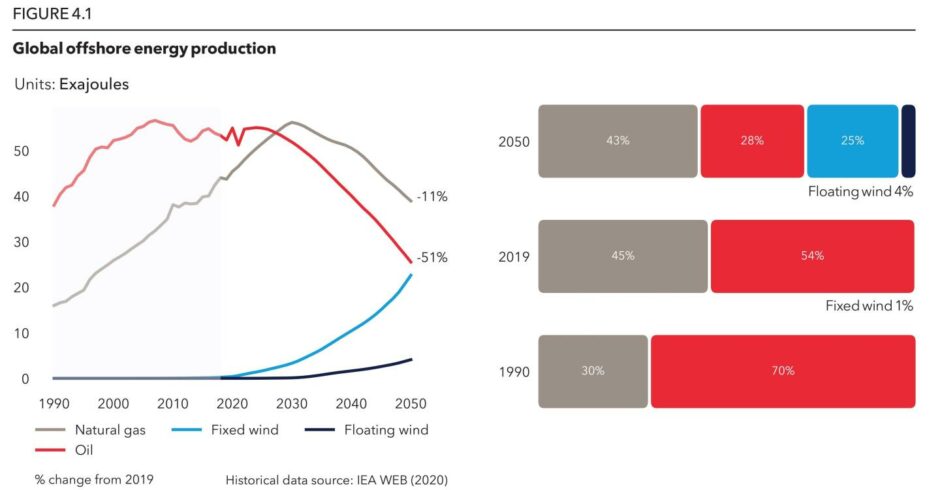

However, although this economy will expand, it will do so below the rate of global GDP growth through to 2050, largely because a sharp decrease in oil and gas investments will not be offset by exponential growth in offshore wind coupled with lower, steadier growth from aquaculture and desalination.

Overall capex in the blue economy will fall from $517 billion in 2018 to $461 billion in 2050, DNV forecast.

At present, 80% of marine capex comes from the oil and gas industry, with a “negligible amount” spent by offshore wind, analysts said. By 2050, offshore wind will account for 50% of capex, with oil and gas shrinking to 25%.

As offshore wind looks to take up more space, it will require an area 30% larger than the area taken up by concessions for offshore oil and gas globally by 2050 – more than 300,000 square km. About 85% of this will be fixed-bottom wind installations, with floating assets making up the remainder.

Nevertheless, DNV makes clear that “large offshore areas are still likely to see further exploration and development” for oil and gas resources, prompting “increasing spatial competition” with other sectors.

Asia and Greater China are set to account for more than a quarter of this capex by 2050, as the region builds out offshore wind capacity and marine aquaculture.

Operational expenditure will rise below the rate of global GDP, from $668 billion in 2018 to $793 billion in 2050 – mirroring the shifts seen in other sectors.

At the same time, marine aquaculture will expand, with output nearing that of reported wild catches, as the latter are increasingly affected by overfishing and climate change.

DNV group president and CEO Remi Eriksen said the sector was entering “a period of sectoral and geographic diversification.”

“Currently, the regions which benefit most from the ocean in economic terms are those with access to oil and gas fields off their coastlines. But as the world decarbonises and the need for renewable energy grows, countries not able to be part of the age of fossil fuel can be part of the age of wind,” he noted.

Marine trade will also see shifts, DNV said. Notably, tankers will be overtaken by container vessels as the second largest segment of traffic, “even if demand for gas tankers remains robust.”

Crude oil and product carrier fleets will continue to grow until 2030 too – beyond DNV’s forecast of peak oil demand – but will recede to around the segment’s present size by 2050.

Evaluating the report’s findings, Mr Eriksen said that as competition for ocean space increases, “humankind must re-evaluate its relationship with the ocean.”

“Although there are opportunities for increased cross-sector collaboration as well as moving infrastructure further offshore, future space requirements will need to be carefully managed to reduce the burden on surrounding ecosystems,” he added.

Recommended for you

© Supplied by DNV

© Supplied by DNV © Supplied by DNV

© Supplied by DNV