As the world moves towards a net-zero scenario for the building sector, it is anticipated that significant investments are required to achieve this scenario.

Based on the 6th ASEAN Energy Outlook (AEO6), 42% of ASEAN households are projected to access AC by 2040, which is 2.3 times more than in 2017.

According to the IEA’s Southeast Asia Energy Outlook, demand for space cooling would grow from 75 TWh in 2017 to 300 TWh of electricity by 2040 in the region.

As cooling is the most significant contributor to energy use, efforts must be taken to mitigate the unwarranted energy use by cooling equipment. The investment opportunities in green buildings are estimated at USD 17.8 trillion in East Asia Pacific and South Asia, representing over 70% of the global total (IFC, 2019).

While the increase in potential energy use and investments within the building sector is significant, does this translate to creating many energy-efficiency jobs since adopting well-enforced building codes and appliance standards could mitigate the unnecessary rise in energy use?

New building projects might not necessarily create many new energy efficiency jobs; hence, this article focuses solely on the retrofit market and explores the challenges a private company may face when trying to venture into the energy efficiency business.

One of the major assumptions in the figures presented in this article is that in the retrofit of equipment, facility owners are not faced with an end-of-life scenario for their equipment and are therefore only considering taking up an energy efficiency retrofit based on operational expenditure savings only.

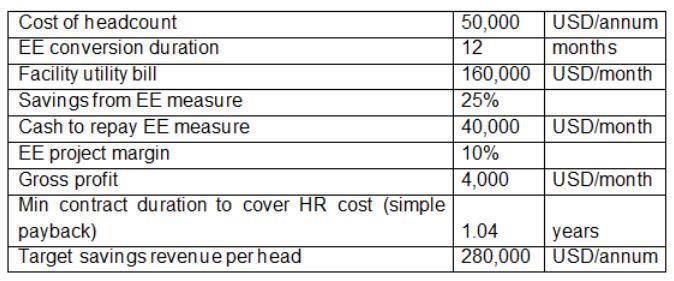

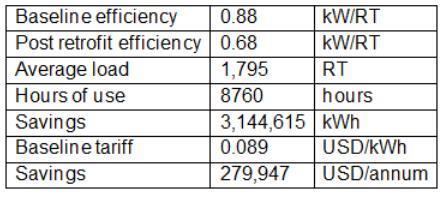

Based on an example of a centralised chilled water-cooling project, if the following were to be the cost of employing a sales staff to develop such energy efficiency cooling projects solely.

It would take a project running 24 hours a day, seven days a week, with at least 1,795 RT to recoup their salary. This cooling capacity is typical for buildings with about 71,463 m2 of cooled area.

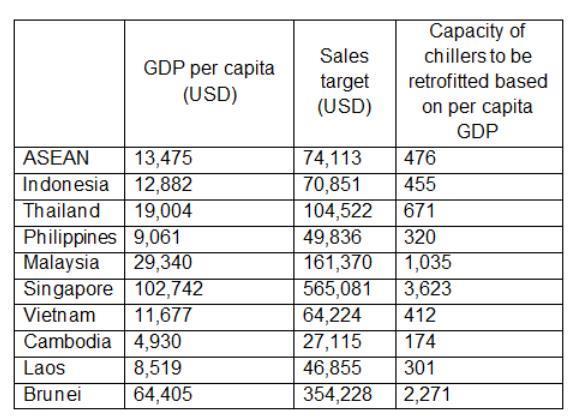

Such large projects at such operating hours are not joint in the market; therefore, not many such positions can be created in the job market. The table below further investigates the chiller capacities which needs to be retrofitted to pay the salary of the sales staff as an indicator to showcase that as income rises, the sales targets of a sales staff increases very quickly, which reduces the number of prospective clients the sales staff may have in the market place. Take Singapore, for example, in a small island where there are already a limited number of cooling systems, and it may not necessarily be possible to close a project running 24 hours a day, seven days a week with at least 3,623 RT per annum to cover the staff’s salary at the GDP per capita levels.

GDP per capita (USD) Sales target (USD) Capacity of chillers to be retrofitted based on per capita GDP

If any, energy efficiency jobs can only be created if retrofit opportunities are present. Creating a pipeline of work from the public sector is therefore critical to building up

capabilities and demonstrating leadership within the public sector to drive changes in the building sector.

This alternative way to explore the challenges in creating employment in the energy efficiency sector highlights the following:

• Sales position to develop such energy efficiency project is a skilled position conversant in technical and commercial aspects of energy efficiency and requires experience hence may be required to be paid no lower than per capita salaries

• Sales targets per person is high. The number of opportunities in the marketplace may be limited

• From the perspective of a commercial company, the potential to generate profits from an energy efficiency team is to be considered carefully. The more developed the country (i.e., the higher the wages, the higher the difficulty to secure enough projects to pay for salaries).

Therefore, greater collaboration between ASEAN and dialogue partners is required to carry out market potential studies to help companies assess if the market potential exists to invest in hiring and developing the business. If ESCO revenues in developed economies such as the United Kingdom and France range from USD 100 – 200 million per annum as shown in IEA’s data extracted from IEA, how impactful would the energy efficiency job creation be since, at the current estimates, only 714 jobs can be created in an optimistic case if companies do not turn a profit from the hiring of the staff. This also considers that new construction in the building sector in the United Kingdom and France are not high, and retrofitting may be representing a more significant segment of the work in the building sector.