Minnow Pandion Energy is to more than double its daily production after buying the Norwegian operations of ONE-Dyas.

The deal includes a 10% stake in the Nova oilfield in the Norwegian North Sea, which is expected to start production in the second half of this year.

Pandion, backed by private equity firm Kerogen Capital, is also gaining 11 exploration licences.

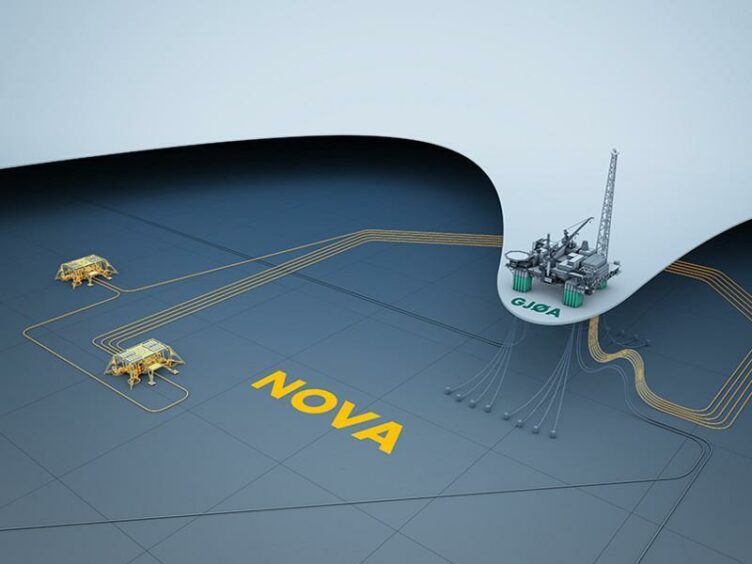

Recoverable reserves from Nova is estimated at 80 million barrels of oil equivalent, with the field being developed as a tieback to the nearby Gjoa platform.

Pandion currently averages production of 5,000 barrels of oil equivalent per day through its current holding of 10% in the Valhall and Hod fields.

That’s due to increase further as a new platform comes on stream for Hod this year and will “more than double” through the Nova holding.

Nova, currently slated for Q3 start-up, is being operated through hydro power from shore via Gjoa.

Combined with Valhall, which has been electrified since 2013, Pandion said ti will have among the lowest CO2 intensity levels of the Norwegian Continental Shelf.

Chief executive Jan Christian Ellefsen said: “This transaction represents a new leap in the Pandion story and secures the foundation for further growth. Our asset base is strengthened and, with Nova on stream, our daily production will more than double.

“During the first five years, Pandion Energy has earned its reputation as a trusted partner in exploration and field development on the Norwegian Continental Shelf (NCS). ONE-Dyas Norge fits well with our existing portfolio and organisation and will strengthen our position as an active, full-cycle partner driving value in high-quality assets on the NCS.”

Mr Ellefsen said Pandion is “actively searching” for additional M&A opportunities going forward.

Financial details of this transaction have not been disclosed, and is subject to approval by the Norwegian government.

ONE-Dyas last year started the process of putting its North Sea assets up for sale.

It was reported last month that Waldorf Production had entered exclusive talks to buy the assets in a deal which could exceed $1 billion.

Recommended for you