Global spending on energy projects has increased by more than 28% in the last three months, compared to the first quarter of the year, according to a new survey.

The estimated investment value of new projects around the world reached £215billion between April and June this year, up 23% on the same period last year and 28% in the first three months of 2013.

Renewables projects saw a dramatic growth, with with the potential investment in new projects up by 44% in just three months to around £42billion.

The figures from the Energy Industry Council’s EIC monitor, which tracks 10,000 proposed or under development projects around the world.

“Overall, figures this quarter indicate that the energy industry is thriving with a significant 28% rise in proposed project spend compared to the first quarter of 2013, albeit with a small decrease in project numbers,” said Clair Miller, EIC interim chair.

“Performance in the midstream and downstream sectors has been particularly impressive as the growing level of natural gas recovery worldwide is fuelling a rise in LNG, petrochemical and associated pipeline projects.”

The total number of projects announced is down 7% around the world, with the power sector showing the biggest decrease in both new projects and new investments.

Downstream saw a 76% hike in the number of new projects announced since the first quarter, with a 206% increase in investment value over the same period.

India, Russia and the USA were the largest areas to invest, with the USA alone launching 24 new projects through the boom in shale gas exploration.

The number of new upstream projects announced in the last three months dropped slightly, though the value of the projects was higher – with Canada alone accounting for $25billion investment in the the quarter.

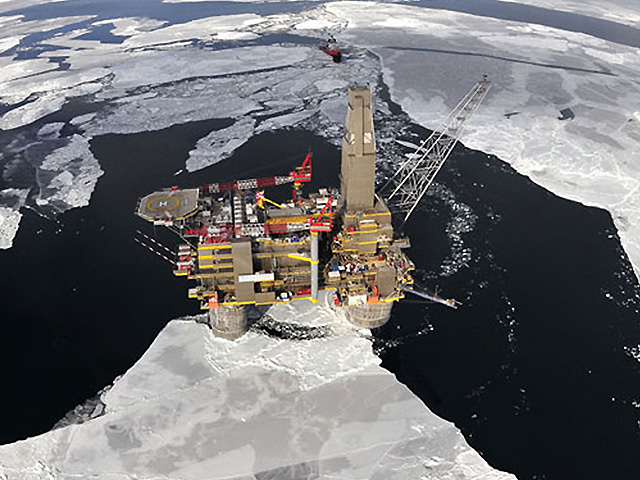

A huge boost to the midstream sector came from the $15billion Sakhalin project proposed by Exxon Mobil and Rosneft, and the Kitsault Energy Coridor and FLNG terminal planned for Canada at a cost of $35billion.

Recommended for you