Harbour Energy has submitted an environmental statement for its proposed Talbot subsea development, with a view to reaching first oil in Q3 2024.

Located block 30/13e of the North Sea, Talbot lies around 170 miles south east of Peterhead, and a few miles west of the UK/ Norway median line, in water depth of around 75m.

Recoverable reserves at the field are estimated at around 18.1 million barrels of oil equivalent (boe) of light oil with associated gas.

Harbour holds a 67% operated interest in the field via two subsidiaries of its prior incarnation, Chrysaor, while Eni holds the remaining 33% equity interest. It acquired the licence via its acquisition of ConocoPhillips’ North Sea assets in 2019.

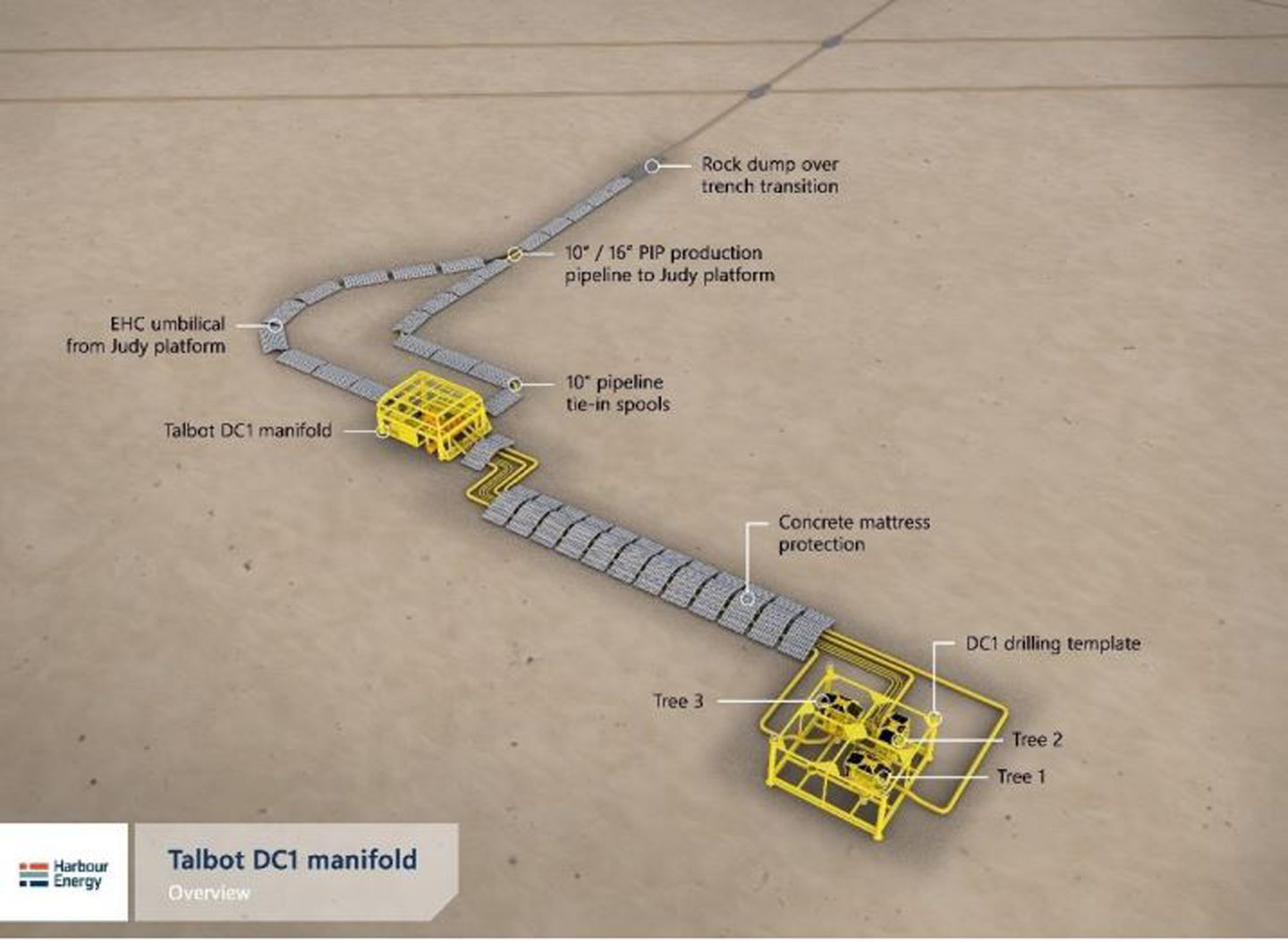

According to its statement submitted on 26 May, the proposed plan for the field centres on a three-well subsea development tied back to the Harbour-operated Judy platform, around 10 miles to the northwest.

Production from Talbot will be routed back to the platform via a new subsea production flowline and umbilical carrying power, communications, hydraulic supply, methanol and chemicals. This will tie-in to the existing Joanne South 12” pipeline at a point upstream of the Judy platform which provides processing and conditioning of gas and condensates from other J-block fields (including Judy, Joanne, Jade and Jasmine).

Once processed, gas will be transported as part of a commingled stream via an export line to the CATS pipeline system, and then on to Teesside for processing.

Liquids will be sent via a 24” oil export line to the Norpipe liquids pipeline and on to the Norsea terminal, also at Teesside.

Oil production from the field is expected to begin at around 3,817 tonnes per day of oil, and 1.7 million cubic metres of gas, both declining with time. Overall field life Is estimated at a minimum 10 years, but will be aligned to the cessation of production at Judy, the statement adds.

Harbour’s provisional timeline suggests development drilling will begin from Q4 2022, though its project summary notes it could begin “potentially Q3”.

Subsea infrastructure and pipelines will then be laid through 2023 and 20244, with a view to first oil from Q3 2024.

Its summary suggests Harbour will maintain its accelerated timeline for the field, with appraisal drilling at the prospect having begun less than a year ago, and an additional horizontal sidetrack having been completed in October.

This week Fitch Ratings said Harbour was among a group of medium-sized companies most exposed to the UK government’s Energy Profits Levy, given that around 90% of its current production is located in the UK North Sea.

However the ratings agency said the company has “sufficient headroom” to absorb the levy – not to mention the potential rebates offered should it proceed with investments in UK projects such as Talbot.

Recommended for you

© Supplied by Harbour Energy

© Supplied by Harbour Energy