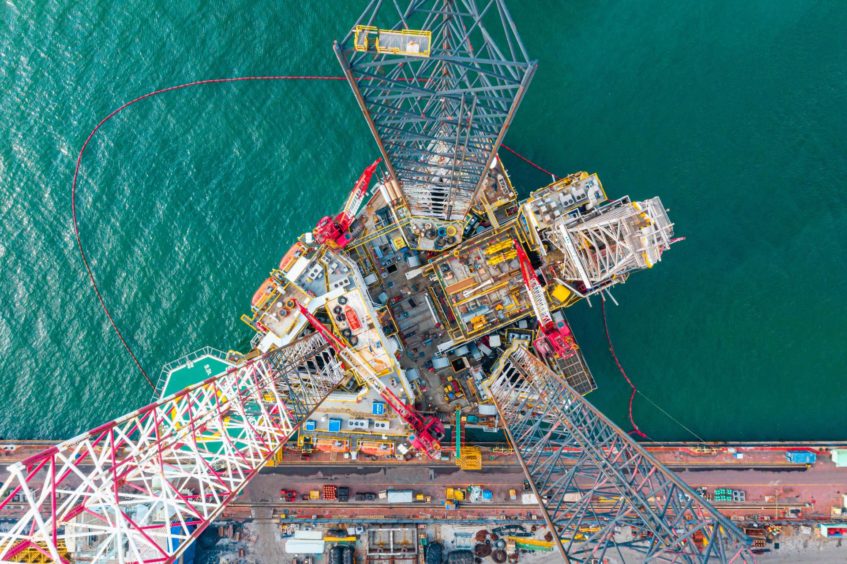

The global market for jack-up rigs has shown strong performance this year, with the number of awards and the duration of bookings already set to outpace 2021, according to Esgian Rig Analytics.

In a blog published last week, the firm’s head of rig market research Cinnamon Edralin noted that between January and the end of May 2022, contractors secured 100 jack-up charters equivalent to just shy of 165 rig-years of work.

The average duration for these new jack-up contracts is about 1.7 rig-years – noticeably above the average of around 1.3 rig-years last year.

Indeed, Esgian Rig Analytics recorded just 187 jack-up awards for 216.6 rig-years of work for full-year 2021, meaning contractors have already matched more than three-quarters of booked time in the first five months of the year.

“With 45 known jack-up requirements still open for this year, and the expectation that high commodity prices and an increased focus on energy security will likely add more near-term demand, 2022 jackup awards should outpace 2021 handily,” Ms Edralin said.

The Middle East is the clear driver of the trend, with the region booking over 43,000 days – roughly 119 rig-years – of work this year, and showing “no signs” of slowing down.

Almost all this work has been booked as multi-year charters, she added, and all scopes are scheduled to start either this year or next year.

And, while some of the backlog is comprised of renewals of existing charters, increasingly the region is absorbing units from other locations.

Of the 23 jack-up sales recorded by Esgian since the beginning of this year, at least 18 are Middle East buyers.

While the remaining five buyers are currently undisclosed, three of these jack-ups are understood to have been sold to the Middle East market, she noted.

The India and Subcontinent region is a “distant second” in terms of time booked this year, with about 13 rig-years of work added to backlog, followed by Southeast Asia.

The is only set to continue, as more Middle East tenders continue to emerge, again followed by open orders for India and the Subcontinent region.

“In third place is Mexico, where much of the incumbent fleet will be rolling off charters this year and next. Therefore, the jackup market is expected to remain hot as we progress through the remainder of this year and into next year as well,” Ms Edralin continued.

Esgian will be hosting an upcoming webinar on the jack-up market, to be held on 29 June 2022.

Meanwhile, a $100+ oil market has already improved utilisation rates for drillships in South America and the US Gulf of Mexico and semi-submersible units in the North Sea region.

In December, Esgian noted that the North Sea market was very tight, with the UK having a “very limited” supply of semi-subs in particular as E&Ps focus on near-field opportunities to support energy security and leverage the current high price environment.

Recommended for you