New research has warned that high oil prices, coupled with the UK Government’s windfall tax, could “pose a threat” to North Sea decommissioning targets.

Boston Consulting Group (BCG) said high prices “incentivise reinvestment” and the new tax does not provide relief for decommissioning costs, so the “rational choice” is to continue to extract oil rather than leave it in the ground.

That could have a knock-on impact on the “backlog, liquidation and performance” of decommissioning, with rising costs, emissions and challenges for specialised companies.

Emissions

“Delays could threaten oil and gas companies’ GHG emissions performance”, BCG said, as decommissioning “goes hand in hand” with decarbonisation.

BCG said decommissioning is often the “primary driver of emissions reduction” so pushing back a field’s cessation of production date “could slow down decarbonisation”.

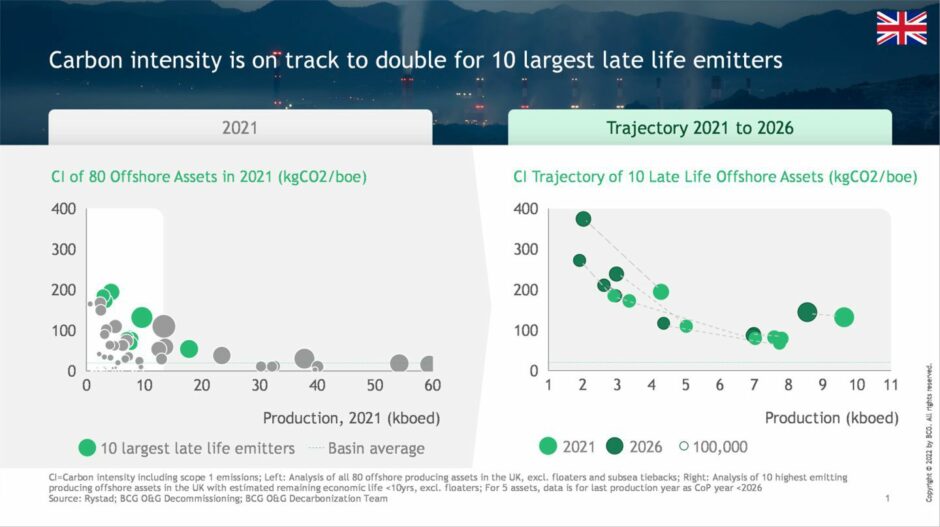

The firm looked at the 10 largest late-life emitting offshore oil and gas assets in the UK and found they are among the most carbon-intensive in the sector and are on track to “double” their emissions intensity in the next five years”.

Under the North Sea Transition Deal signed last year, the industry agreed to cut emissions by 25% by 2027 and 50% by 2030.

Decommissioning Cost

In addition, delays in decommissioning could cost companies more in the long run as inflation surges; the UK’s rate hit a 30-year high of 7% in April, meanwhile, global costs of industrial materials increased by 8% in March, according to IHS Markit.

The North Sea has targets from the industry regulator to slash the cost of decommissioning in order to protect the taxpayer from hefty rebates.

Last year the industry regulator warned that a “slowdown in progress” meant the goal to slash the total to £39bn by 2023 could be missed.

Supply chain

As well as the impact delays may have on costs and emissions performance, it could also “deter the oil and gas supply chain from building specialist capability”, the report authors said.

This is not unprecedented as two specialist suppliers in the North Sea have closed their doors (Fairfield Decom and Maersk Decom) in the last year.

Delaying further is “likely to deter specialists”, increasing the difficulty for operators to access an essential ingredient to realize the full potential from scale, BCG warned.

The report authors added: “We can only achieve high performance decommissioning with specialized staff, fit for purpose equipment and assets, processes and standards adapted to decommissioning.”.

Recommended for you

© Supplied by Boston Consulting Gr

© Supplied by Boston Consulting Gr