More than a month on from its announcement, the nuances of the recent oil and gas windfall tax still divide opinion.

And given there’s a strong likelihood the energy profits levy could be in place for another two and a half years, debate is likely to rumble on.

But there are small signs emerging that the controversial bill – and the investment relief included within it – is having a somewhat positive impact on some North Sea firms.

Alright for some

Andrew Austin’s Kistos plans to take “full advantage” of the incentive, while Orcadian Energy said the mechanism could slash the cost of its Pilot oilfield by 75%.

And Cornerstone Resources recently revealed to Energy Voice that, off the back of the windfall tax, it has experienced an uptick in companies looking to partner with it.

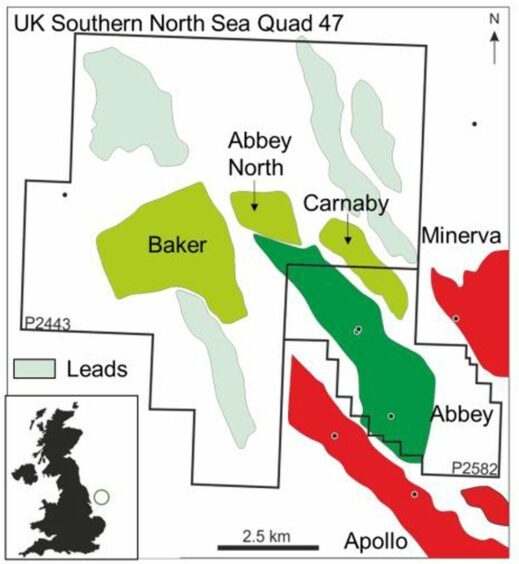

The Aberdeen-based southern North Sea gas firm recently bought up several assets from Painted Wolf Resources and is currently progressing its flagship Abbey discovery.

With a start-up date on the cards for 2024, Cornerstone is at “advanced stage” of negotiations to secure a rig to drill the three-well project.

A field development plan for Abbey is also due to be lodged imminently.

Given companies can now claim relief on their investment, the big winners will be those with large spending plans, boosting Cornerstone’s stock.

Courting interest

“It has been interesting,” acknowledged Peter Young, the company’s chief executive, adding “the difference in our post-tax NPV numbers are relatively small, but we’ve certainly had more industry interest in partnering with us in the last few weeks”.

“That’s something we’re having a good think about. We could choose to remain independent and ourselves in the public markets, or we can partner up. We already have a partner on the infrastructure; we have a large infrastructure fund.

“I would say it has been helpful. Certainly we’re seeing a lot more interest in partnering with us.”

Investment relief for oil spend

Designed to raise cash to help hard up households cope with the cost-of-living crisis, the energy profits levy raised the headline tax rate for North Sea profits by 25%, taking the total to 65%.

While that rise made most of the headlines, the bill also featured a mechanism intended to incentivise spend by reducing the amount a firm is taxed based on the amount they invest.

A near-doubling of the investment allowance to 80%, on top of other measures, means firms will get 91 pence back per £1 spent for a total relief rate of 91.25%.

Analysts have said the change will benefit those firms with spending in their pipeline, and could bring forward final investment decisions for certain projects.

There are concerns though that uncertainty resulting from the windfall tax could push companies to invest elsewhere.

Recommended for you

© Supplied by Cornerstone

© Supplied by Cornerstone © Supplied by Cornerstone

© Supplied by Cornerstone