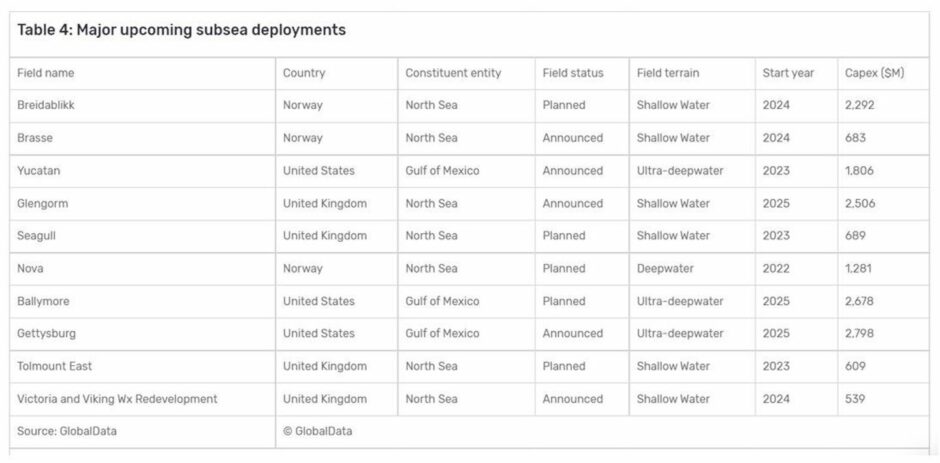

The UK will lead the way on the number of major subsea projects coming globally over the next five years, according to new analysis.

GlobalData reports that the UK North Sea will deliver four schemes by 2025, with a projected combined capital expenditure of $4.3 billion.

However, the sector is eclipsed on spending by the US at $5.4bn, but beats Norway marginally, with capex of $4.25bn.

Despite “a sizable decline in production in 2020”, production from major subsea projects around the world has increased.

GlobalData estimates an increase from approximately 1,400 Mboed in 2017 to 1,450 Mboed in 2021

Two years ago subsea production saw a sizable decline in production as a result of the demand for oil and gas falling.

However, demand is recovering at a steady rate, encouraging drillers to invest in increasing their production, according to GlobalData Energy’s Adrian Mason.

Production is expected to reach 1,850 Mboed by 2025.

Five of the ten fields listed on the “major upcoming subsea deployments” table are based in the North Sea, within the United Kingdom. The table shows major subsea oil and gas production projects that are expected to come online in the next 5 years:

Glengorm

Glengorm was the first UK, North Sea field to be listed in the table.

Set to start production in 2025, the field is said to have a capital expenditure (Capex) of $2.5 billion (£2.09 billion).

The CNOOC owned field is located in shallow water, with a depth of approximately 86 meters.

The exploration well Glengorm was drilled to a total depth of 5,056 meters and has encountered net gas and condensate pay zones with a total thickness of 37.6 meters.

Seagull

The four-well subsea tie-back project re-using the existing facilities on the Heron pipeline and hosted by the BP-operated ETAP central processing facility in the Central North Sea, the Seagull field also found itself on the table.

Located 10 miles south of the BP-operated ETAP Central Processing Facility (CPF), the Seagull is also based in shallow waters and is scheduled to begin production next year.

The field, operated by Neptune Energy in partnership with BP Exploration and JAPEX UK E&P, has a capex of £574 million ($689 million).

Seagull’s production will be delivered via a new 5 km subsea pipeline, which will tie the Seagull manifold to the existing Heron pipeline system via a newly installed tie-in skid at the Egret manifold.

Tolmount East

Tolmount East is located approximately 37 km east of Flamborough Head (English coastline) and approximately 95 miles from the UK/Netherlands median line in shallow, 50m deep waters.

The Harbour Energy-operated Development will involve subsea infrastructure tied back to the main Tolmount platform, approximately 2.5 miles south west of the installation.

Harbour Energy has told the regulator OPRED that Tolmount East has an expected operational life of 22 years.

Although GlobalData projects capex of $609m ($510m), Harbour said the development’s projected capex is just £117m.

Victoria and Viking Wx Redevelopment

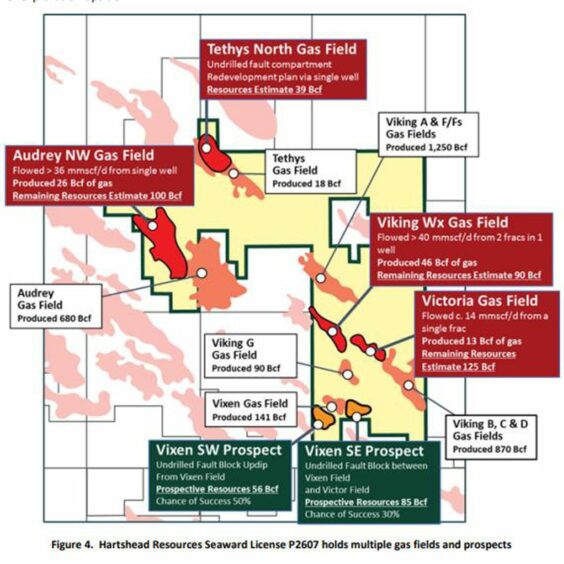

Located in shallow water in the UK and is operated by Hartshead Resource, the Victoria and Viking Wx Redevelopment is a conventional gas project.

With the lowest Capex on the table at £449 million (£539 million), the Victoria and Viking Wx scheme is set for production in 2024.

Launching in 2024, the project is forecast to peak in 2025, to approximately 115 Mmcfd of natural gas and production will continue until the field reaches its economic limit in 2054.

The field is expected to recover 47 million barrels of oil equivalent.

Norwegian and US projects

The UK is not the only site for subsea development. The US is spending $1.1 billion more than the UK.

All of the US subsea projects are found in “Ultra-deepwater”, with some starting production next year and others scheduled for 2025.

Upcoming US projects include; Yucatan, Ballymore (pictured below) and Gettysburg.

Topping the spending charts is Gettysberg in the Gulf of Mexico at nearly $2.8bn, around 10 miles away from the giant Shell-operated Appomattox platform.

Elsewhere, with three upcoming deployments on the table, Norway is spending just $87m less than the UK, according to the projections.

The Norwegian projects listed are Equinor’s Breidablikk, DNO International’s Brasse and Wintershall Dea’s Nova (depicted below).

Recommended for you

© Supplied by TotalEnergies

© Supplied by TotalEnergies

© Supplied by Chevron

© Supplied by Chevron