Hurricane Energy (LON: HUR) is weighing up an M&A deal or a potential $250m boost to its existing Lancaster asset in the West of Shetland.

The firm is newly debt-free after repaying more than $78m to bondholders, leaving the revitalised operator with options.

With a strong balance sheet, the challenge is to “identify how best to optimise capital allocation”, the board told investors at its AGM last month.

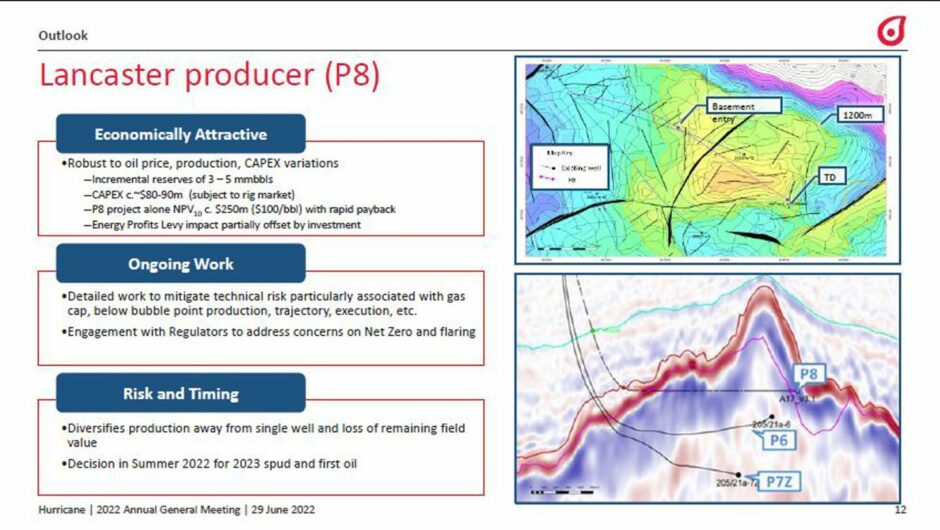

A potential new Lancaster producer – the P8 well – would add incremental reserves of 3-5 million barrels, with capital expenditure of $80-90m subject to the rig market, Hurricane told the AGM.

In return, the board estimates the NPV10 (net present value, discounted 10%) of the project to be around $250 million if the oil price stays at $100/ barrel, with “rapid payback” making the move “economically attractive”.

Adding another producer to the existing P6 well also “diversifies production away from a single well and loss of remaining field value”.

‘Dealing with the regulators’

London-listed Hurricane Energy said it anticipates a final decision being made “later this summer” with first oil in Q3 or Q4 2024 and the team is “looking at what it would take to do that in 2023”.

Such a move would not be without problems, however.

The firm laid out a series of potential barriers, including “dealing with the regulators as we navigate the issues around the below bubble point risks and the net zero targets they are focussing on”.

Hurricane had previously mooted a side-track well to P6, but had been in discussions with the then-named OGA regulator on producing below the “bubble point” – when reservoir pressure declines to the point at which gas is liberated from oil, and may therefore need to be flared.

It will also have to navigate the implications of the government’s windfall tax, though this was described as “manageable”.

The company ultimately decided against a sidetrack in 2021 due to “unacceptable operational and cost risk”.

Lancaster used to be a two-well operational until May 2020 when “interference” led to one of the P7z well being shut in.

That announcement came before a huge downgrade in reserves for the operator, and the resignation of several key board members.

But the shift in oil prices in recent months has led to a significant turnaround for Hurricane.

Even without the new well, the firm expects Lancaster to continue producing through to 2024, investors were told at the AGM – an extension to the timeline from April this year.

M&A

The alternative to another well at Lancaster is an M&A deal, with Hurricane being “attractive to outside investment and well positioned to look for new growth opportunities”.

Doing so would diversify its portfolio from its single asset, Lancaster.

Hurricane told investors it is considering gas and oil opportunities, mainly in the UK, and is “currently engaged with multiple potential targets”.

It added: “Regarding possible acquisitions, this would bring the advantage of geographical diversity and the potential to also diversify into gas as well as oil.

“Our technical team is currently engaged in detailed reviews of a number of exciting opportunities.

“We are primarily looking at assets in the UKCS, and at assets that are near term developments giving the potential to see significant value growth as we invest and bring those assets to production.”

Shares in Hurricane Energy are up more than 14% over the last 5 days to 8.43pence.

© Supplied by Hurricane Energy

© Supplied by Hurricane Energy