There has been no change to Shell’s stance on Cambo and it still has no intention to progress the field, the company’s chief executive has confirmed.

Ben van Beurden said on Thursday that the oil giant has “better things to do” with its cash than spend it one the project, despite the recent rise in commodity prices.

Shell (LON: SHEL) announced at the end of last year that is planned to pull out of the controversial West of Shetland scheme, in which it has a 30% stake.

It followed months of public discussion about the field, which became a whipping boy for environmental groups in the run up to the COP26 climate conference.

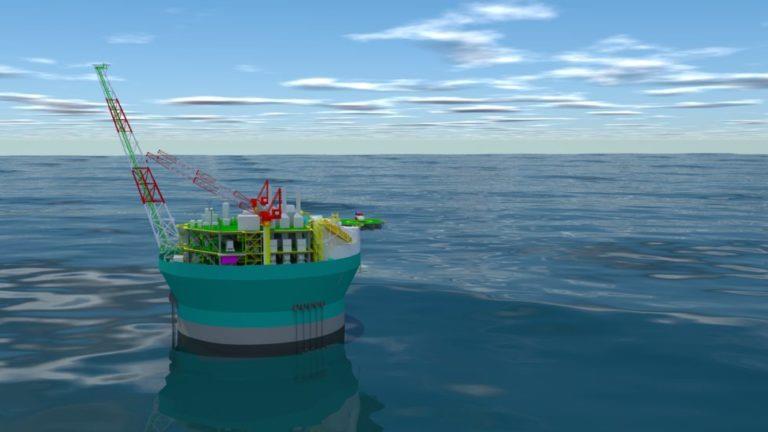

Cambo is operated by recent Ithaca Energy-acquisition, Siccar Point Energy with a 70% stake – it is one of the largest untapped fields in the UK North Sea.

Following Russia’s attack on Ukraine, which sent oil and gas prices soaring, there was speculation that Shell was reconsidering its decision, something Mr van Beurden has dismissed.

He said: “Let me be very clear and short about it, our position on Cambo hasn’t changed. We can’t see it being developed with us in there – the economics simply aren’t supportive enough.

“Of course, we are looking at a slightly better environment at the moment but it is a long term project, with scope for delays and everything else will remain.

“We have better things to do with our money to be perfectly honest.”

Mr van Beurden was speaking after Shell published another set of record quarterly accounts, trumping the personal best it set several months ago.

For the first half of 2022, the oil giant posted pre-tax profits of $36.9bn and revenue of $184bn, sparking fury from environmental groups.

After oil companies reported huge takings earlier this year, the UK Government opted to hit the sector with a windfall tax.

The Energy Profits Levy raises the headline rate of tax on producers by 25%, from 40% to 65%.

It is aimed at helping families cope with rising energy bills, but there are fears it could deter investment and drive companies elsewhere.

But despite the windfall tax, and the lack of movement on Cambo, Shell is still “very committed” to the North Sea.

Sinead Gorman, the company’s chief financial officer, said: “It is government prerogative to put in place taxes and of course, you’ve heard them talk about our view on the tax.

“We remain very committed to the UK, let’s be very clear about that. Shell has announced £20bn to £25bn worth of investment over the next decade, and that will continue. You’re seeing Pierce, you’re seeing Jackdaw, and you’re seeing many other examples of our commitment to the UK.”

© Greenpeace

© Greenpeace © Supplied by Shell

© Supplied by Shell