A new report from the North Sea regulator says decommissioning costs have fallen by 25% since 2017, but COVID-19 and supply chain pressures have slowed progress towards its 35% goal.

The total forecast costs of North Sea decommissioning fell by £1.5 billion (2%) to £44.5bn last year, according to the North Sea Transition Authority’s (NSTA) Decommissioning Cost Estimate Report 2022.

2021 expenditure on decom work totalled some £1.2bn, lower than the forecast £1.4bn, due to improved project execution and Covid-related deferrals of activity.

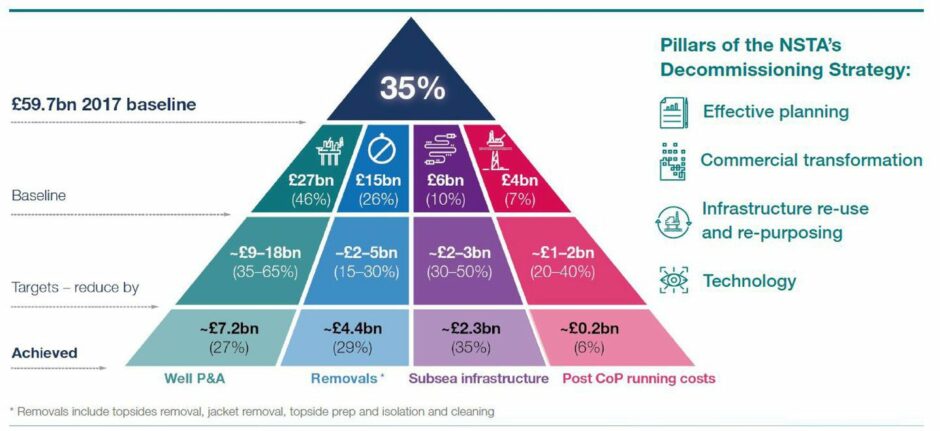

The tally means the sector has slashed its cost estimates by a quarter – around £15bn – since 2017, however the findings suggest the sector will miss a longstanding target.

In 2017 the NSTA introduced a baseline estimate of £59.7bn and set a target of reducing costs by 35% to £39bn by the end of 2022.

A full account of the progress made during 2022 will be made next year, however the NSTA’s head of decommissioning Pauline Innes told Energy Voice that: “I think it is fair to say that the conditions are challenging and a 10 [percentage point] reduction over the next year does look challenging.”

The regulator said the “highly ambitious” 35% target was “always intended to be challenging” and that the savings already delivered would greatly benefit North Sea operators, enabling them to invest more in production and emissions reduction projects.

The sector made solid progress during the first two years of the target, cutting estimates by 17%, though its pace slowed in recent years due to the logistical and economic pressures of the Covid-19 pandemic which resulted in delayed and deferred projects.

The NSTA said the £15bn reduction achieved to date still shows the sector’s ability to work more cost effectively and to generate “huge savings for the Exchequer.”

Oil firms can claim tax relief by offsetting decommissioning costs against current profits, or repayments of previous tax paid, if losses from decommissioning expenditure are carried back.

They can also claim lower levels of tax on future profits, which are reduced by losses created by current decommissioning costs being carried forwards.

£2.5bn per year

Despite the decrease in spend last year, the NSTA said the effort represented a “sizeable investment” in the face of “unprecedented logistical and economic pressures.”

Looking ahead, decommissioning spend is expected to ramp up to between £1.5–£2bn by 2024, and peak at £2.5bn per year during the late 2020s. The report says the spend will offer a long-term opportunity for the supply chain to develop cost-efficient services and win more work overseas.

Ms Innes added: “There’s a long programme of work ahead, and the next two decades are going to be particularly active for decommissioning, so we see that momentum is truly building here.”

The report concedes that improving performance on costs alone is likely to be challenging in the short term, owing to inflation pressure and competition for resources from other energy sectors.

The NSTA called on industry to redouble its efforts, and plan effectively, collaborate on new commercial models, deploy new technologies and, where possible, reuse and repurpose infrastructure.

Ms Innes said she was encouraged that campaigning models for well decommissioning – representing around 45% of costs and by far the singularly most expensive component of the decom process – have gained traction, as shown by recent, longer-term contract awards.

The NSTA has long pushed for such models, which can deliver better value and lower emissions.

In addition, the regulator said its new data and digital offerings, such as the Energy Pathfinder portal, Decommissioning Data Visibility pilot project and Suspended Wells application, give suppliers a much clearer picture of upcoming work, enabling them to better invest in skills and technologies.

New decom target

The NSTA is now engaging with the sector to develop a new baseline estimate and cost efficiency target, effective from the start of 2023 and running until 2028.

“We can see that target and in and off itself has been really good at crystalizing and engagement with industry around something to aim for,” Ms Innes added.

NSTA decommissioning manager Alasdair Thomas said the new target would focus on a more short-to-medium term goal, as opposed to the present target which covers North Sea decommissioning across its full lifecycle.

This would likely correspond to spending over a ten-year period, as “that is that typically the period in which the money is starting to be actively spent,” he explained.

The new target will be also respect and acknowledging the medium-term economic outlook and market pressures, NSTA said.

A final report on progress against the 35% target, which expires at the end of 2022, will be published in mid-2023.

Nevertheless, Ms Innes concludes that the decom industry, already worth billions in the UK market, is in “a strong position to compete for what is a big international prize.”

“The sector must not lose focus and allow inflation to drive up prices. Now is the time to build on the progress already made.”

Recommended for you

© Supplied by NSTA

© Supplied by NSTA