Australia’s carbon capture, utilisation, and storage (CCUS) sector looks set for a boost as oil and gas companies, including BP (LON:BP), Santos (ASX:STO), and Woodside Energy (ASX:WDS), are investing heavily in large-scale projects.

Significantly, based on the current project pipeline some US$20 billion will be invested in the sector by 2030, Sohini Chatterjee, a CCUS and global upstream analyst at consultancy Rystad Energy, told Energy Voice.

Moreover, analysts at Rystad Energy see renewed momentum in Australia following significant policy and budgetary support from the Federal Government. CCUS projects can now apply to be rewarded with carbon credits for every tonne of carbon dioxide (CO2) sequestered and receive government backing to help develop new CCUS facilities and hubs.

“The initiatives will support the gas industry in maintaining the production and export of liquefied natural gas (LNG) to Asian markets – a crucial revenue generator for the Australian economy – by tacking the significant emissions associated with the fuel’s extraction and processing,” the consultancy noted in a report.

In April, the Australian government pledged A$67 million (US$49.7 million) of funding to help development of two carbon capture and storage (CCS) hubs – one led by Woodside and the other by Mitsui E&P. The funding will also be used to support the appraisal of a third potential storage site in Western Australia.

Also in April, the Australian government said that it will provide additional funding of up to A$70 million (US$52 million) for BP’s proposed A$252.5 million green hydrogen hub at Kwinana in Western Australia.

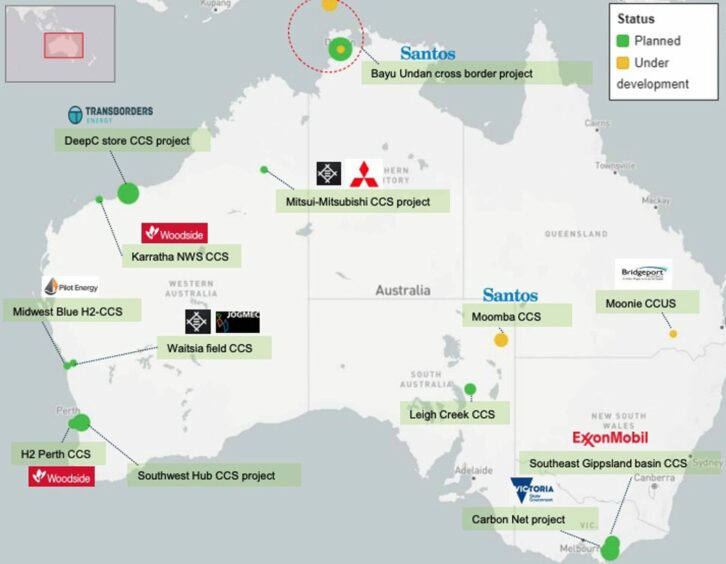

According to data from Rystad, there has been 75% growth in new commercial CCUS projects in Australia post Q4 2021. There are now more than 27 million tonnes per year (t/y) of commercial CCS capacity in the project pipeline set to start up by 2030. Australian oil and gas producer Santos leads the way in Australia with a 25% share of proposed CCS projects. Santos is proposing a $1.7 billion CCS hub at Bayu Undan to store emissions from its Barossa development off northern Australia that will supply Darwin LNG. CO2 captured from gas processing facilities for LNG leads the commercial landscape and accounts for 31% of the total project carbon source, noted Rystad.

Japan’s Inpex has also said that it plans to introduce CCS at its Ichthys LNG project by the late 2020s. The company announced in its H1 results earlier this week that it aims to select an appropriate injection site and carry out evaluation works by 2025. It is also a partner in the Santos-led Bayu Undan CCS project that started front-end engineering and design (FFED) works in March 2022.

Australia is the fourth-largest region globally in terms of operational capacity and planned CCUS projects, making up 7.5% of the overall market, right behind Asia, noted Rystad. However, Australia trails North America and Europe, both of which have for some time had stable and very favorable carbon policies for deployment of CCUS.

“Despite that, we expect momentum to pick up in Australia as more policies and investments will kick in. In fact, shortly after being qualified under the ACCU system, Australian natural gas developer Santos took a final investment decision on the Moomba CCUS project. Currently, large players including BP, Woodside, Santos, Mitsubishi, and Mitsui are sizing up opportunities for CCUS in the country and to invest in research and development of next generation CCUS, as well as direct air capture technologies,” said Rystad.

“Santos is currently the most dominant player, with a total of four out of the 13 operational and planned projects. Six of these 13 projects are set to capture and store CO2 from LNG plants, three are eyeing hydrogen production and one is targeting coal power generation, with the rest under evaluation as part of large industrial clusters,” added the firm.

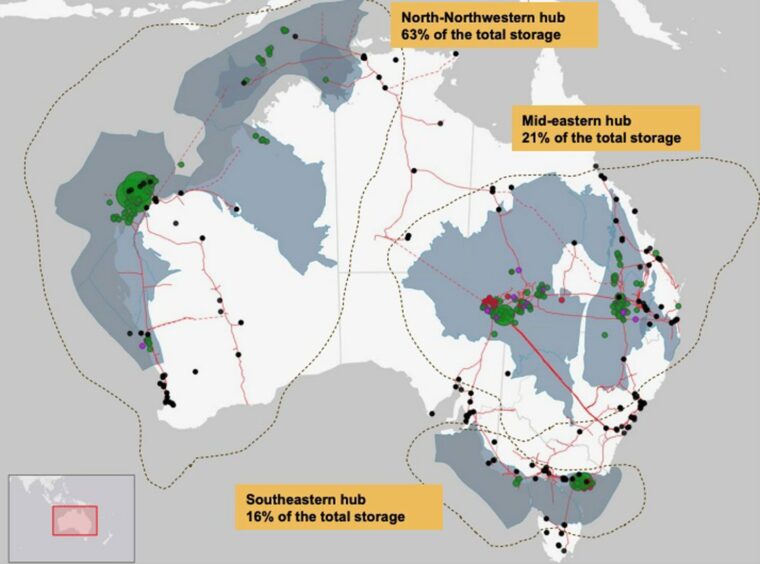

Demand for CO2 capture is set to hit 40 million t/y by 2030 driven by the energy sector. Fortunately, there is plenty of storage potential in depleted oil and gas fields, as well as saline aquifers. Rystad has identified three potential storage hotspots in Australia: the Northwestern hub, the Mid-eastern hub, and the Southeastern hub. “These storage hubs have a cumulative CO2 storage potential of 855 gigatonnes, that is located close to important industrial clusters and is sufficiently large, so it does not pose any barrier for CO2 storage,” said the consultancy.

In March, Australia’s main oil and gas industry lobby group reported there has been strong interest in acreage releases for new CCS opportunities off Western Australia and the Northern Territory. Significantly, Australian producers need to be at the forefront of carbon-neutral liquefied natural gas (LNG) or “green LNG” to remain competitive and CCS is considered one potential route to help achieve this, noted the Australian Petroleum Production & Exploration Association (APPEA).

Recommended for you

© Supplied by Rystad Energy

© Supplied by Rystad Energy © Supplied by Rystad Energy

© Supplied by Rystad Energy