Aker BP (OSLO:AKRBP) has outlined plans to invest NOK 150 billion ($15.3bn) in Norwegian development projects over the next six years.

Following its recently completed merger with Lundin Energy, Aker BP said it was working on 15 development projects on the Norwegian continental shelf, for which it would submit Plans for Development and Operation (PDOs) to the Ministry of Petroleum and Energy during the next 12 months.

The projects operated by Aker BP alone are expected to contribute to 145,000 man-years to Norwegian workers and the supply chain, and NOK 170bn ($17.4bn) in tax payments to the state.

Making clear the link between its plans and recent tax incentives approved by the Norwegian government, Aker BP CEO Karl Johnny Hersvik said the measures have been “a fantastic success for both the supplier industry and the society in general.”

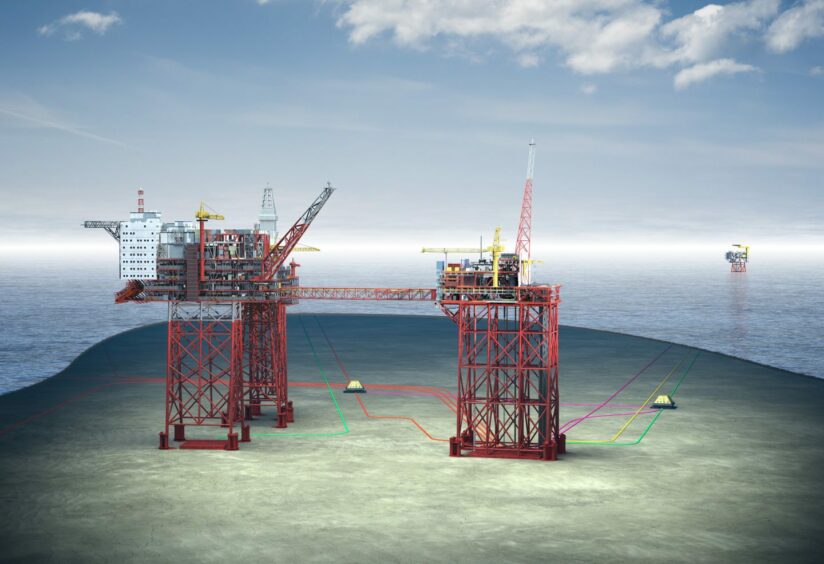

The largest development project is in the NOAKA area in the North Sea, a coordinated development of several fields where Aker BP expects to commit around NOK 80 billion ($8.2 bn). This project alone will create around 50,000 Norwegian man-years in the development and operation phase.

Construction of a new platform on the Valhall field in the southernmost part of the Norwegian North Sea, and hook-up of the Fenris field (formerly King Lear) to the new platform, has estimated investments of NOK 40-50bn (up to $5.1bn), which will result in 65,000 Norwegian man-years in total employment.

Contracts issued last week to Worley for the construction of two new modules for Valhall are expected to create 1,000 jobs at the group’s Rosenberg yard in Stavanger.

The third largest project involves development of satellite fields near the Skarv FPSO in the Norwegian Sea, where investment is estimated at NOK 16-20bn ($2.1bn).

This would generate total employment equivalent to 8,500 full-time positions.

The operator also has several subsea developments which will be tied back to the Alvheim, Edvard Grieg and Ivar Aasen fields, all in the North Sea.

Furthermore, it said there would be additional “ripple effects” of its share in the Wisting development, where Equinor is the operator.

Mr Hersvik contrasted the company’s position with the sector two years ago.

“When we were in the midst of the crisis, the Norwegian society showed itself from its very best side. The authorities, the political parties in the parliament, employers’ and employees’ organisations and the industry – all talked together and sought a solution to a dramatic situation for the supplier companies across the country.

“The result was a package of measures adopted by a broad majority in the parliament (Stortinget) in June 2020. This package of measures made the oil companies able to invest again. The wheels started turning. And now the suppliers are receiving large and important assignments,” he said.

Along with efficiency measures across its existing portfolio, Aker BP expects new developments to up its production from 400,000 barrels per day at present, to about 525,000 barrels in 2028.

Including the NOK 170bn from these projects, Aker BP said it expects to contribute more than NOK 400 billion ($41bn) in taxes to the treasury over the next ten years.

“We will lead the transformation of the oil and gas industry. We are investing heavily in a number of digitalisation initiatives aimed at creating a productivity revolution in the oil and gas industry. At the same time, we work closely with our alliance partners, all to maximise value creation and reduce emissions,” Mr Jersvik added.

Recommended for you