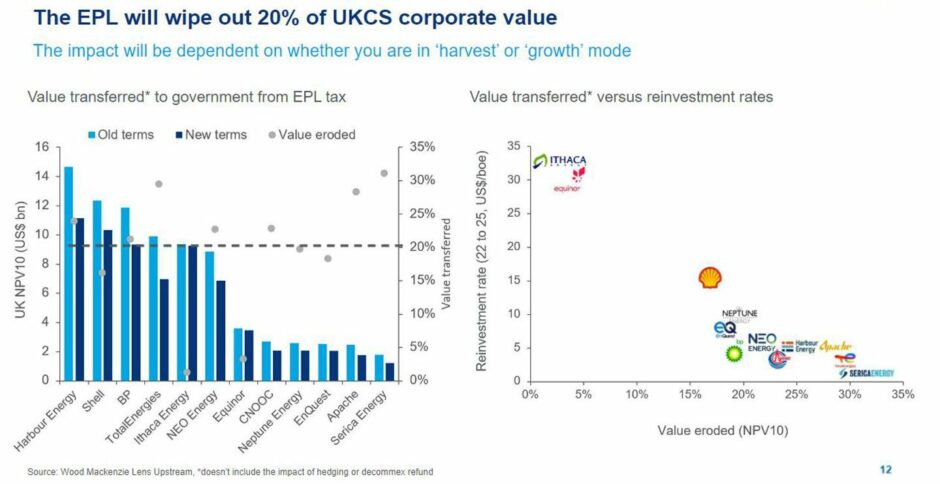

Wood Mackenzie researchers say the government’s windfall tax measures are likely to wipe around 20% off the value of North Sea operators on average, with the impact largely dependent on current tax and investment status.

In a webinar addressing energy security, cost inflation and fiscal disruption in the North Sea and Europe, research directors Neivan Boroujerdi and Ashley Sherman said the energy profits levy (EPL) was likely to transfer around £15 billion of “record” company profits to the UK government over the next three and half years.

“In terms of actual value, we see it wiping out around 20% of total UK business value on an [net present value] NPV 10 basis,” Mr Boroujerdi added.

Introduced in May, the EPL ups the level of corporation tax on North Sea oil and gas producers from 40% to 65% until the end of December 2025, but also grants generous tax rebate allowances of up to 90% for those investing in offshore projects.

“The impact is really highly dependent on whether you’re in harvest mode or whether you’re in growth mode, and that’s because of the investment allowances that have been introduced,” he said.

“For some companies, they’ve seen a value wipe-out of over 30%, but actually the big spenders like the companies behind Rosebank and Cambo, if they were to proceed with those projects actually the overall value transferred would be quite limited.”

Under the analysts’ calculations, operators such as TotalEnergies (PARIS:TTE) and Serica Energy (AIM:SQZ) stand to see the most value eroded, while Ithaca Energy and Equinor look to benefit most from high reinvestment rates thanks to the aforementioned projects.

Despite the sizable impact on firms, he said that “in theory” the fiscal changes are therefore “achieving what they’ve been set out to do.”

Mr Boroujerdi said that despite the current and prolonged $100/barrel oil price, there remains hesitance among companies to sanction projects that do not break even at $35 per barrel, with capital discipline “still very much the buzzword.”

The economics of EPL rebates are most affected by whether an operator is currently a net taxpayer or not. Without investment allowances, he suggested both Rosebank and Cambo are “fairly marginal” developments but would provide significant benefits to those companies already paying higher levels of tax.

“If we then take these projects, put them into the hands of a full taxpayer, the returns are boosted, the break evens come down, and the payback periods are shorter as well,” he said.

“So all of a sudden these projects look super profitable within these businesses and you think would surely start to creep up the pecking order of an international portfolio.”

Equinor recently submitted an environmental statement for Rosebank, ahead of a mooted final investment decision (FID) next year.

Exploration impact

Mr Boroujerdi suggested the same trend was true for companies looking to claim rebates on new exploration expenses.

“The impact on exploration is really pronounced and there’s probably never been a period where it’s more attractive to invest in new projects,” he said, pointing out this “unprecedented” arrangement beats even Norway’s current suite of generous exploration incentives.

However, based on the firm’s conversations with operators, he was unconvinced this would lead to an actual uptick in UK North Sea activity.

“Certain changes have made it probably a bit harder to attract capital and it takes a while for that to filter through to the headquarters,” he explained.

It follows warnings from trade body Offshore Energies UK that EPL measures would lead to “a flood of investment” going overseas, instead of into the basin.

Harbour Energy chief executive Linda Cook inferred as much last month, suggesting the additional tax burden would prompt the group to continue with plans to diversify its regions of operation.

One potential area of UK growth could be the farm-in market, where Mr Boroujerdi said taxpaying companies may look to make the most of the EPL rebates and “explore a bit more.”

Yet on the M&A side, he suggested any new money into the North Sea would likely be from private firms or independents, with neither private equity nor international majors particularly keen to pick up assets.

Recommended for you

© Supplied by Wood Mackenzie

© Supplied by Wood Mackenzie