Priority clusters, earmarked for speedy development by the industry regulator, could deliver enough gas to meet 40% of the UK’s yearly demand.

Research body Wood Mackenzie believes the four areas flagged by the North Sea Transition Authority (NSTA) could have a “bigger impact” than unexplored regions.

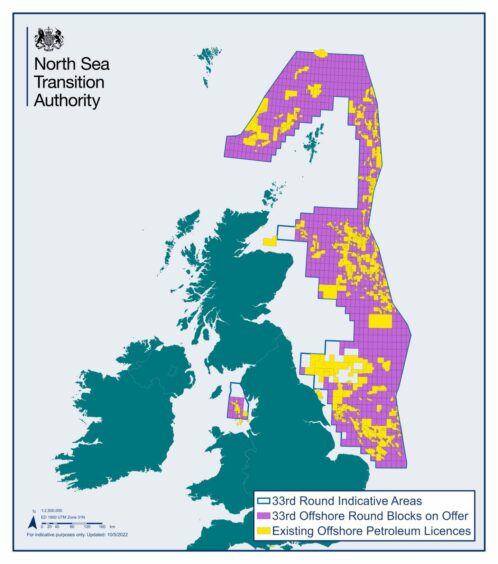

As part of the 33rd oil and gas licensing round, launched last week, the NSTA identified four priority clusters in the gas rich Southern North Sea.

All of them are known to have hydrocarbons, are near to existing infrastructure and have the potential to be developed quickly, a key selling point with the UK currently crying out for gas.

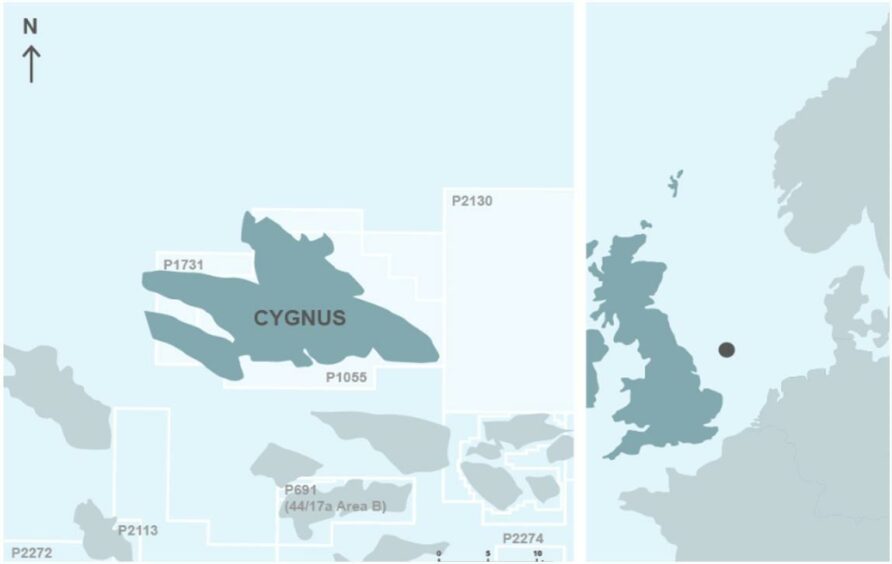

The four clusters that have been flagged are the Greater Pegasus Area, Greater West Sole Area, Greater Cygnus Area and Cotton Area.

The NSTA is pushing companies to bid for the areas, with the intention of licensing them first.

Gas price could ‘unlock’ clusters

According to Wood Mackenzie, they represent nearly two billions barrels of oil equivalent (boe), more than third of which is gas.

The company said: “These clusters include 30 predominantly gas discoveries that could be developed quickly and make use of nearby infrastructure. In total, they could deliver 1 trillion cubic feet of new supply, enough to meet 40% of the UK’s yearly gas demand.

“While these discoveries will have been previously relinquished, current commodity prices and area-wide solutions could unlock on their potential.”

33rd licensing round

A new offshore oil and gas licensing round was launched by the regulator on Friday to much fanfare from industry.

It is the first of its kind since 2019, following a government-led review into the regime.

A total of 898 blocks and part-blocks of acreage are up for grabs in the North Sea, which may lead to over 100 licences being dished out.

Energy companies can bid for exclusive permits to explore and potentially recover any oil or gas they uncover, though NGOs have threatened legal action against the process.

In the last year, UK and European energy security has been thrown into the spotlight due to Russia’s invasion of Ukraine.

In order to try and minimise the environmental impacts of new projects, a climate compatibility checkpoint has been introduced.

It aims to ensure any future licensing round is consistent with net-zero goals, though it has been criticised for being too weak.

A dose of reality

With new North Sea exploration on the cards, there is a thought a renaissance for the oil and gas industry could be in the offing.

But Wood Mackenzie has pointed out that while there have been discoveries in recent years, not since the 27th round in 2012 has new acreage delivered a commercial discovery.

Moreover, the first well from the last round three years ago is not expected until 2023.

Neivan Boroujerdi, research director – North Sea upstream oil & gas at Wood Mackenzie said: “While we think exploration still has a role to play in the UKCS, drilling activity is already at historic lows and the addition of new acreage – which will have been offered up in previous rounds – is unlikely to reverse that trend significantly.

“It remains to be seen what industry appetite will be. With tax relief on exploration and development spend increasing from 40% to over 90% under the Energy Profits Levy, there is an immediate incentive to ramp-up activity while the levy is in place. But typically, most active explorers and developers are local players who will not be able to take full advantage and will require farm-in partners. Can the bigger IOCs overcome increasing environmental scrutiny and political instability to step up the plate?”

Recommended for you

© Supplied by NSTA

© Supplied by NSTA