The world has large potential technical recoverable resources of tight oil possibly several times those of North America, according to a new geological study by global analytics firm IHS.

It turns out that commercial production of these resources could equal and exceed the current estimates for North American tight oil output, according to the study, released last month at the IHS Forum in Houston.

The study, Going Global: Predicting the Next Tight Oil Revolution, confirms widespread geological potential of tight oil globally.

The research identifies the 23 highest-potential plays throughout the world and finds that the potential technically recoverable resources of just those plays is likely to be 175billion barrels – out of almost 300billion for all 148 play areas analysed.

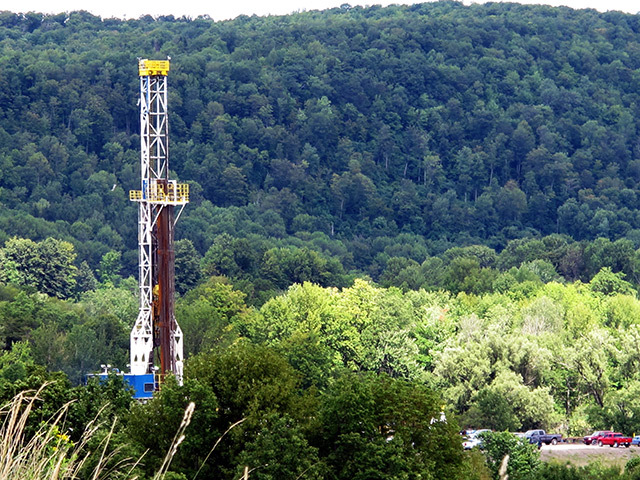

The growth of tight oil has driven the recent surge in North American production; basically this means the shale gas revolution.

The production process applies the same hydraulic fracturing and horizontal drilling techniques that have led to a boom in the production of shale gas.

The prediction is that 40billion barrels of recoverable oil will have been identified in North America by 2035 and that the US and Canada will ramp up to and sustain an increase of 4.5million barrels of oil/condensate per day between 2018 and 2033.

Furthermore, recoverable dry gas associated with North American tight oil plays is thought to be around 270trillion cu.ft, while output of recoverable NGLs (natural gas liquids) will increase to 4million bpd by 2021 and exceed 5million by 2035 . . . a recoverable total of 36billion barrels

Total hydrocarbons production could be 9million barrels per day by the end of the current decade

The study claims to provide a comprehensive assessment of the potential of tight oil plays outwith North America, where well-level data does not currently exist.

The 23 highest-ranking tight oil plays identified include well-documented areas such as the Vaca Muerta formation in Argentina, the Silurian “hot” shales in North Africa and the Bazhenov shale in West Siberia.

However, the list also includes lesser-known geological plays in Europe where 27 have been identified, the Middle East, Asia and Australia.

The highest-ranking plays were identified from a group of 148 potential play areas around the world.

Each of the 148 plays was assessed on key geological and geochemical characteristics such as thickness, lithology, porosity, permeability, pressure, organic richness, presence of natural fractures and oil maturity, among others.

However, IHS was reluctant to release any further information on the Europe position when approached by Energy.

Steve Trammel, IHS research director and advisor for unconventional; also project leader for the study, said: “The comprehensive screening and evaluation process revealed that the range of geological characteristics and risks of the 23 highest-ranking global tight oil plays compare favourably, or even better in some cases, than those of leading North American plays.”

While the commercial potential is not yet proven, the analyst says it is clear that it is by no means limited to the 23 highest-ranking plays, the study notes. Local market conditions, government policies and/or innovative exploration and production activity could drive commercial developments in a number of the 125 additional tight oil plays that were screened for the study.

Above-ground issues, including the need for a strong service sector to deliver modern rigs, specialised well completion crews and modern hydraulic fracturing equipment, as well as factors ranging from government policy, land access constraints, regulatory frameworks to water management issues will heavily influence the pace of development, the study says.

The research puts the cost of the average well outside North America at $8million compared with $5.6million inside North America, ranging from $6.5million in Australia to more than $13million in parts of the Arabian Peninsula.

IHS chairman Daniel Yergin wrote recently that the shale revolution meant that the US had already become much more competitive in the world economy; with gas in Europe three times more expensive and, in Japan, four times more costly than in the States.

“Business leaders in Europe are aware of America’s current energy advantage, and they are sounding the alarm,” said Yergin. “The chief executive of Austrian steel company Voestalpine, Wolfgang Eder, declared that “the exodus” from Europe has already started in the chemical, automotive, and steel industries.

“Indeed, Voestalpine announced plans to build a half-billion-dollar plant in Texas to produce iron that it would ship back to Austria for fabrication into steel. European suppliers will follow their customers across the Atlantic, building new factories in the US to be near their customers’ new factories.”

The hope in the US is that the revival of indigenous oil production will reinforce the surging competitive advantage.