Aberdeen-headquartered Plexus (LON: POS) plans a return to return to a market it left four years ago after another set of losses in its half-year results.

The London-listed firm lost £5,556,000 during the first six months of 2022, an even wider deficit of more than the £4.3 million reported the year previous.

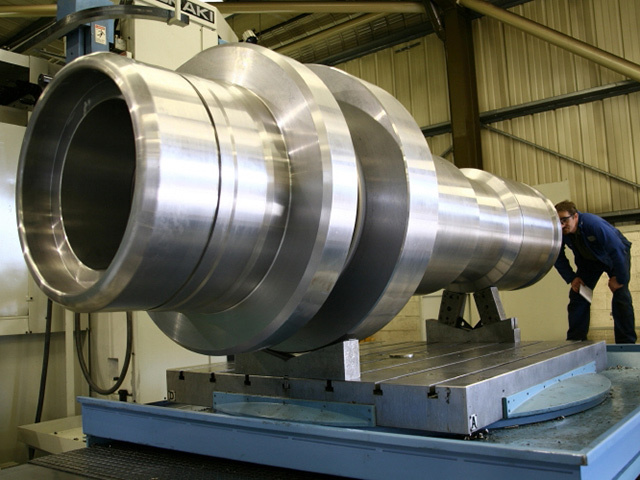

Plexus, a specialist in wellhead engineering, said it aims to return to the jack-up rental market after it sold that business to engineering giant TechnipFMC for £42.5m in 2018.

The Aberdeen company chose to leave the market as a result of the oil downturn in a move described, at the time, as bringing a debt-free balance sheet, allowing the company to focus on the Pos-Grip wellhead technology roll-out.

The firm said it will continue to work with firms such as Schlumberger, which Plexus signed a major agreement with in November 2020, an agreement that was expanded upon in December last year.

Plexus is also seeking to establish revenue streams through both direct sales and the licencing of its POS-GRIP wellhead technology to third parties.

CEO Ben Van Bilderbeek said: “During the year to 30th June 2022, the Group made a loss before tax on continuing operations of £5.56m compared to a loss in the prior year of £4.37m.

“The board is focussing on reversing this performance and several pivotal decisions have been taken.

“Perhaps the most significant being the Company’s re-entry into the drilling from Jack-up rigs exploration rental wellhead business.

“This is the sector in which Plexus initially built its name and reputation, before we elected to exit this market in 2018 following the collapse of the oil price in 2014 and 2015.

“During that time, capital investment in exploration activity dwindled away and, six years on, the oil and gas market has changed once again.”

The deal sees non-exclusive licence agreement terms between Cameron International Corporation, Schlumberger’s wellhead company and the Aberdeen-based firm.

International

Plexus said it is seeking to support the UK in its energy independence, explaining that in an “ideal world” energy independence would come solely from renewable energy”, natural gas is still needed and the company looks to proceed in the extraction of the fuel source as “cleanly as possible.”

The report described the importance of gas as “unavoidable”, Plexus’s chief executive, Ben Van Bilderbeek agreed with Saad al-Kaabi the chief executive of QatarEnergy in his argument that natural gas should be central in the energy transition as it emits fewer carbon emissions when burnt that oil and coal.

Earlier this year the Aberdeen firm took a £650 thousand hit as it chose to suspend activities in Russia, however, the company has also reported signing a £500K contract with Oceaneering for a North Sea decommissioning campaign.

Recommended for you