Aberdeen-headquartered Awilco Drilling (OSLO: AWDR) is raising $10m to help finance an ongoing legal case with Singapore shipbuilder Keppel FELS.

Awilco, a now rig-less drilling firm having sold the remains of its fleet this year, is using private placing on the Euronext in Olso to raise the cash, alongside creation of new debt.

The company has been locked in high-stakes arbitration cases with Keppel FELS over a pair of cancelled orders, and the net proceeds of Awilco’s placing will be partly used to fund the battle.

Keppel is demanding a total of £516m over the orders for the Nordic Spring and Nordic winter.

Both rigs have since been taken up by Dolphin Drilling, whose headquarters are also in Aberdeen.

Keppel is claiming £316m for Nordic Spring and another £200m for Nordic Winter, though these are “strongly denied” by Awilco.

Awilco has meanwhile entered counter-claims in respect of deposit and other variation payments of £73million which it claims to be recoverable.

The Aberdeen firm said the cases are expected to reach conclusions no earlier than Q2 and Q4 2023 for the two rigs.

Placing and debt

To raise the $10m, a $7.7m raise through placing of nearly four million new shares, took place earlier this week.

Awilco, listed in Oslo, also intends to raise new debt of $2m once the first placing is completed, guaranteed by its largest shareholder, the investment group Awilhelmsen Offshore, and fund manager QVT.

Earlier this year, analysts said it “could be the end of the line” for Aberdeen-headquartered Awilco Drilling after the firm agreed to offload the remains of its fleet.

Awilco Drilling in 2022

In May, Awilco announced the sale of its last operational rig, WilPhoenix, to Well-Safe Solutions in a £12.4m deal.

The firm has meanwhile scrapped its other vessel, WilHunter.

At the time, management told Energy Voice that headcount was down to around 20 onshore and 20 offshore staff, and said there are other “opportnuties” in the drilling contracting space which it will monitor.

Sarah McLean, senior rig analyst at Esgian, said the loss of its rigs would mean Awilco will “no longer have a foothold” in the market and it is “difficult to see” how it can continue as a contractor.

Earlier this year the firm secured a £3.2m loan from Awilhelmsen Offshore and QVT to fund its operations.

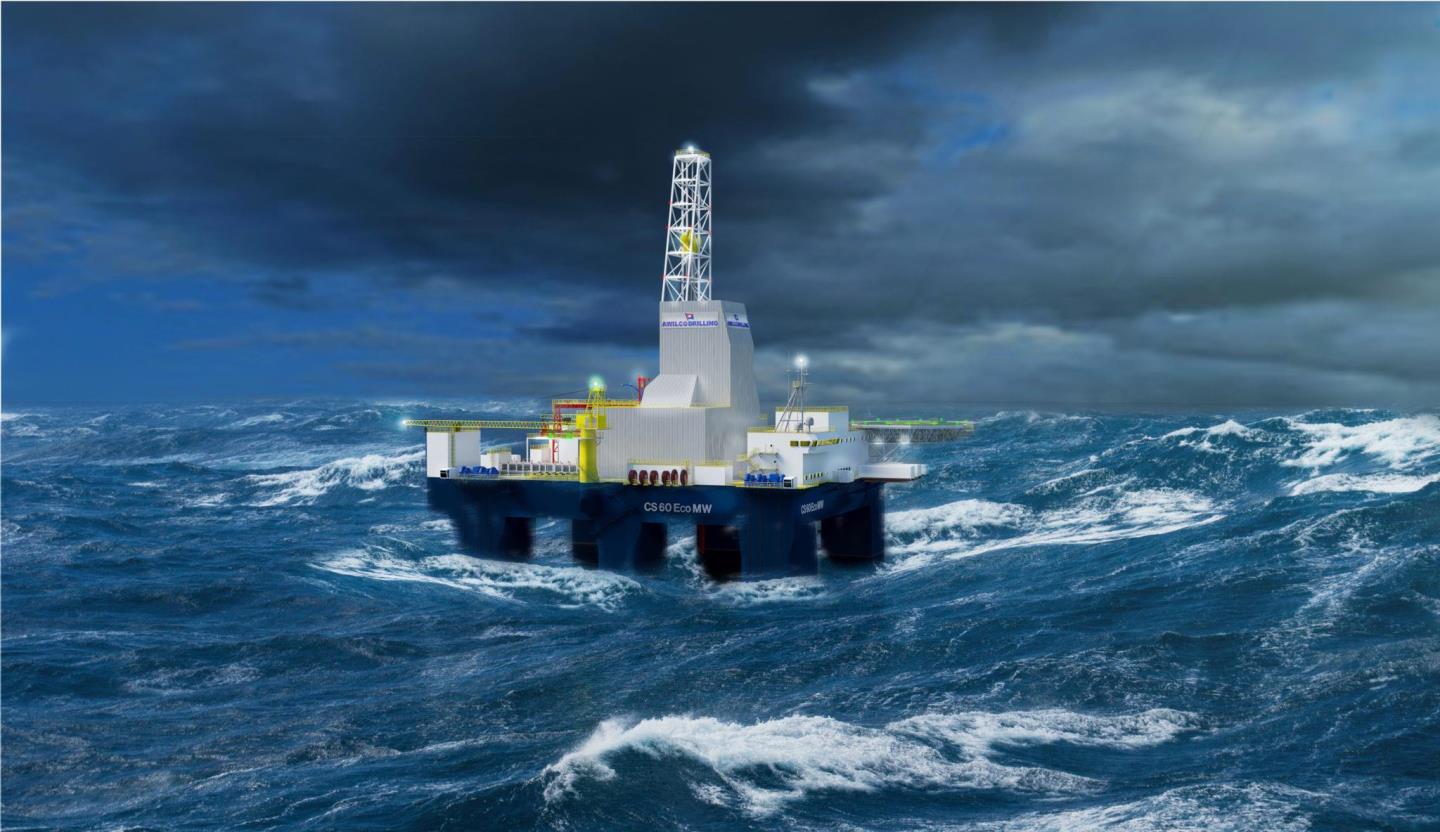

© Supplied by Awilco Drilling

© Supplied by Awilco Drilling