Drydocks World and Aker Solutions have signed off a contract with Altera Infrastructure for work to upgrade the vessel used to develop the Rosebank field.

Norway’s Aker Solutions (OSLO:AKSO) and Drydocks World – part of the Dubai Ports World group – agreed a deal for work to upgrade the Petrojarl Knarr floating production storage and offload (FPSO) vessel last month.

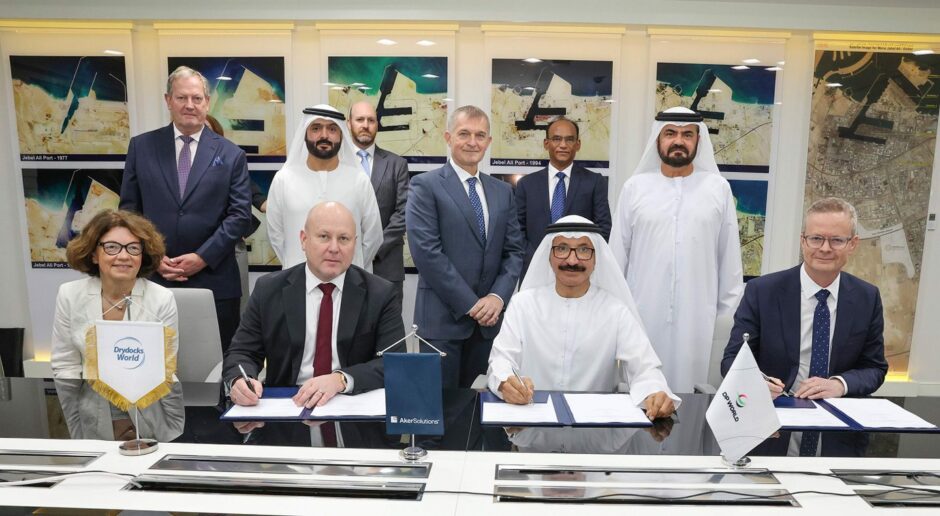

The contract was officially signed in Dubai at DP World’s head office by group chairman and CEO Sultan Ahmed Bin Sulayem, Aker Solutions’ topsides and facilities EVP Sturla Magnus, and Altera Infrastructure EVP Arne Hygen Tørnkvist.

Under the terms of the venture, Aker Solutions will handle detailed design and procurement of equipment in Norway, while Drydocks World will be responsible for the fabrication and construction work at its yard in Dubai.

The Petrojarl Knarr is currently at Aker’s yard in Stord, Norway and will remain there until it is towed to Dubai during the second half of this year.

Engineering, procurement and construction (EPC) work is planned for completion by the end of 2025.

Aker Solutions has said it expects to book an order intake of around 2.5bn NOK (£206.8m) from the order for its renewables and field development segment in Q1 2023. The contract is worth between £206.8 and £330.5m.

Mr Ahmed Bin Sulayem said: “This joint venture between Drydocks World and Aker Solutions will deliver world-class maritime engineering and construction solutions to the global energy industry. The sector needs smart, collaborative partnerships like this to ensure sustainable production and to successfully transition equipment and vessels for the future. Today’s announcement is an important step forward.”

Mr Digre of Akers Solutions added: “Collaboration and partnerships are at the core of how we work. In Drydocks World-Dubai, we have a world-class partner in developing solutions and we look forward to continuing our long-term relationship by delivering jointly towards the Rosebank oil and gas field development project.”

Once redeployed, the upgrades should allow the FPSO be kept at the field west of Shetland for 25 years without drydocking.

Norwegian energy giant Equinor (OSLO:EQNR) submitted an environmental statement (ES) for the 300-million-barrel Rosebank project last year, and outlined plans to invest more than £8 billion over the life of the field, including £80m set aside for electrification capabilities.

Equinor has a 40% operated stake in the development, while Suncor Energy and Ithaca Energy hold 40% and 20% respectively.

Separately, Altera recently launched its own recruitment drive for “candidates within several disciplines” to prepare the vessel for use at the field.

Mr Tørnkvist said he hoped the signing of the contract marked the start of “a strong and long-term relationship” with Drydocks World.

© Supplied by Altera Infrastructur

© Supplied by Altera Infrastructur