Viaro Energy’s buying spree shows no sign of letting up, with the company in the final phases of a deal for more North Sea fields.

Fresh from announcing the takeover of Spark Exploration, company chief executive Francesco Mazzagatti revealed they are at a “very advanced stage” of an acquisition for “two large production assets”.

It has also put in a “final bid” for another exploration licence, as part of the London-headquartered independents drive to “grow” in “different areas” of the North Sea.

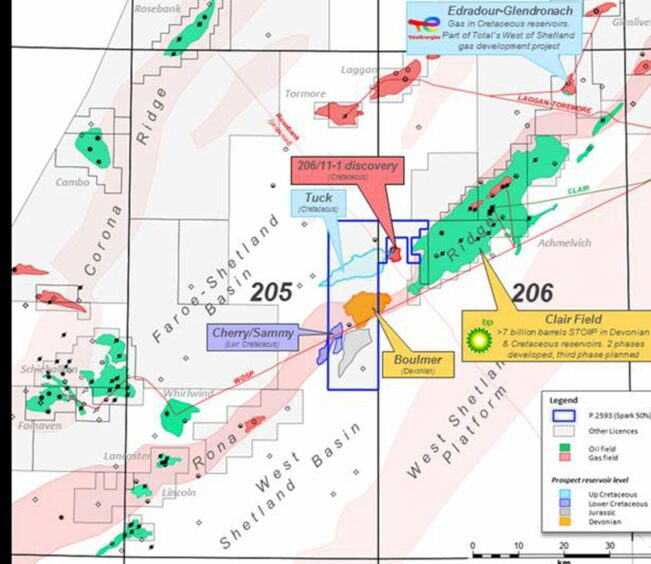

On Wednesday, the firm announced it had added a clutch of West of Shetland targets to its portfolio with the acquisition of Spark.

The deal gives Viaro a 50% stake in the P2593 licence, paired with London-listed Ithaca Energy (LON: ITH), operator of the Cambo field, amongst others.

Notably, the permit includes the Tuck prospect, tipped to hold some 87 million barrels of recoverable oil equivalent.

It also comprises a 50% stake in the Boulmer, Cherry and Sammy exploration prospects – they contain estimated prospective resources of 280m barrels.

‘We’re here for the long-term’

Mr Mazzagatti said: “There is a good chance that Tuck will be a success, that’s why we went into the deal. We have committed to invest £208 million to bring the prospect on stream. The next step for the licence is to secure approval from the North Sea Transition Authority.

“The opportunity to acquire this licence presented itself, and we want to grow our portfolio. Viaro’s reserves will eventually start to decline, and we want to replace that by bringing new fields on stream.

“We have a large amount of cash on the balance sheet, and we want to spend it – West of Shetland is a good area to invest and develop. Soon we will release our audit reports, and there will be no dividends paid out, and our strategy is not to pay any for the next couple of years at least.

“My intention, as owner of the group, is to build a legacy; there’s no short-term ambition to cash in and then pull out. We’re here for the long-term.”

Tuck is sandwiched in-between some of the basin’s largest remaining resources, including BP’s Clair Ridge and Equinor’s Rosebank development.

Development options for Tuck

Viaro expects the prospect to reach first gas by 2028, with a tie-in to TotalEnergies’ nearby Greater Laggan Area one of the options under consideration.

Located north-west of Tuck, licence partner Ithaca’s Cambo project, which will be developed using an FPSO, could also provide a potential development option.

“We haven’t discussed that with Ithaca yet, but we can’t exclude anything at this stage,” said Mr Mazzagatti.

Viaro honing strategy

Viaro, a subsidiary of commodities trading firm Viaro Group, burst onto the scene in 2020 with a £250m acquisition of Andrew Austin’s RockRose Energy.

It continued a series of purchases and divestments in the UK, including the acquisition of 16 non-operated gas interests in the UK from SSE in 2021, including a stake in TotalEnergies’ Laggan-Tormore.

After a subdued few years, the West of Shetland is quickly becoming a hive of activity once more, and Viaro isn’t “ruling out anything” as it looks “360 degrees as to what is on the market”.

Mr Mazzagatti said: “As investors in the basin, we should look at and be responsible for the energy security that the UK needs by finding new reserves – that’s a must.”

Recommended for you

© Supplied by Viaro Energy

© Supplied by Viaro Energy © Supplied by Spark Exploration

© Supplied by Spark Exploration © Steven Donaldson.

© Steven Donaldson.